Delta Air Lines Q2 2023 Earnings Report: Fundamental and Technical Stock Analysis

9 minutes for reading

In Q1 2023, Delta Air Lines (NYSE: DAL) stock price surged by 40%, driven by positive financial reports for the first quarter and management’s optimistic forecasts for the second quarter. The company’s Q2 report published on 13 July 2023 exceeded expectations, and management presented a promising outlook for the next period, signalling a further improvement in Delta’s financial performance. This gives reason to believe that the airline's stock prices will continue to grow in Q3, just like they did in the previous one. In this article, we will focus on Delta's financial reports and management’s forecasts for future periods, and examine how they have influenced the stock price, and whether further growth is possible.

Delta Air Lines Q1 2023 financial report and outlook for Q2

Delta Air Lines concluded Q1 with record revenue of 12.8 billion USD, marking a 36% increase compared to the 2022 Q2. Delta also managed to reduce its losses significantly, from 940 million USD to 363 million USD. Part of this loss was related to a signed four-year contract with pilots, which includes a 34% wage increase.

In the same quarter, Delta Air Lines saw a 6-percentage point increase in the passenger load factor, reaching 81%. Passenger traffic remained the primary source of income, as revenue from this segment soared by 51% to 10.4 billion USD compared to the same period last year. On the other hand, cargo traffic experienced a decline of 28%, dropping to 209 million USD.

It is evident that the company significantly improved its financial performance compared to the 2022 Q1 and exceeded the revenue target for 2019. Following these impressive results, Delta Air Lines presented an even more optimistic forecast for the second quarter of 2023, projecting revenue growth of approximately 14.6 billion USD (an 18% increase from the previous period) and earnings per share between 2.2 and 2.25 USD (there was a loss last year). Furthermore, the airline expects free cash flow to exceed 2 billion USD, representing an 81% increase from the previous period.

CEO Ed Bastian stated that the demand for air travel remains high. To enhance customer service quality and operational reliability, the airline planned to scale back capacity expansion during the summer.

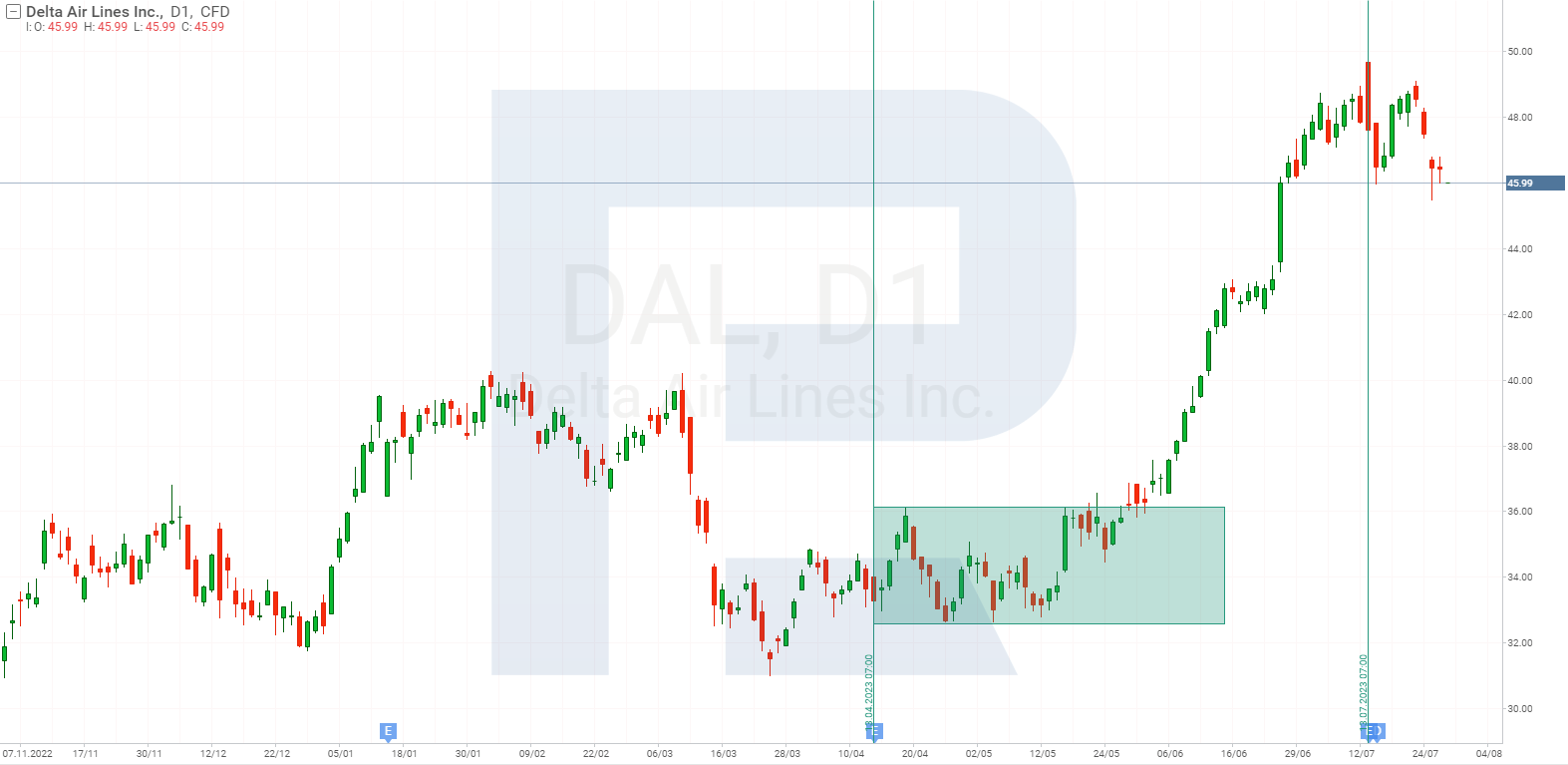

How the stock value changed in Q2 2023

On 13 April 2023 (the day the report was published), Delta Air Lines shares were trading at a price 48% lower than the historical peak recorded in July 2019. Notably, the airline’s revenue for the Q2 2023 surpassed the revenue Q2 2019 by 22%, which was when the historical high was reached.

The comparison with 2019 is particularly significant considering the impact of the COVID-19 pandemic in 2020, which severely affected airlines and pushed them to the brink of bankruptcy.

Given this context, it was reasonable to assume that the stock of Delta Air Lines was undervalued.

Following the report’s release, Delta's stock value started to rise rapidly on the second day. However, investors remained hesitant for a while, primarily due to their pessimistic outlook regarding the forecast presented by the company’s management. Consequently, the stock remained within the trading range of 32.50 and 36.00 USD until 30 May.

Once the resistance at 36.00 USD was breached, all doubts dissipated, and the share price began to soar rapidly. Investors continued purchasing the stock until the release of the Q2 2023 report. Eventually, the stock quotes reached their peak value of 49.70 USD by 13 July.

Delta Air Lines Q2 2023 report

Delta Air Lines once again posted impressive results for the Q2 2023. The airline was able to increase its revenue and profit but failed to reach the projected free cash flow target. It closed the Q2 with record revenue of 14.6 billion USD, a 19% increase compared to Q2 2022. Net profit also surged from 735 million to 1.8 billion USD, which is a record for the past nine years. The EPS reached 2.68 USD against the loss experienced in 2022.

In the Q2, the company noted a 1 percentage point increase in the passenger load factor to 88% compared to the same period last year. Passenger traffic remained the main source of income, as revenue from this segment increased by 21% to 13.2 billion USD compared to the Q2 2022. However, cargo transportation, similar to the previous quarter, continued to show a negative trend, declining by 37%.

According to the data in the forecast and results table, the only unmet forecast was for free cash flow. During the pandemic, Delta Air Lines had to resort to borrowing to avoid bankruptcy, which increased the airline's debt burden from 8.8 billion USD in the Q4 2019 to a peak of 29.8 billion USD in the Q3 2020. The airline is now in the process of actively repaying its debts. As a result, in the Q2, the amount of 1.8 billion USD was allocated for debt repayment, which is 600 million USD more than in the previous quarter, leading to a decrease in the overall debt to 18.14 billion USD. However, despite these numbers, the company was unable to meet its free cash flow forecast. Consequently, on the day of the report's publication, the stock fell by 4%.

Competitors’ Q2 results

Reports and forecasts from Delta Air Lines indicate that air travel in the US seems to have fully recovered to pre-crisis levels. However, to get a comprehensive picture, it is necessary to also consider the reports of competing airlines. For the analysis, we will consider key indicators such as revenue, operating profit (profit from core operations), and aircraft load factor. The data will be compared to the same period in 2022.

The table shows that the load factor for all airlines exceeds 80%, surpassing pre-crisis levels in 2019 when the load factor was below 50%. Almost all airlines have reached or surpassed their 2019 levels, indicating a full recovery in air travel to pre-crisis levels. Based on the data in the table, Delta Air Lines currently leads in the competitive landscape, as it is the only airline to increase its load factor in the Q2 2023.

Delta Air Lines forecast for Q3 2023

The company has forecasted earnings per share for Q3 2023 at 2.2-2.5 USD, which implies an increase of 45-65% compared to the corresponding period of 2022. Revenue is projected to reach 14.25-14.64 billion USD, indicating a growth of 10-14% from the Q3 2022.

Ed Bastian, the CEO of Delta Air Lines, emphasised that after years of spending on goods, many consumers now consider travel as their primary goal and are willing to indulge in premium experiences. Delta Air Lines takes pride in providing top-notch service in the industry. However, Bastian also acknowledged that the aviation infrastructure remains fragile, and the industry continues to face numerous challenges across the supply chain, including aircraft delivery delays, and training requirements. Consequently, there is a significant gap between the current supply and demand capacity, and this gap is expected to persist for an extended period.

Delta Air Lines stock analysis

As mentioned above, the financial indicators and load factor have already surpassed pre-crisis 2019 levels. However, the stock price is currently trading 27% below the historical peak set in July 2019. This suggests that Delta Air Lines’ stock might be undervalued, and there is potential for further growth.

In the Q2 2023, buyer actions led to a breakthrough in resistance at 45 USD and the establishment of a new peak at 49.70 USD. However, after the report's publication for the Q2, the price dropped back to 45 USD. Based on the chart, there is a possibility of forming a new trading range with boundaries at 45.50 to 49.70 USD, which repeats the situation at the beginning of the Q2 2023.

In this case, two variants of events can be considered:

- If the trading range forms, breaking above its upper boundary will lead to further price growth, where the main target of the movement will be the historical maximum at 62.40 USD.

- A breakdown of the lower boundary of the range could provoke a correction, as a result of which the quotes might fall to support at 40.00 USD. From this level, share price growth is expected to resume.

Delta Air Lines (DAL) live price chart

Summary

The only reason Delta Air Lines' stock has not reached its historical peak is its debt burden. According to statements by the CFO, Dan Janki, the airline plans to pay off debts amounting to over 4 billion USD in 2023, which will reduce interest expenses by more than 100 million USD. Ed Bastian also aims to achieve a free cash flow of 10 billion USD from 2023 to 2025, which would return the balance to investment-grade levels with the long-term debt-to-equity ratio dropping below 1. If these goals are achieved, Delta Air Lines stock has a chance to set a new historical peak.

FAQ

1. How to buy Delta Air Lines, Inc. (DAL)?

Open a trading account at RoboMarkets, decide on the number of assets to buy and then place an order for Delta Air Lines, Inc. (DAL).

2. Which platforms are suitable for trading Delta Air Lines, Inc. (DAL)?

You can trade Delta Air Lines, Inc. (DAL) on MetaTrader 4 and MetaTrader 5 or the R StocksTrader platform.

3. Which account to open to buy Delta Air Lines, Inc. (DAL)?

You can trade Delta Air Lines, Inc. (DAL) on Prime, ECN, Pro, or R StocksTrader accounts.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high