2024 IPO Market Outlook: Trends and Predictions for Investors

10 minutes for reading

On 13 February 2024, we discussed trends and forecasts for the global IPO market in 2024, looked at the largest and most anticipated flotations this year, and explored the potential risks of investing in the issuers’ stocks.

2023 IPO market overview

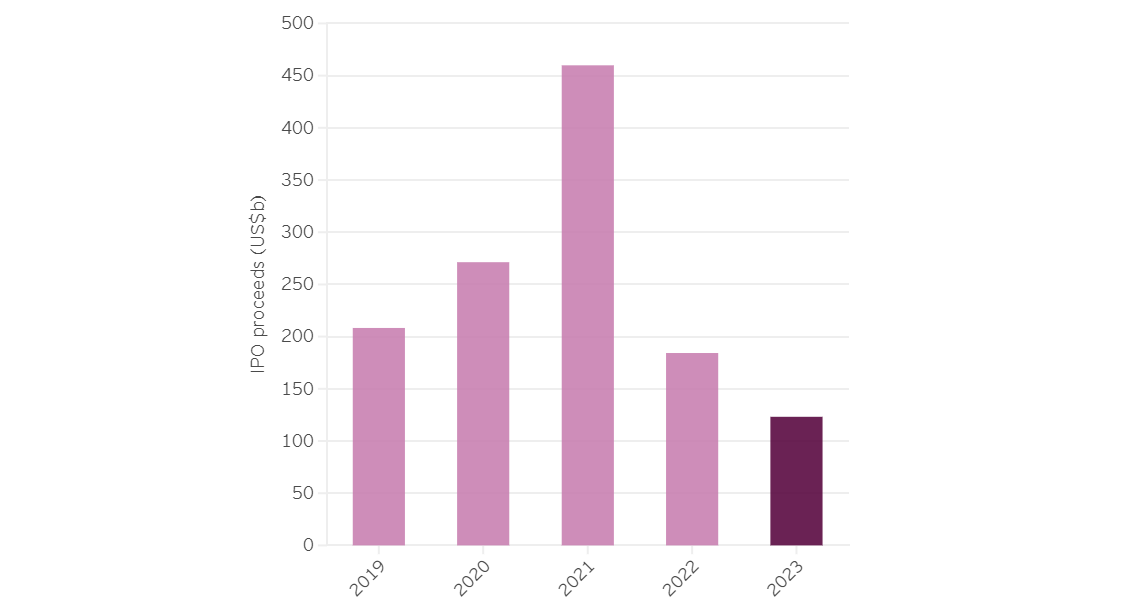

According to Ernst & Young Global Limited, the total number of global IPOs reached 1,298 flotations in 2023, raising 123.2 billion USD. In 2022, the figures were 1,415 and 184.3 billion USD, respectively.

As reported by PwC, China was the largest IPO market in 2023, with 302 IPOs raising 50.4 billion USD, a decrease of 29% and 43% compared to 2022.

The US was the second-largest market, with 154 IPOs raising 25.8 billion USD, marking decreases of 15% and 0.77% from the previous year, respectively. It is worth noting Indonesia separately, as it saw 79 IPOs on the local stock exchange raising 3.6 billion USD, reflecting increases of 32% and 60% from 2022, respectively.

The largest IPOs in 2023 were held in September when Arm Holdings plc. (4.87 billion USD), Maplebear Inc. (660 million USD), and Klaviyo Inc. (576 million USD) went public. However, the results following the start of trading disappointed investors as Arm Holdings plc stock lost 6.14% within a month of the IPO, Maplebear Inc. shares are still trading 8.73% lower than the IPO price, and in early January 2024, Klaviyo Inc.'s stock value was 18.3% lower than the IPO price.

Probably due to this, other large companies (such as Discord Inc., Reddit Inc., and Payward Inc.), which have continuously postponed their listing, did not dare go public. In addition, issuers were deterred by general economic uncertainty, partly caused by geopolitical events.

However, the primary reason behind such subdued activity in the IPO market was monetary policy tightening by central banks. Even the stock market performance did not add to optimism. For example, according to Trading Economics, interest rates in the US and the UK rose from 0.25% to 5.50% and from 0.00% to 4.50% over the past year, respectively. An elevated interest rate typically increases the yield of conventional assets, making investments in the IPO market less appealing. Moreover, the debt burden typically rises for growth companies.

Regarding positive IPO examples, Garden Stage Limited (NASDAQ: GSIW) was the leader among the top 10 stock gainers after the IPO, according to Stock Analysis. Most of the top 10 companies represent the technology and healthcare sectors.

Factors potentially impacting the IPO market in 2024

The US Federal Reserve’s monetary policy

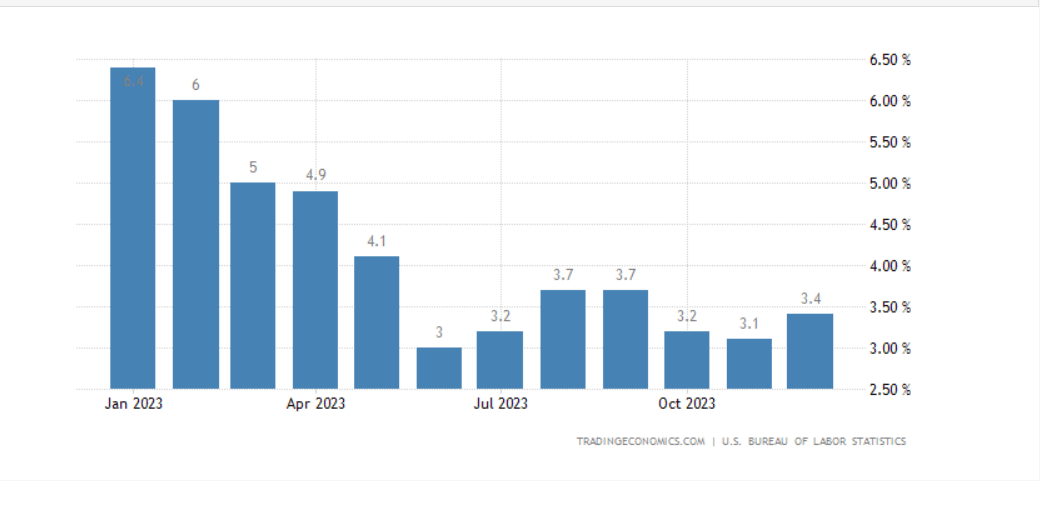

According to Trading Economics, in January 2023, US inflation stood at 6.4%, and the Federal Reserve achieved a lower figure of 3.4% in December by tightening monetary policy. However, the regulator’s actions also resulted in a noticeable decline in the IPO market activity. We have previously described the impact of interest rate hikes on this market.

Inflation rate dynamics give reasons to presume that the Fed’s interest rate hike cycle is over, and the rate may subsequently start to decrease smoothly. This may create favourable conditions for lower capital costs for companies and stronger investor interest in IPOs.

If inflation in the US continues to decrease, it will likely enable the Fed to ease monetary policy faster, potentially giving an impetus to the IPO market.

Geopolitical risks: military actions and the US elections

- Military actions in Ukraine and the Middle East. Russia’s full-scale incursion into Ukraine has made investors more cautious in the IPO market. Amid general economic instability, investors typically opt for more conventional assets. The Israel-Hamas conflict in the Gaza Strip and Houthi attacks on vessels in the Red Sea have led to disruptions in the supply of goods from Asia to Europe. These events have also contributed to an uptick in vessel freight costs globally, potentially leading to another upsurge in global inflation. This could compel the US Federal Reserve to tighten monetary policy further

- US elections and budget crisis. Donald Trump and Joe Biden will likely meet again in the US presidential elections. Their standoff has already resulted in a budget crisis and a conflict between Texas and the federal government. It can be assumed that if the situation continues to aggravate, the US may face a large-scale political crisis, deterring investors from the IPO market. Furthermore, issuers themselves may postpone going public until conditions improve

US, EU, and China trade war prospects

Should Donald Trump win the US presidential race, he may proceed with his idea of negotiating a new trade agreement with the EU and China to reduce a negative balance of foreign trade with these regions, namely by reducing US imports from the EU and China. This decision will likely result in countermeasures, potentially creating conditions when IPOs and participation in them may entail additional risks.

Primary IPO market trends in 2024

- In 2024, under the current economic conditions and with still relatively high interest rates, investors will probably focus on purchasing shares in large companies capable of running their businesses stably and supporting market capitalisation steadily

- As Bloomberg reports, the IMF has raised its forecast for the US GDP growth to 3.1% this year, noting that other developed countries are lagging. Given this information and the political and economic instability in Europe, China, and other large financial centres, it can be assumed that private companies may view the US as a safer place to go public

- Issuers that postponed their IPOs in 2022 and 2023 may go public this year, taking advantage of a potentially improving market environment. Investors will likely, in turn, lock in profits after large companies’ stocks hit their all-time highs. Probably, they will be willing to invest the generated funds in new IPOs

- The market is unlikely to see a boom as in 2021. Given the environment, possible risks, and investor caution, it is fair to presume that issuers must provide robust financial reports to attract market players’ attention to their stocks. At the same time, it is worth noting that Crunchbase Unicorn Board has over 1,500 private companies that might go public

Top 5 most anticipated IPOs in 2024

When compiling this list, we relied on Crunchbase's data and methodology for assessing the potential capitalisation of companies.

1. Shein IPO – 66 billion USD

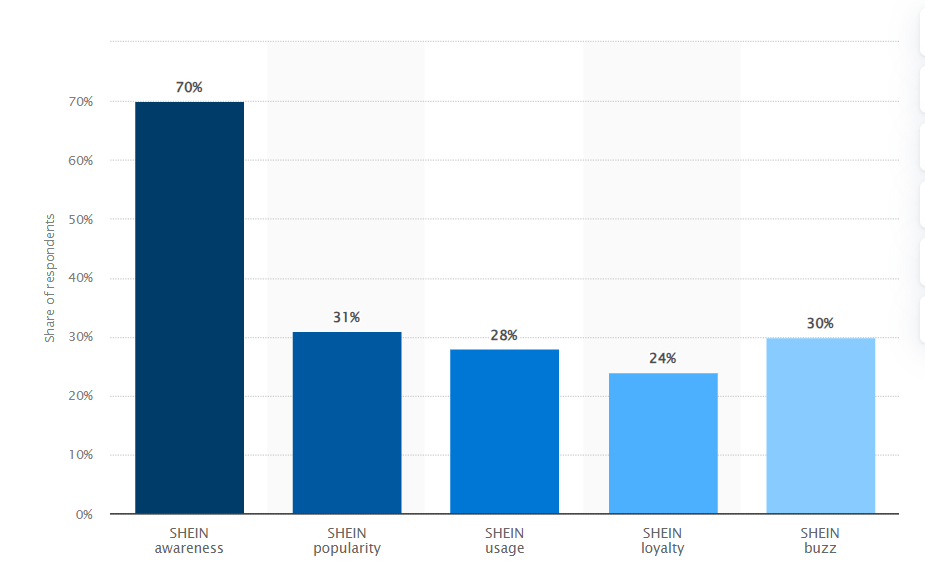

Shein plc. is a Chinese online retailer of women's, men's, and children’s wear, shoes, and accessories, founded in 2008. It is renowned for its extensive range of products and low prices. According to Statista's 2023 data, Shein achieved 70% brand awareness among US consumers, with a 31% popularity rating, 28% usage rate, 24% customer loyalty, and 30% buzz.

2. Stripe IPO – 50 billion USD

Stripe Inc. is a US-based tech company founded in 2010, specialising in online payments and financial services for Internet businesses. Its primary products include an online payment platform and tools for financial management, analytics, and business process automation.

Stripe is one of the leading players in the online payment industry, serving clients such as Meta Platforms Inc. (NASDAQ: META), Alphabet Inc. (NASDAQ: GOOGL), Amazon.com Inc. (NASDAQ: AMZN), and many other prominent corporations. Its electronic payment system supports over 100 payment methods and over 135 currencies across 195 countries.

3. Databricks IPO – 43 billion USD

Databricks Inc., founded in 2013, specialises in data analytics and processing, artificial intelligence, and cloud computing. According to the BusinessWire survey, the global big data market could reach a valuation of 142.5 billion USD by 2024.

According to the official website data, as of today, the number of Databricks Inc. clients exceeded 9,000 companies, including Microsoft Corporation (NASDAQ: MSFT), Amazon.com Inc. (NASDAQ: AMZN), Adobe Systems Incorporated (NASDAQ: ADBE), and AT&T Inc. (NYSE: T). As reported by Getlatka, the company’s revenue exceeded 1.5 billion USD in 2023.

The company’s competitor is Snowflake Inc. (NYSE: SNOW), whose IPO garnered investors a 171% net profit during the lock-up period. Therefore, Databricks Inc.’s anticipated initial public offering is of heightened interest to investors.

4. Fanatics IPO – 31 billion USD

US-based Fanatics Inc., established in 1995, specialises in licensed sports goods and memorabilia. It is one of the largest retailers of sportswear, outfits, souvenirs, and related sports products in the US. In 2023, its subsidiary, Fanatics Betting and Gaming, commenced operations.

The company operates as an online retailer with a widespread network of partnerships with professional sports leagues, teams, and brands to distribute its products.

5. Chime Financial IPO – 25 billion USD

Chime Financial Inc., a US company founded in 2013, offers financial technology services through its Chime mobile app and online platform, with financial and banking services as its primary product.

Chime Financial Inc. mainly focuses on providing convenient and accessible financial tools, utilising technology to automate and streamline banking operations for its clients. The company is also known for its innovative approach to banking servicing, including a roundup function that automatically rounds up purchase prices, transferring the difference to the client’s savings account.

According to Apptopia, Chime was the most downloaded digital banking app in the US in the first half of 2021, with 6.4 million downloads.

Risks for Investors in the 2024 IPO Market

- Issuers’ subdued activity. Impacted by economic and geopolitical factors, large companies may delay their flotations. This subdued activity may pose challenges for investors in finding suitable investment opportunities

- Inflation. If the US inflation rate does not maintain its downward trajectory, the Federal Reserve will likely be compelled to keep the interest rate at the current level or even raise it. Consequently, the IPO market may witness market conditions reminiscent of the liquidity shortage observed in 2022-2023

- Political crisis in the US. It can be assumed that the risk of a large-scale political crisis in the country persists due to a highly contested US presidential race. Such conditions can hardly be deemed appropriate for going public or investing in IPOs

Analysts’ forecasts for the 2024 IPO market

- According to Yahoo Finance, John Chirico, Citi's US head of banking, capital markets, and advisory, forecasts a significant uptick in the IPO market in 2024, with promising opportunities towards the end of the year. He believes that companies valued from 2 to 3 billion USD will dominate the market

- José Manuel Gómez-Borrero, an investment expert at BBVA Corporate & Investment Banking, expects the IPO market to recover in 2024. He bases his outlook on a high probability of interest rate cuts by the US Federal Reserve and robust quarterly corporate reports surpassing analyst expectations

Conclusion

In 2022 and 2023, the global IPO market stagnated, contrasting with the record number of IPOs and funds raised in 2021. Last year, the technology and healthcare sectors saw the most successful IPOs. In total, there were 1,298 global IPOs in 2023, enabling issuers to raise 123.2 billion USD.

The analysts mentioned above believe that the IPO market is poised for recovery in 2024, thanks to changes in the US Federal Reserve’s monetary policy. Companies like Shein plc, Stripe Inc., Databricks Inc., Fanatics Inc., and Chime Financial Inc. may lead this year’s biggest IPOs.

However, this year’s potential main risks for investors will likely include a possible rise in inflation, geopolitical tensions, and post-election political uncertainty in the US.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high