Top 5 Stocks of September: Leaders of Growth and Decline

8 minutes for reading

The Top 5 list of companies that demonstrated the most noticeable growth in September includes SSR Mining Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, Interactive Brokers Group Inc., and Cal-Maine Foods Inc.

On the other hand, the leaders of decline are Scotts Miracle-Gro Company, Alcoa Corporation, FedEx Corporation, V.F. Corporation, and Spirit AeroSystems Holdings Inc.

Selection criteria

- The stocks are traded on the NYSE or NASDAQ

- The stock price is over $2

- The companies are not funds

- Their market capitalisation is over $2 billion

- Their average trade volume of the last 30 days is over 750,000 stocks.

Growth and decline were expressed in percent as the difference between the closing prices of 31 August and 30 September. The market capitalisation of the companies remained valid at the moment when the article was prepared.

Stocks with most prominent growth in September

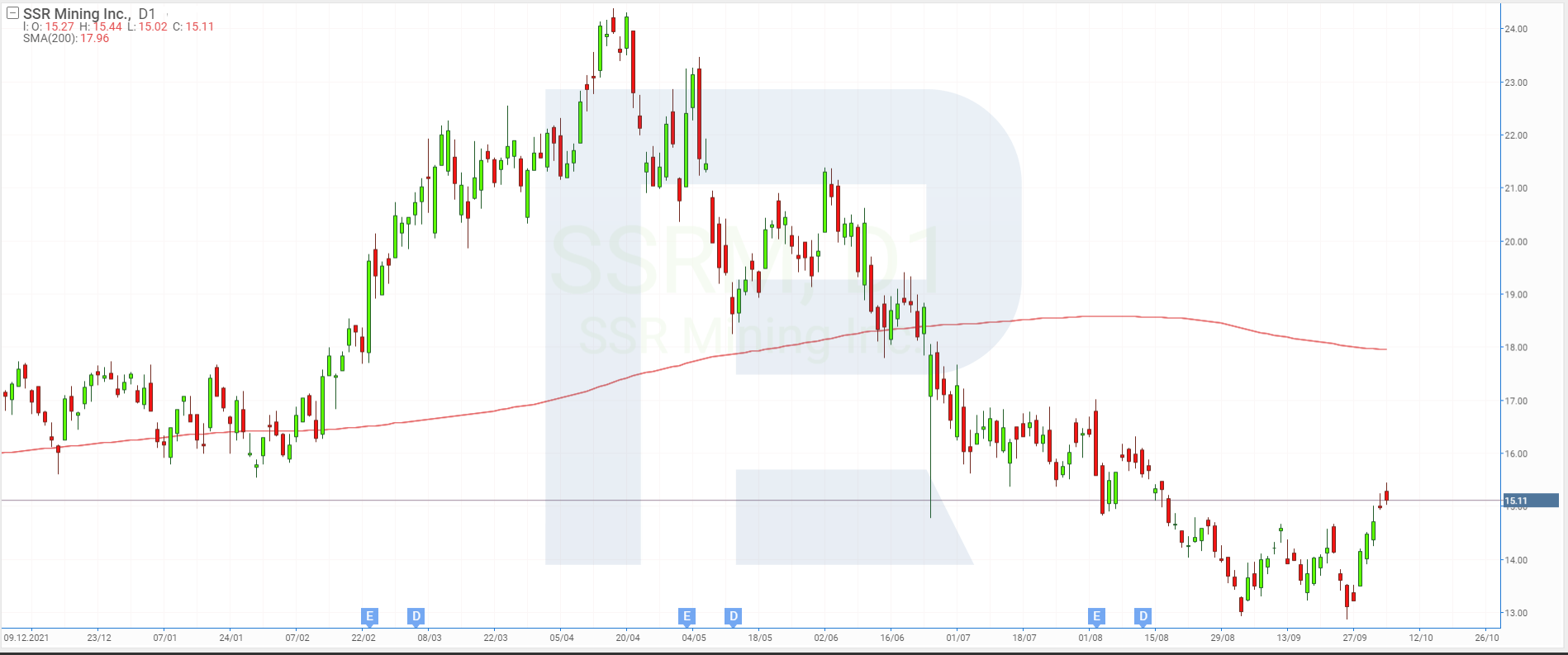

1. SSR Mining – 9.04%

Founded in: 1946

Registered in: the US

Head office: Denver, Colorado

Sector: non-resource minerals

Platform: NASDAQ

Market capitalisation: $3.04 billion

SSR Mining Inc. which used to be called Silver Standard Resources Inc. until 2017, specialises in exploring, developing, and exploiting gold, silver, copper, lead, and zinc deposits in Turkey, Canada, Argentina, and the US.

In September, the shares of SSR Mining Inc. (NASDAQ:SSRM) recorded a 9.04% growth with their price rising from $13.49 to $14.71. At the end of the month, the company announced that it had received all the necessary permissions from the Turkish regulators to resume work at the Ҫӧpler mine.

2. Eli Lilly – 7.34%

Founded in: 1876

Registered in: the US

Head office: Indianapolis, Indiana

Sector: healthcare

Platform: NYSE

Market capitalisation: $307.24 billion

Eli Lilly and Company develops and produces drugs. It is known as the first company that started mass production of the insulin hormone in 1923. The company has offices in 18 countries and supplies medication to 125 countries.

Over the last month, the share price of Eli Lilly and Company (NYSE:LLY) rose 7.34% from $301.23 to $323.35. Analysts state that this must be the consequence of the successful clinical tests of a new drug against Alzheimer’s, which is developed by Biogen Inc. alongside Eisai Co. Ltd. This success story impacted Eli Lilly and Company as well, fuelling its growth and sending its stock price up because the company is working on a similar drug.

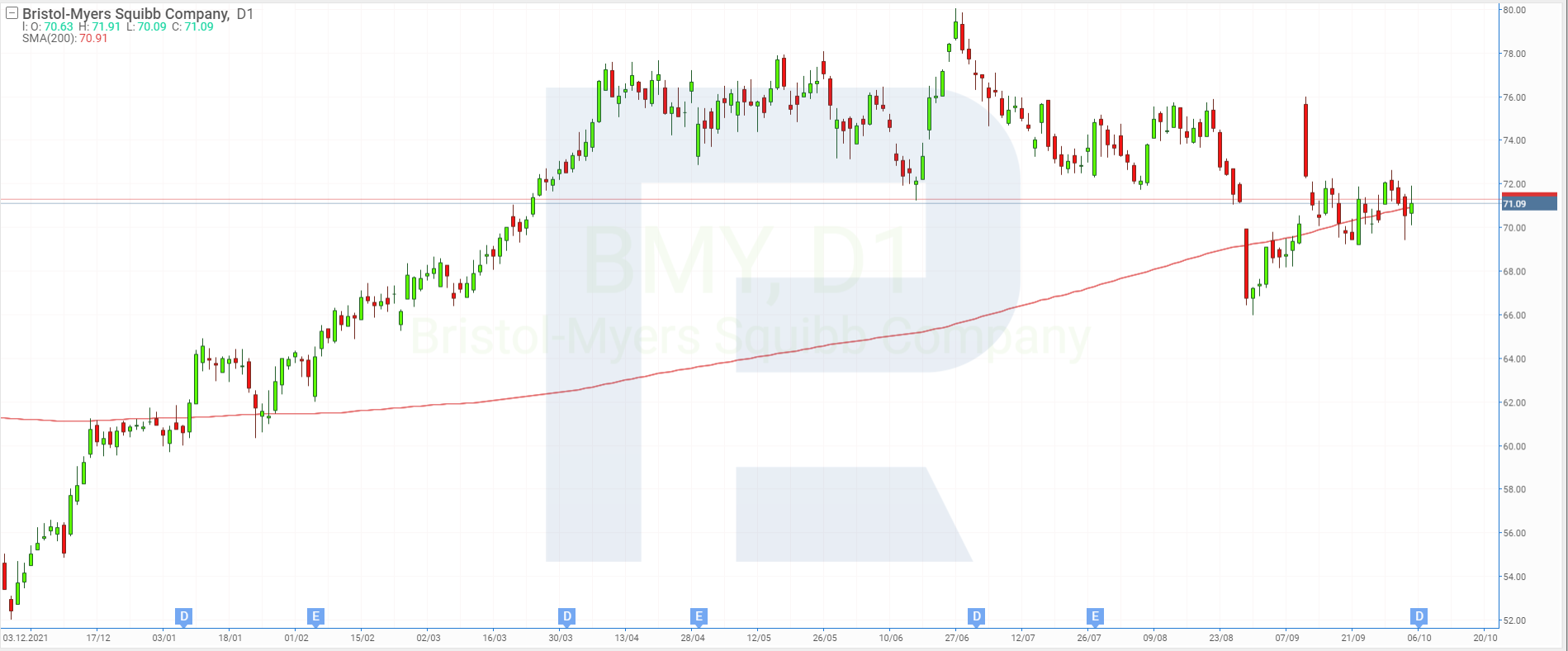

3. Bristol-Myers Squibb – 5.46%

Founded in: 1887

Registered in: the US

Head office: New York, New York

Sector: healthcare

Platform: NYSE

Market capitalisation: $151.79 billion

In September, the quotes of Bristol-Myers Squibb Company (NYSE:BMY), another large representative of the healthcare sector, surged 5.46% from $67.41 to $71.09.

Note that the company did not demonstrate any particularly impressive performance in the said month. Experts say that the share price growth is attributed to the fact that investors consider these shares safe at a time when the main stock indices are falling.

4. Interactive Brokers Group – 3.77%

Founded in: 1977

Registered in: the US

Head office: Greenwich, Connecticut

Sector: financial services

Platform: NASDAQ

Market capitalisation: $26.8 billion

Interactive Brokers Group Inc. owns platforms for trading stocks, options, futures, currencies and bonds. Last month, new functions were added to the trading apps of the company, such as trading options.

This might be the reason for the growth of Interactive Brokers Group Inc. stock (NASDAQ:IBKR) in September, with the share price rising 3.77% from $61.59 to $63.91.

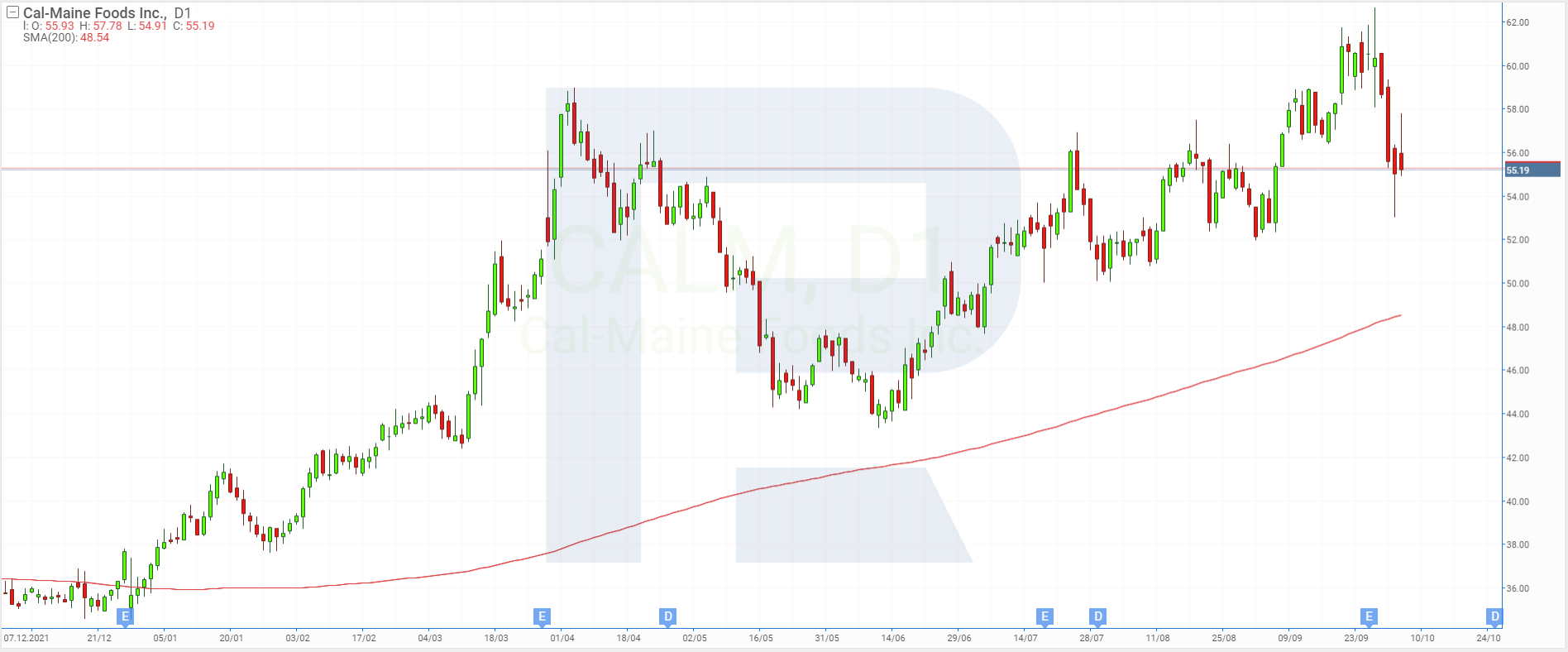

5. Cal-Maine Foods – 3.69%

Founded in: 1957

Registered in: the US

Head office: Ridgeland, Mississippi

Sector: non-durable consumer goods

Platform: NASDAQ

Market capitalisation: $2.72 billion

Cal-Maine Foods Inc. is the largest producer and distributor of chicken eggs in the US. According to the information on 28 May 2022, the total number of laying hens in the company’s factories amounted to 42.2 million birds.

Over the last month, the share price of Cal-Maine Foods Inc. (NASDAQ:CALM) surged 3.69% from $53.61 to $55.59. The company has just published a strong financial report for Q1, financial 2023.

Earnings increased by 102.6% compared to the statistics of the same months of the previous year, reaching $658.3 million. Net profit skyrocketed 794.2% to $125.1 million, and EPS 797.3% to $2.58. Moreover, dividend payments were announced for Q1, financial 2023, sized at $0.85 per share.

Leaders of decline in September

1. Scotts Miracle-Gro – 36.15%

Founded in: 1868

Registered in: the US

Head office: Marysville, Ohio

Sector: chemical industry

Platform: NYSE

Market capitalisation: $2.37 billion

Scotts Miracle-Gro Company produces and sells a wide variety of products for lawn and garden care, including goods for pro gardeners. Its assortment includes fertilisers, pest control agents, top dressings, garden soil, seeds, and much more. The company works in North America and Europe.

In September, the shares of Scotts Miracle-Gro Company (NYSE:SMG) dropped 36.15% from $66.95 to $42.75. At the beginning of August, the company reported an unexpected slump in quarterly earnings and profit. Investors are now anxious that the situation will keep worsening due to the possible recession, high inflation, and growth of interest rates. All these factors influence the readiness of consumers to make purchases.

2. Alcoa – 31.97%

Founded in: 1888

Registered in: the US

Head office: Pittsburg, Pennsylvania

Sector: non-resource minerals

Platform: NYSE

Market capitalisation: $6.06 billion

The metallurgic Alcoa Company is one of the world’s largest aluminium manufacturers. Moreover, the company mines bauxite and produces alumina. It mostly works in the US, Canada, Australia, Brazil, Norway, Spain, and Iceland.

With falling aluminium prices, the share price of Alcoa Corporation (NYSE:AA) plummeted 31.97% last month, dropping from $49.48 to $33.66. Almost 70% of the trading sessions in these shares in September closed with a decline.

3. FedEx – 29.57%

Founded in: 1971

Registered in: the US

Head office: Memphis, Tennessee

Sector: delivery services

Platform: NYSE

Market capitalisation: $38.63 billion

Over the last month, the share price of FedEx Corporation (NYSE:FDX) which specialises in postal, delivery, and logistics services worldwide lost 29.57%, falling from $210.81 to $148.47.

On 22 September, FedEx Corporation published a report for Q1, financial 2023. Compared to the statistics of the same part of last year, earnings in June-August increased 5.5% to $23.2 billion. However, net profit dropped by 21.2% to $875 million and EPS fell 8.6% to $3.33.

The company expects the situation to worsen in this quarter, so a cut down on expenses was announced, namely using less transport and shutting down more than 90 FedEx offices.

4. V.F. – 27.84%

Founded in: 1899

Registered in: the US

Head office: Denver, Colorado

Sector: non-durable consumer goods

Platform: NYSE

Market capitalisation: $11.62 billion

V.F. Corporation produces clothes, shoes, and accessories for women, men, and children. The company owns 13 brands, including The North Face, Timberland, Vans, Supreme, Napapijri, Eastpak, and Dickies.

Over the last month, the stock quotes of V.F. Corporation (NYSE:VFC) plummeted 27.84% from $41.45 to $29.91. Due to the macroeconomic challenges in the market, the low demand, and goods accumulating in stock, the management of the company changed the forecast for 2023.

The expected EPS of V.F. Corporation was corrected from $3.05-$3.15 to $2.6-2.7. On the next day after the forecast was changed, Wells Fargo and Wedbush changed the target price of V.F. Corporation shares from $50 to $40 and from $48 to $35, respectively.

5. Spirit AeroSystem Holdings – 27.18%

Founded in: 1996

Registered in: the US

Head office: San Carlos, California

Sector: aerospace and defense industry

Platform: NYSE

Market capitalisation: $2.3 billion

Spirit AeroSystems Holdings Inc. constructs, produces and sells commercial aviation constructions. The Boeing Company is one of its clients. The corporation works in the commercial, defence, and space segments, offering after-sales maintenance services.

Over September, the shares of Spirit AeroSystems Holdings Inc. (NYSE:SPR) lost 27.18%, falling from $30.1 to $21.92. The decline over the year hit 46%, reaching 72% over three years. Investors are losing confidence in Spirit AeroSystems Holdings Inc., which is understandable because the company has not made any net profit for a long time.

Companies that demonstrated the most prominent dynamics in September

The leaders among the companies that demonstrated the most noticeable growth in September are SSR Mining Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, Interactive Brokers Group Inc., and Cal-Maine Foods Inc.

On the other hand, the leaders of decline are Scotts Miracle-Gro Company, Alcoa Corporation, FedEx Corporation, V.F. Corporation, and Spirit AeroSystems Holdings Inc.

While the leaders of growth had their individual reasons for growth, the decline in the other group of stocks is mostly attributed to the prevailing economic challenges, high inflation, the growth of the interest rate, and weak consumer demand.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high