What Influences Gold Quotes?

6 minutes for reading

The energy crisis and the quantitative easing policy in the US have led to the growth of inflation to the current level of 7.7%. To bring it down to 2%, the Fed has been tightening the monetary policy since the beginning of the year. These measures might have already had some effect because, since August, inflation in the country has dropped from 9.1%; nevertheless, this is still far from the target level.

Inflation depreciates money; hence, people seek protection from inflation through investments in other financial instruments, such as gold. However, since March 2022, gold quotes have lost 22%, and are now trading 14% below the all-time high.

Today we will analyse the supply and demand for gold, look at its dynamics over the last twelve years, and find out whether investments in this metal are ahead of inflation.

Sources of demand for gold

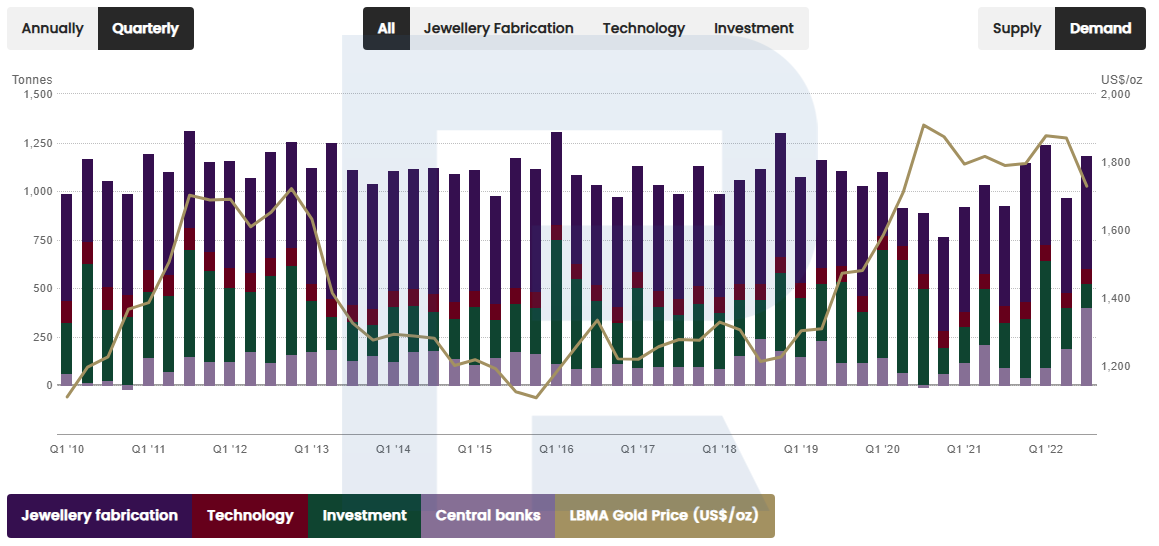

According to the chart below, which is based on the data provided by ICE Benchmark Administration, Metals Focus, Refinitiv GFMS, and World Gold Council; the demand for gold in 2022 was mostly generated by the producers of jewellery. Number two was private and institutional investors, number three was Central Banks, and number four was tech production. Let's analyse all these sources of demand for this precious metal.

Jewellery makers

The demand from the jewellery-producing sector has long been more or less stable, at about 2,000-2,500 tons a year. Demand for the precious metal increases when its price falls but returns to average values thereafter.

In other words, when the price of gold drops, whoever has been postponing its purchase now decides to bring their dreams to life until the price restores. The demand for gold surges, only to balance out shortly thereafter.

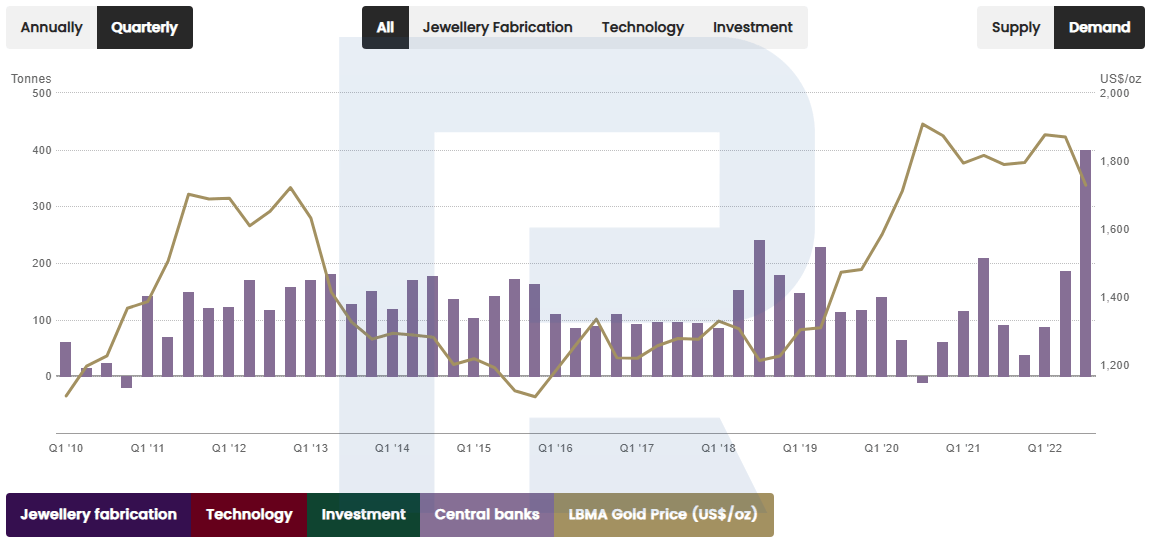

Central Banks

By 2016, gold quotes have dropped from 1,700 to 1,250 USD per troy ounce. Alongside the price, the demand generated by Central Banks dropped to 85 tons a quarter.

However, the situation changed in 2018 when CBs started buying gold actively, pushing the price up to 2,000 USD. The CBs continued to gradually sell the precious metal while the price was growing. In 2020, when the price reached its peak, supply in the market exceeded demand.

The reason behind such actions of CBs was not speculation, but the world crisis, which was caused by the COVID-19 pandemic, and which made countries sell gold to support their economies.

At the beginning of 2021, the demand for gold grew but dropped again later on. The demand from Central Banks started growing again in 2022, but the quotes of the precious metal plunged from 2,000 to 1,600 USD regardless.

The results of Q3 2022 demonstrate that CBs bought a record quantity of gold – 400 tons. This is twice more than the average, but even such a large volume of trades did not lead to the rise in the gold quotes: from 1 July to 1 October, the quotes dropped by 8%.

One of the main reasons for such a record is the sanctions against Russia, whose gold reserves have been frozen. Consequently, to diversify risks, certain countries opted for investing in gold instead of US treasury bonds.

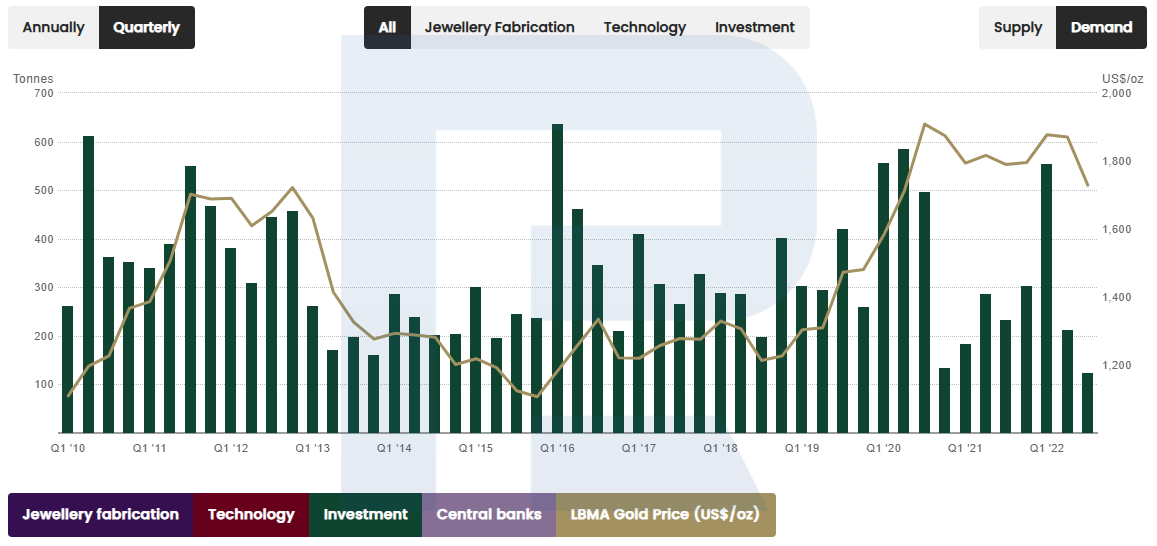

Investors

In Q1 2022, the demand for gold generated by investors was high, pushing the price of gold up to all-time highs. But in Q2, investments shrank almost 3 times, sending the quotes to plummet.

In Q3, the demand generated by CBs hit a record high, but at the same time, the investment volume in gold dropped by 71.6%, compared to the statistics of the previous quarter. This, in the end, led to a further drop in the price of this financial instrument.

The investment sector includes individual investors who buy gold coins and bars, and institutional investors – ETFs. Inflows of capital into funds lead to increased investment volumes.

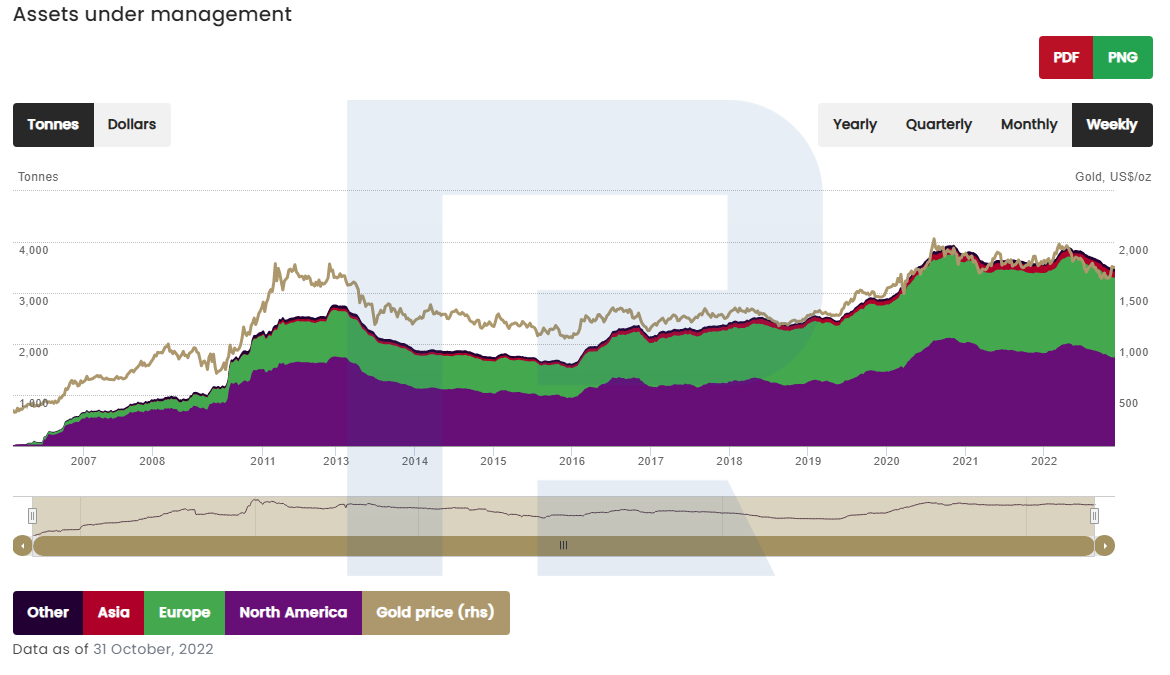

According to the chart below, which is based on information from Bloomberg, Company Filings, ICE Benchmark Administration, and World Gold Council; on 31 October 2022, investors from Asia held almost 120 tons of gold, Europeans held 1,500 tons, while American investors held 1,700 tons.

American ETFs are the largest gold investors, and normally buy 200 tons more than European ones. The chart demonstrates that the outflow of money from European ETFs stopped in October, but the price of gold still went on falling. In November, money outflow stopped from the US ETFs, and the price of gold started rising gradually.

How to invest in gold

There are several ways of investing in gold on the stock exchange: By way of futures, stocks of gold-mining companies, and ETFs.

Amongst the gold-mining companies, if we single out the industry leaders in terms of market capitalisation, these are Newmont Corporation (NYSE: NEM), Barrick Gold Corporation (NYSE: GOLD), and Agnico Eagle Mines Limited (NYSE: AEM). Their market cap figures are 38.5 billion USD, 30 billion USD, and 23.7 billion USD, respectively.

Amongst the ETFs of the sector, the three leaders in terms of managed assets are:

- SPDR Gold Shares (NYSE: GLD) - 51 billion USD

- iShares Gold Trust (NYSE: IAU) - 25.3 billion USD

- SPDR Gold MiniShares Trust (NYSE: GLDM) - 4.9 billion USD

Comparing return on investments in gold to inflation

Here, everything depends on the time of investments in the precious metal. If an investment was made in August 2011, the return over the last 11 years would be near zero; if it was made at the beginning of 2010, then it would be almost 64%.

Now let's compare this result to inflation: from 2010 until the moment this article was being prepared, the average inflation level of the USD was 2.64% a year, or 34.3% over twelve years and eleven months.

Summary

The main sources of demand for gold are jewellery producers, individual and institutional investors, and Central Banks. We analysed the major changes in the interest towards this financial instrument over the last several years. We talked about ways of investing in gold and listed the leaders of the gold-mining sector alongside large ETFs that specialise in gold.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high