Top-5 Companies from Renewable Energy Sector

6 minutes for reading

On 5 November 2021, the House of Representatives of the US Congress voted for Joe Biden's infrastructure plan, and the President signed it on 15 November 2021. The plan calls for allocating $1.2 trillion from the budget for the renewal and development of the communal, transporting, and energy systems, the construction and maintenance of roads, and supporting alternative energy sources.

The new law calls for creating a national network of charging stations for electric cars for the purpose of replacing school and city buses and other public transport with zero-emission alternative vehicles. The amount of $15 billion is planned to be spent on this part.

Moreover, on 19 November 2021, the House of Representatives supported Biden's Build Back Better Act for the investment of $1.75 trillion in the social and ecological infrastructure of the country. Out of this sum, the amount of $500 billion is to be allocated to fighting climate change, mostly at the expense of clean energy tax incentives.

These are the all-time largest federal investments in the sector of clean energy in the US.

The stock market immediately reacted to this news, which particularly affected the shares of companies that produce batteries for electric transport, hardware and software for charging it, and generators of alternative energy for households.

Which companies can benefit from the plan? Here is top-5 candidates.

1. ChargePoint

The company was founded in 2007. It creates and sells hardware and software for charging electric vehicles. Today it is the leader of the North American market, while it is also developing efficiently in EU countries.

ChargePoint owns 118,000 charging stations, with 5,000 of them situated across Europe. With sales having grown over previous quarters, ChargePoint Holdings had reason to revise its forecast for the current financial year and increase the expected revenue by 15%.

On 8 November 2021- the next trading day after Congress passed the bill for the infrastructure plan - the share price of ChargePoint Holdings (NYSE: CHPT) leaped up by 11.79% to $27.6.

However, the reaction to the signing of the draft law by President Biden and the voting for the social programme was much feebler. On 15 November 2021, the quotations grew by just 0.41% to $26.41, and on 19 November 2021 by 2.95% to $26.9.

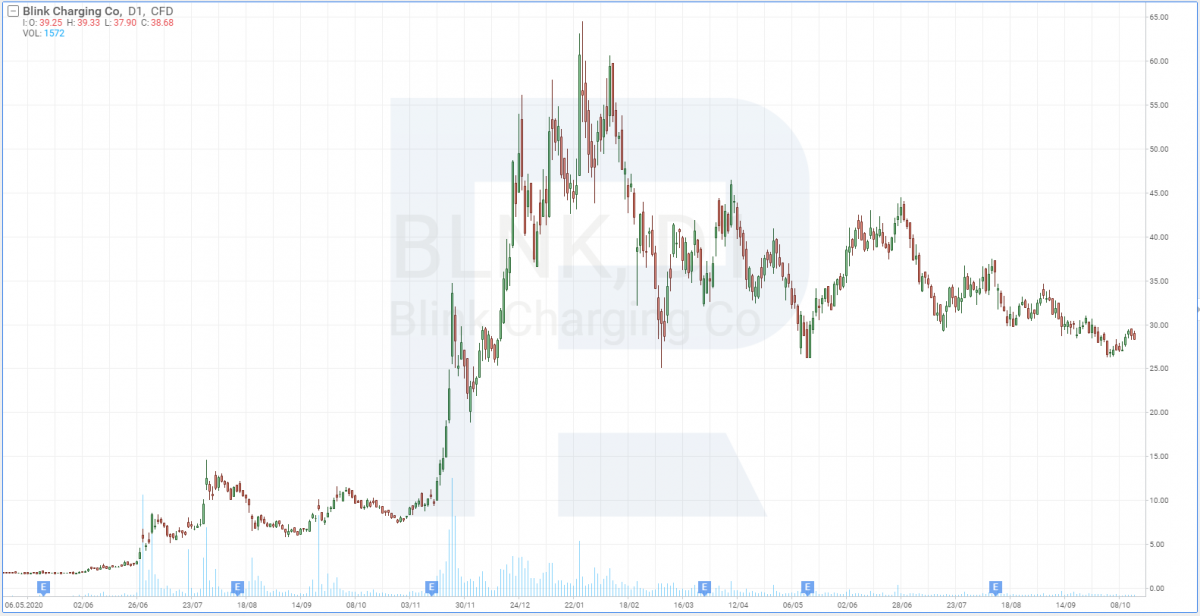

2. Blink Charging

Blink Charging was founded in 2009 in Miami Beach, Florida. It designs, manufactures, owns, and operates electrical vehicle (EV) charging stations. Its diverse product range for residential and commercial properties boasts the most advanced equipment in the industry. According to the information on the Blink Charging website, the company is committed to expanding its EV charging network, which currently consists of as many as 17,300 charging stations across the US.

In October 2021, Blink Charging treated its investors to two new trades. The first agreement increased the number of charging stations in Los Angeles by 300 units. By the second agreement, the company sold 64 charging stations to Rudy's Performance Parts. There is no information yet about the profit made on these agreements.

On 8 November 2021, the shares of Blink Charging Co (NASDAQ: BLNK) sky-rocketed by 24.27%, reaching $39.07.

On 15 November 2021, the shares grew by 17.1% to $46.8, and on 19 November 2021, after a deep decline, they rose by 2.16% to $43.08.

3. Plug Power

Plug Power was founded in 1997 as a joint venture between Mechanical Technology and DTE Energy. It specialises in systems of hydrogen fuel cells for electric vehicles.

In 2021, Plug Power demonstrated how serious it was about extending its market influence. Iits agreements with Phillips 66, Airbus, HevenDrones, SK Group, and Lhyfe are proof of this.

On 8 November 2021, the reaction of Plug Power Inc (NASDAQ: PLUG) quotations was quite moderate compared to that of other companies: by the end of the trading session, growth only amounted to 6.7%, with the price reaching $40.94.

On 15 November 2021, the share price even dropped by 3.06% to $41.82, while on 19 November 2021, the quotations sky-rocketed by 10.22% to $44.55.

4. Bloom Energy

Founded in 2001, the company produces and sells high-tech efficient equipment, which transforms natural gas, biological gas, and hydrogen into electricity through an electrochemical process. These generators feature a minimum of carbon dioxide, nitrogen oxides, and sulphur in emitted gases.

Among Bloom Energy clients are such companies as Adobe, Alphabet, IBM, Intel, SoftBank, Honda, AT&T, FedEx. In Q3 of 2021, the number of installed generators reached a record 353 units. Moreover, the company signed an agreement with the South-Korean SK Ecoplant for the supply of no less than 500 megawatts of electric energy by 2024. The amount of the agreement is $4.5 billion.

The trading session on 8 November 2021 closed with noticeable growth in the quotations of Bloom Energy Corp (NYSE:BE). Its shares reached $35.56, growing by 11.13%. The quotations reacted to other news by falling 11.07% to $30.37, and with feeble growth of 0.4% to $29.95.

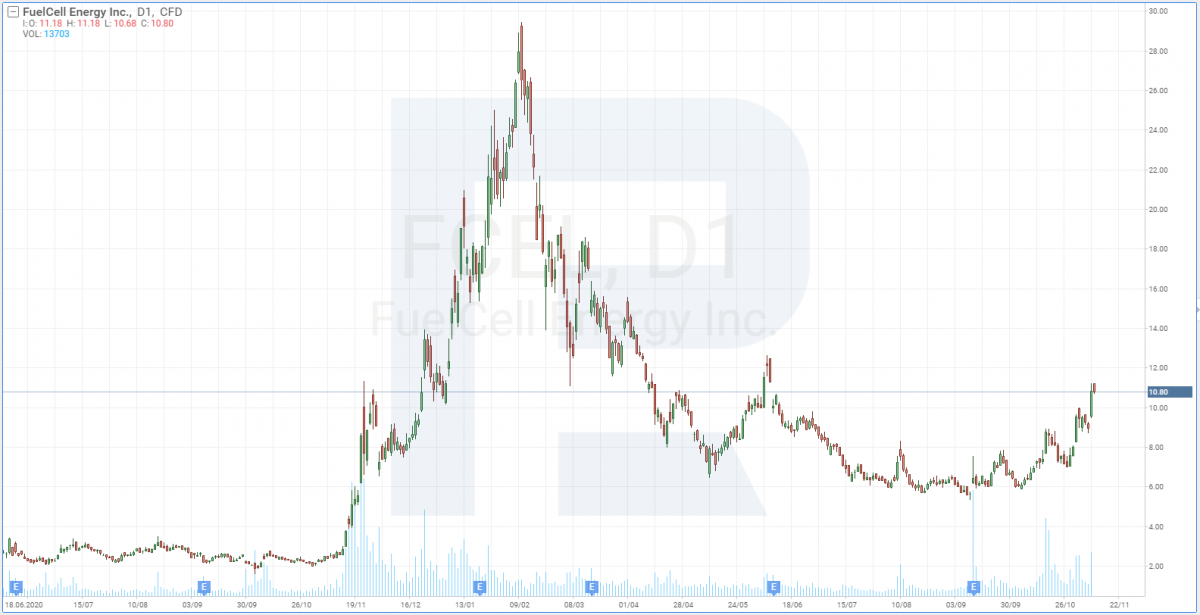

5. FuelCell Energy

FuelCell Energy, founded in 1969, designs, produces and services ecologically-clean electric plants. The fuel cell power plants are equipped with batteries that generate electric energy by chemically recycling natural gas, biogas, and hydrogen.

According to FuelCell Energy, in June 2021, all company equipment generated almost 12.5 million megawatts per hour. This is enough coverage for 3.5 million households in South Korea for one year, as stated on the company website.

FuelCell Energy Inc (NASDAQ: FCEL) stocks shot up following the announcement that the House of Representatives has supported the infrastructure draft law. On 8 November 2021, they leaped up by 20.78%, reaching $10,810.

On 15 November 2021, when the US President signed the draft law, the shares saw a four-day decline by 15.8%, which stopped on 19 November 2021 with a 3.7% growth to $9,810.

What triggered growth in the stock of the clean energy sector in the US?

The passing of the bill for the renewal and development of the US infrastructure, which was supported by Congress and the US President, has given a big push to the electric vehicle sector and everything relating to renewable energy.

The amount of $15 billion would be allocated from the US budget to create a national network of charging stations for electric cars and introduce clean vehicles into the public and school transport system.

Moreover, the House of Representatives has supported the programme of investing $1.75 trillion in the social and ecological infrastructure of the country, with $500 billion being allocated to tax incentives for clean energy.

Consequently, the shares of numerous producers of accessories for electric transport, charging equipment, and alternative energy generators have grown immediately following this news.

Among them ChargePoint, Blink Charging, Plug Power, Bloom Energy, and FuelCell Energy are in the top-5.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high