Microsoft and Activision Blizzard Deal: Chances of Success and Stock Prospects

7 minutes for reading

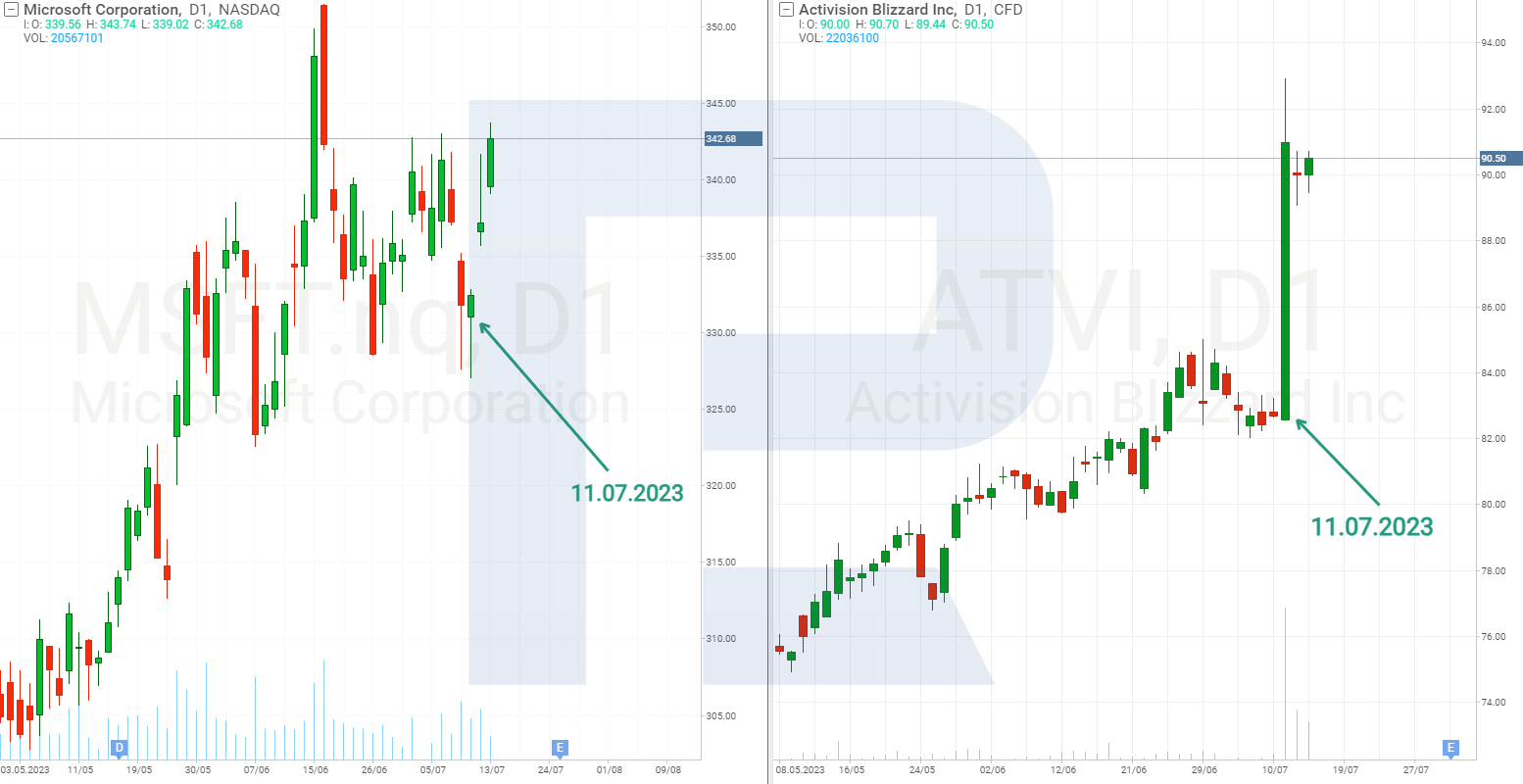

Activision Blizzard Inc. (NASDAQ: ATVI) stock gained over 10% on 11 July 2023 following the news of the federal court of San Francisco lifting the ban imposed by the US Federal Trade Commission (FTC) on the deal between Microsoft Corporation (NASDAQ: MSFT) and the gaming company. At the time of writing, the only remaining obstacle to the completion of the acquisition is the ban from the UK Competition and Markets Authority (CMA).

Today we will examine the deal between these corporations and its complexities. We will explain the risks the IT giant faces in case the purchase of the game developer fails and explain how these developments are affecting the value of the stocks of both companies.

When was the deal between Microsoft and Activision Blizzard announced?

Microsoft Corporation announced its intention to acquire one of the world’s largest video game publishers and developers on 18 January 2022. In the official press release, it was stated that the management of Activision Blizzard Inc. agreed to the terms of the deal, which amounted to 52 billion GBP, exceeding the company’s market capitalisation at the time by 45%.

Following the acquisition, Activision Blizzard Inc. would become a subsidiary of Microsoft Corporation, led by the head of Xbox, Phil Spencer. The technology corporation has committed to preserving the creative independence and culture of the gaming company, as well as supporting all its brands and franchises, including Call of Duty, Overwatch, World of Warcraft, and Candy Crush.

What challenges have Microsoft and Activision Blizzard faced?

The deal between Microsoft Corporation and Activision Blizzard Inc. could significantly alter the landscape and the balance of power in the video game and cloud services market, as well as affect the fate of many popular franchises. Therefore, the companies must obtain approval from antitrust authorities to complete the acquisition.

By June 2023, the purchase had been approved by the respective regulators in 37 countries, including the European Union and China. However, the US Federal Trade Commission (FTC) and the UK Competition and Markets Authority (CMA) expressed opposing views.

FTC opposition to the takeover of Activision Blizzard

In December 2022, the FTC went to court to block Microsoft Corporation’s deal with Activision Blizzard Inc. The Commission stated that this acquisition would harm consumers as the IT corporation would gain exclusive access to the products of the gaming company and potentially eliminate competition from Sony Group Corporation (NYSE: SONY), Alphabet Inc. (NASDAQ: GOOG), and other competitors in the cloud gaming market, thereby establishing a monopoly. In addition, according to FTC officials, Microsoft Corporation did not provide sufficient information about the deal and its market implications.

On 11 July 2023, the federal court in San Francisco ruled in favour of the technology giant. Two days later, the regulator appealed to overturn this decision and extend the review period for the acquisition, but the request was denied.

CMA opposition to the Microsoft-Activision deal

The UK regulator blocked the deal in April 2023 over concerns that the acquisition would strengthen Microsoft Corporation’s advantage over competitors in cloud gaming and threaten to create conditions for the development of a monopoly.

However, after the US court refused to block the acquisition, CMA officials said they were ready to consider any proposals from Microsoft Corporation to restructure the deal. Furthermore, the CMA is ready to abandon litigation – it is only necessary to reach a compromise. However, the parties failed to reach an agreement, and on 14 July, the regulator extended the deadline for its review of the case to 29 August.

What risks does Microsoft face if the deal is not completed?

Microsoft Corporation and Activision Blizzard Inc. signed an agreement on 18 January 2023 that specified the deadlines for closing the deal. If the tech corporation fails to complete the acquisition on time for any reason, it is obligated to pay financial compensation to the other party. There were three specified dates:

- If the deal is not completed by 18 January 2023, Microsoft Corporation is required to pay Activision Blizzard Inc. 2 billion USD or extend the deal until 18 April

- If the deal is not completed by 18 April 2023, Microsoft Corporation is required to pay Activision Blizzard Inc. 2.5 billion USD or extend the deal until 18 July

- If the deal is not completed by 18 July 2023, Microsoft Corporation is required to pay Activision Blizzard Inc. 3 billion USD. The agreement does not provide for further extension of the deadlines

Recall that the UK CMA extended the deadline for its review of the deal to 29 August 2023 with a hearing scheduled for 28 August.

How did the stock prices of Microsoft and Activision Blizzard react?

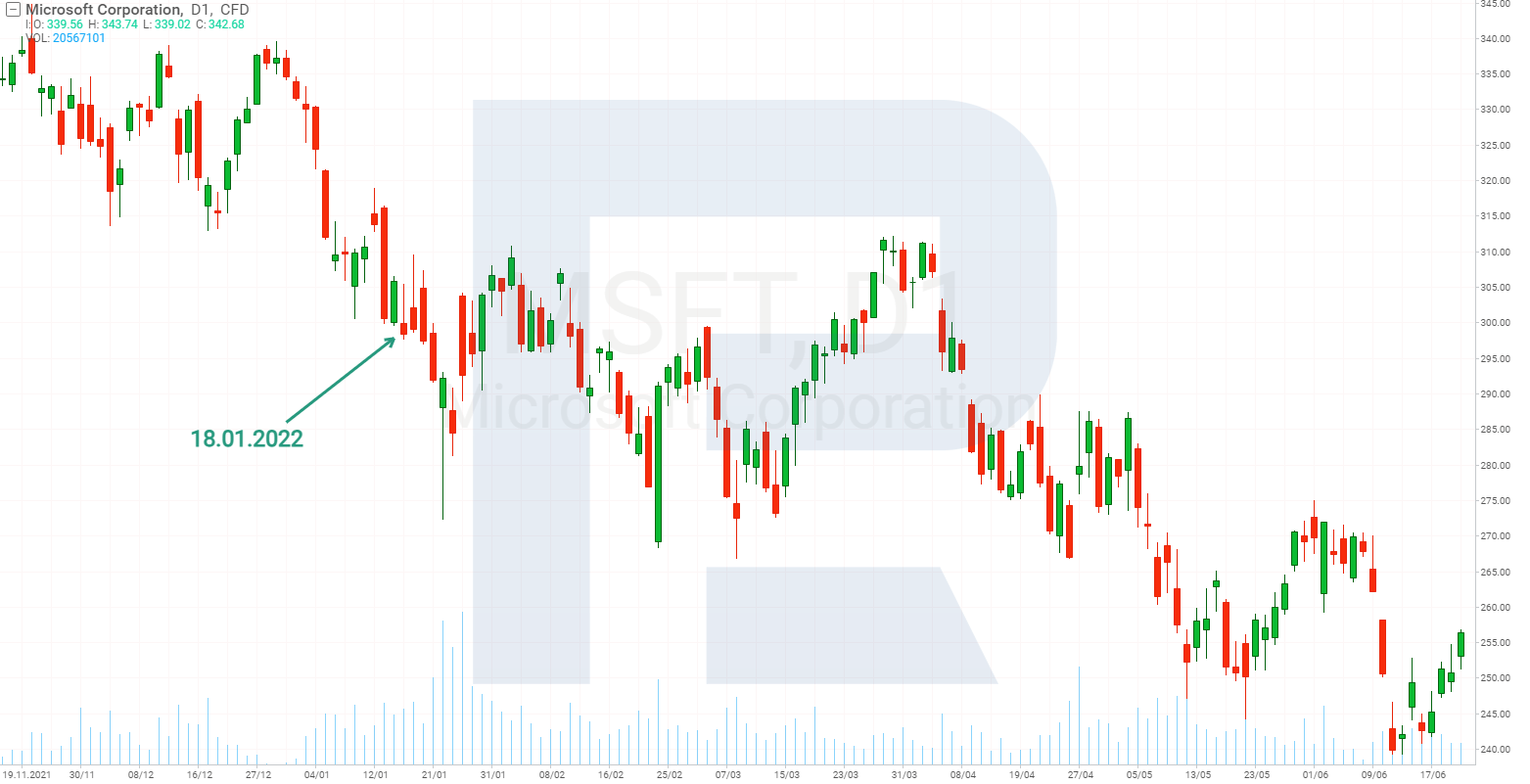

Microsoft Corporation’s stock dropped 2.5% on 18 January 2022, the day the deal was announced, and continued to decline. Investors were negative since the acquisition and integration of the gaming company involves heavy expenses for the corporation.

For Activision Blizzard Inc., that day was very positive as its shares surged 26% to 82 USD at the close of trading. But the quotes could not sustain such a prominent level and experienced fluctuations throughout the year, reacting to regulatory statements.

Microsoft Corporation’s stock rose 0.43% and that of Activision Blizzard Inc. gained 10% on 11 July 2023 when the federal court of San Francisco lifted the FTC’s ban on the acquisition.

What is Microsoft doing to meet CMA’s requirements?

Microsoft Corporation filed an appeal against the decision of the Competition and Markets Authority, stating that the regulator’s actions have shaken confidence in the UK as a safe place for the technology business. The corporation offered the CMA an agreement, under which it pledges not to restrict access to the products of Activision Blizzard Inc. on other platforms or degrade their quality, and to provide independent game developers and publishers with equal access to its cloud services.

On 16 July 2023, Microsoft Corporation signed an agreement with Sony Group Corporation to keep the Call of Duty series of video games on PlayStation consoles after the completion of the deal with Activision Blizzard Inc.

Summary

Microsoft Corporation’s stock has surged more than 42% since the beginning of 2023. However, it can be assumed that such a rapid rise in the stock value was influenced not by the entire context associated with the acquisition of the gaming company but by the hype around AI technologies. Recall that the IT giant was at the centre of the news buzz thanks to its partnership with OpenAI.

In addition, the value of Microsoft Corporation’s stock might continue to rise thanks to the completion of the deal with Activision Blizzard Inc. and the monetisation of its products. Given the amount of news on the deal for the last 10 days, it can be assumed that the technology corporation is doing everything possible to meet the deadlines and complete the purchase. If we look at the stock charts of both companies, we can see that the prices have not dropped after the CMA extended the deal completion date. This could mean that investors are optimistic and expecting a positive decision from the UK regulator.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high