Why NIO Shares Are Growing

5 minutes for reading

Quarantine restrictions in China are being eased, pushing the stocks of Chinese companies up high. A good example here is the stocks of electric car makers: over the past two weeks, the shares of NIO Inc. (NYSE: NIO) recorded 40% growth, Xpeng Inc. (NYSE: XPEV) soared 90%, and Li Auto Inc. (NYSE: LI) rose 47%.

The hero of today’s article is one of these companies – NIO Inc. Let's analyse its sales statistics, and its management's forecasts, and try to find out what factors are pushing the quotes up.

General information about NIO

NIO Inc. is a Chinese company that designs, develops, and manufactures electric cars. It was founded by William Li in 2014 and was called NextEV until 2017.

Among its first investors are Tencent Holdings Ltd. (SEHK: 0700), Xiaomi Corporation (SEHK: 1810), Lenovo Group Ltd. (SEHK: 0992), and Baidu Inc. (NASDAQ: BIDU). The company does not have its own production facilities yet, so to produce electric cars NIO signed an agreement with JAC Motors in May 2016. On 26 April 2022, the 200,000th electric car by NIO rolled off the production line at the JAC-NIO plant in Hefei. In November 2021, the company began construction of its own manufacturing plant. However, the launch scheduled for Q3 2022 was impeded by the quarantine measures in China.

As you may recall, the company was on the verge of bankruptcy at the beginning of 2020, but the Chinese government provided one billion USD in financial aid and opened a credit line for 1.5 billion USD.

NIO financial report for Q3 2022

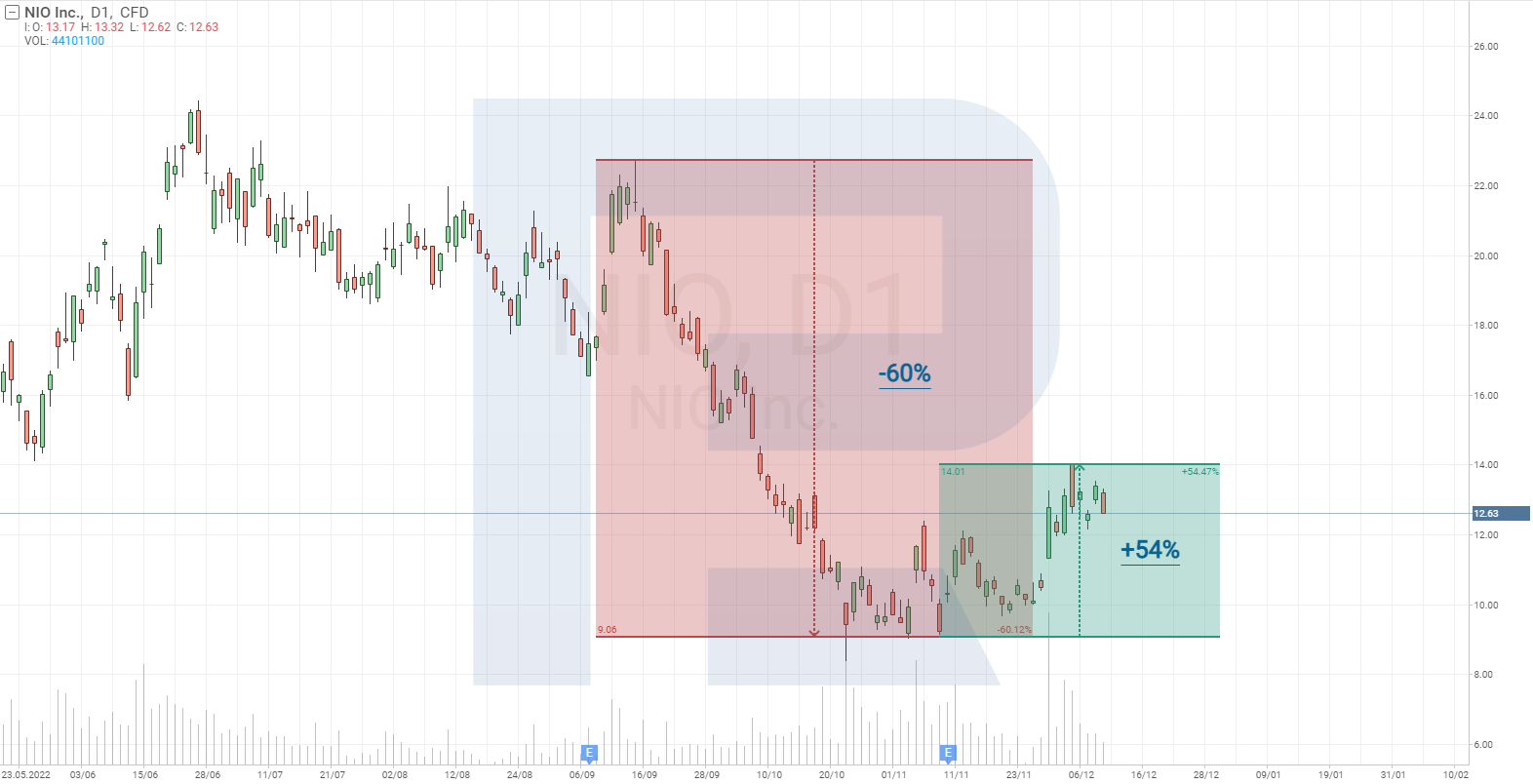

Since the middle of September, the shares of the Chinese car maker have been falling, and by the moment the report was published, they had lost 60%. On 10 November, NIO Inc. presented its Q3 results, and thanks to an optimistic forecast made by its management, the shares surged 25% over two days.

NIO's revenue amounted to 13 billion RMB, which is 32% more than in the same period last year. However, it failed to reach the expected 14.08 billion RMB. The number of electric cars sold amounted to 31,607 – 29% more than a year before. Net loss amounted to 4.1 billion RMB, and loss per share was 2.1 RMB, which represents a whopping 486% growth. The margin reached 16.4%, which is 1.6% less than last year and 0.3% less than in the previous quarter. The reason for the decline in the margin is the increased cost of batteries.

The company had 51 billion RMB on its balance in the form of cash, short-term investments, and long-term deposits.

Forecast for Q4 2022

NIO management forecasts that by the end of Q4, the number of electric cars delivered to clients might reach 43,000-48,000. The forecast growth, compared to the results of the previous quarter, is 36% higher; and 71% higher compared to the results of the last quarter.

According to the information on NIO's website, the company supplied 10,059 electric cars in October 2022, and 14,178 cars in November. To reach the lower border of the forecast range – 43,000 vehicles – the company needs to increase the supply in December to at least 18,763 vehicles. In other words, this month's supply must increase by 32% after a growth of 40% last month, while also taking the quarantine measures into consideration.

Characteristic features of NIO electric cars

NIO electric cars are popular in the Chinese market. But why? The reason must be the large power reserve on one battery (up to 1,000 km by CLTC), and the speed and ease of replacing the battery. The company claims this process takes no more than five minutes.

NIO decreased the charging time by offering to replace batteries at dedicated stations instead of charging them. There are more than 1,200 such stations over the country.

Moreover, the carmaker suggests subscribing to batteries when purchasing an electric car. This noticeably decreases the cost of an NIO electric car and spares the owner from worrying about the battery wearing out.

In October 2022, NIO cars became available in Europe, namely in Norway. Moreover, by the end of this year, special charging stations where batteries can be replaced will appear in Europe. By now, the company has announced the opening of 20 stations but plans to bring this number to 100 over the next year. Also, offices of the corporation will be opening in the ten largest European cities.

Summary

NIO Inc. is a Chinese manufacturer of green passenger vehicles. The company counts on increasing its presence in the local market and expanding worldwide, with a priority on European countries.

One of the key characteristics of NIO electric cars is a large power reserve on one battery charge, and the speed and ease of replacing the battery.

Since the beginning of November and by the moment this article was written, the shares of the corporation had recorded a growth of 39%. This growth might have been fuelled by the optimistic forecasts of NIO management for Q4, the easing of restrictions in China, and the appearance of the company in the European markets.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high