Energy and Minerals: Top 5 Shares with the Most Prominent Growth in June

5 minutes for reading

In the past 13 days of June, the most noticeable stock growth was demonstrated by companies from the sector of energy and mineral resources such as PBF Energy Inc., Enerplus Corporation, CVR Energy Inc., Crescent Point Energy Corp., and Centennial Resource Development Inc.

Selection criteria

- Sector: energy and mineral resources

- The companies are not funds

- Their shares are traded on the NYSE and NASDAQ

- Their stock price is above $2

- Their market capitalisation is over $2 billion

- The average trading statistics in the last 30 days is more than 750,000 shares.

Growth was expressed in percentage as the difference between the closing price on 31 May and 13 June 2022. The market capitalisation of each company is relevant to the time when the article was being prepared.

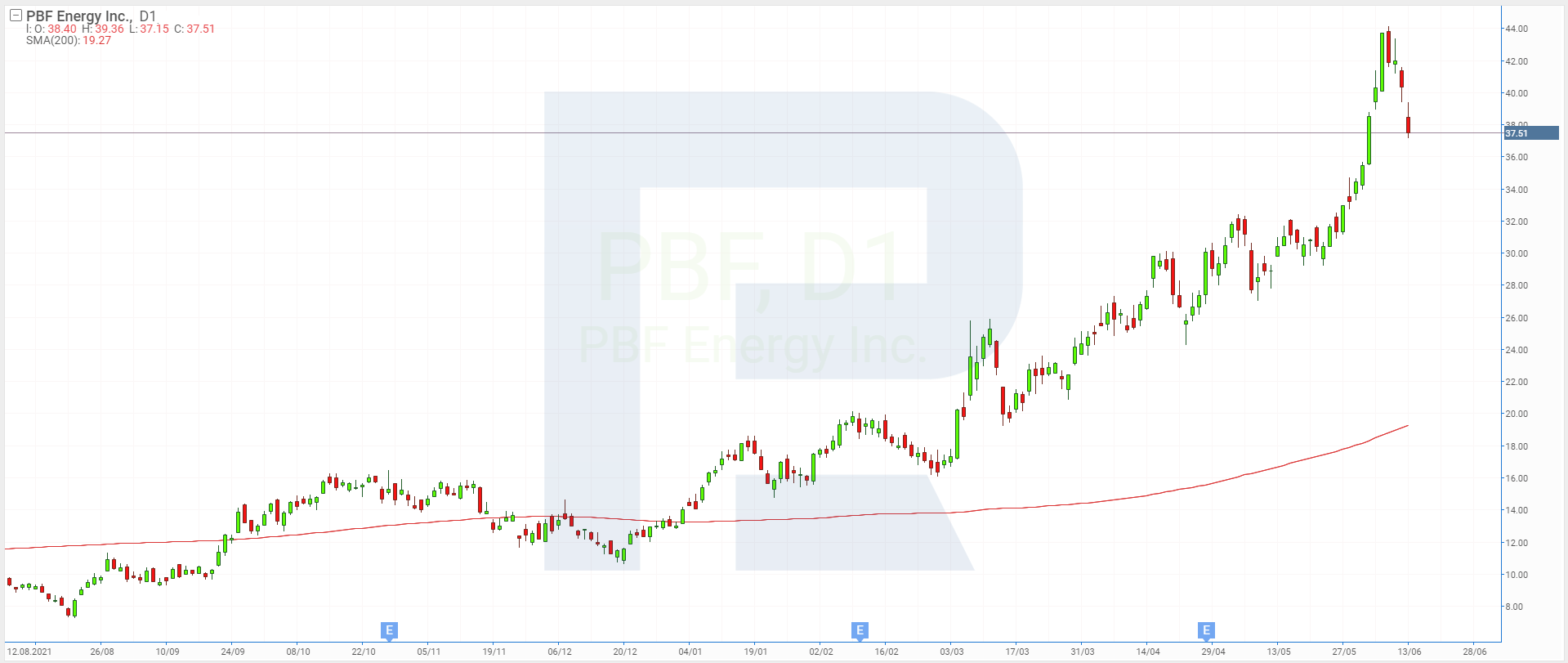

1. PBF Energy – 13.04%

Founded: In 2008

Country of registration: US

Headquarters: Parsippany, New Jersey

Exchange: NYSE

Market capitalisation: $4.7 billion

PBF Energy Inc. is an independent oil refiner and supplier of oil and chemical materials, transport fuel, lubricants, fuel oil, etc. The company sells its products in the US, Canada, and Mexico.

In the first two weeks of June, the share price of PBF Energy Inc. (NYSE: PBF) recorded a 13.04% rise from $33.20 to $37.53. This growth was attributed to the news that Joe Biden would give $700 million to the biofuel industry to compensate for the losses incurred due to the COVID-19 pandemic.

PBF Energy Inc. shares were growing for five sessions in a row from 1 June to 7 June, increasing 31.8% from $33.2 to $43.74 during this period. However, the stock quotes eventually lost positions, and trades closed on 13 June at $37.53. It might be supposed that the quotes will go on developing an uptrend when the correction comes to an end.

2. Enerplus — 12.94%

Founded: In 1986

Country of registration: Canada

Headquarters: Calgary, Alberta

Exchange: NYSE

Market capitalisation: $4.1 billion

Enerplus Corporation is one of the largest independent suppliers of oil and gas in Canada. Over 13 calendar days, the share price of Enerplus Corporation (NYSE: ERF) recorded a 12.94% rise from $14.84 to $16.76.

During the first six trading sessions of this month, the quotes of the Canadian company rose from $14.84 to $18.04, demonstrating growth of 21.6%. The highest growth was recorded on 6 June: 5.11% to $16.86.

On the previous day, Enerplus Corporation published positive results for Q1 2022 and announced that dividends would be increased by $0.043 per share alongside the budget of the buyback programme to $350 million.

The stock quotes of Enerplus Corporation are currently forming a correction wave after skyrocketing following the report.

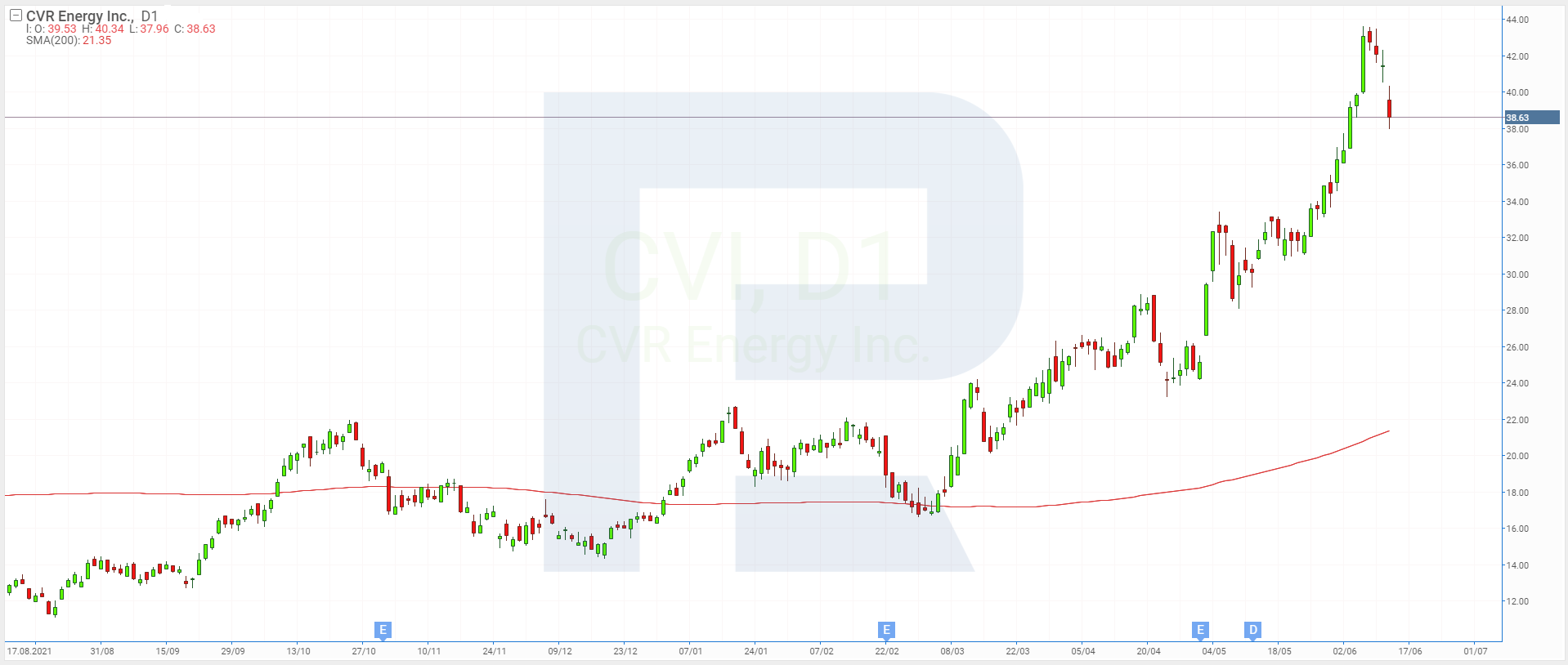

3. CVR Energy — 12.26%

Founded: In 1906

Country of registration: US

Headquarters: Sugar Land, Texas

Exchange: NYSE

Market capitalisation: $3.9 billion

CVR Energy Inc. specialises in petroleum refining and the manufacturing of nitrogen fertilisers. The corporation refines and sells gasoline, diesel fuel, and other oil products.

In the first ten days of June, the share price of CVR Energy Inc. (NYSE: CVI) rose 12.26% from $34.43 to $38.65. At the beginning of the month, the company published a report for Q1 2022, according to which earnings grew 62.2% to $2.4 billion, net profit increased 378.2% to $153 million, and EPS skyrocketed 338.5% to $0.93.

Moreover, CVR Energy announced an increase in dividend payments to $0.4 per share. On 9 June, analysts from Credit Suisse Group raised the target share price of the company to $40.

The good news sent the shares of CVR Energy Inc. renewing all-time highs.

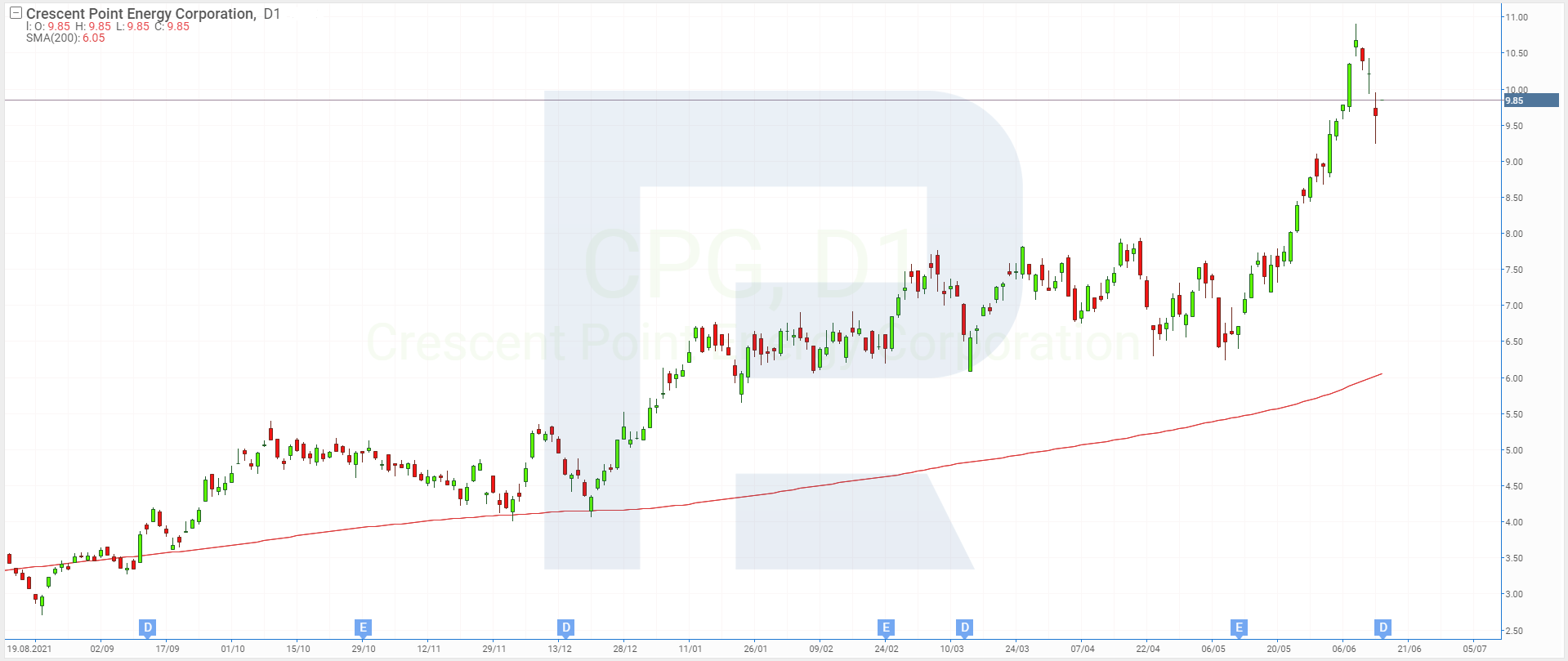

4. Crescent Point Energy — 9.62%

Founded: In 1994

Country of registration: Canada

Headquarters: Calgary, Alberta

Exchange: NYSE

Market capitalisation: $7.2 billion

Crescent Point Energy Corp. mines light and medium density oil and natural gas. From 1 June to 13 June inclusive, the stock quotes of the company saw a 9.62% rise from $8.84 to $9.69.

During the first six trading sessions, the shares of Crescent Point Energy Corp. (NYSE: CPG) were demonstrating stable growth of 21.4% to $10.73. The quotes were growing confidently while the oil prices were also aiming high. Currently, the shares of Crescent Point Energy Corp. continue a correction impulse.

5. Centennial Resource Development — 9.07%

Founded: In 2015

Country of registration: US

Headquarters: Denver, Colorado

Exchange: NASDAQ

Market capitalisation: $2.5 billion

Centennial Resource Development Inc. is an independent oil and gas company that develops deposits of crude oil and natural gas in the US. Until 2016, it was called Silver Run Acquisition Corporation.

In the first fortnight of this month, the shares of Centennial Resource Development Inc. (NASDAQ: CDEV) saw a 9.07% rise from $7.94 to $8.66. During this timeframe, the largest daily growth was recorded on 7 June, when the stock price surged 7.89% to $9.57.

Wall Street analysts increased the forecast earnings of Centennial Resource Development Inc. for 2022 from $1.4 billion to $2 billion. Compared to the statistics of last year, this means a growth of 70%. This new forecast can become a catalyst for the growth of the quotes to $14.

What impacted growth in the share prices in the sector in June

In the first half of June, the most prominent growth in the sector of energy and mineral resources was demonstrated by the shares of PBF Energy Inc., Enerplus Corporation, CVR Energy Inc., Crescent Point Energy Corp., and Centennial Resource Development Inc.

The growth of the shares is mainly attributed to the rising oil prices. Additional factors were strong quarterly reports, increased dividend payments, and budgets for buyback programmes.

This material and the information contained therein are for informational purposes only and should in no way be construed as providing investment advice for the purposes of the Investment Companies Act 87 (I) 2017 of the Republic of Cyprus, or any other form of personal advice or recommendation relating to certain types of transactions in certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high