IPO of Genius Group: A Future Competitor of Udemy and Coursera

4 minutes for reading

During the COVID-19 pandemic stay-at-home restrictions, millions of people around the globe focused on self-development and took to self-studying, acquiring new skills by attending field-specific online courses. This had an immediate impact on the popularity of the different online educational platforms.

Today, we will talk about one of the representatives of the online education sector, Genius Group Limited. This international holding company is planning to go public on 16 March 2022 by listing on the NYSE under the "GNS" ticker symbol.

Short review of Genius Group

Genius Group Limited was founded in 2009 with headquarters in Singapore and New York. It is run by Roger Hamilton and currently employs over 250 people.

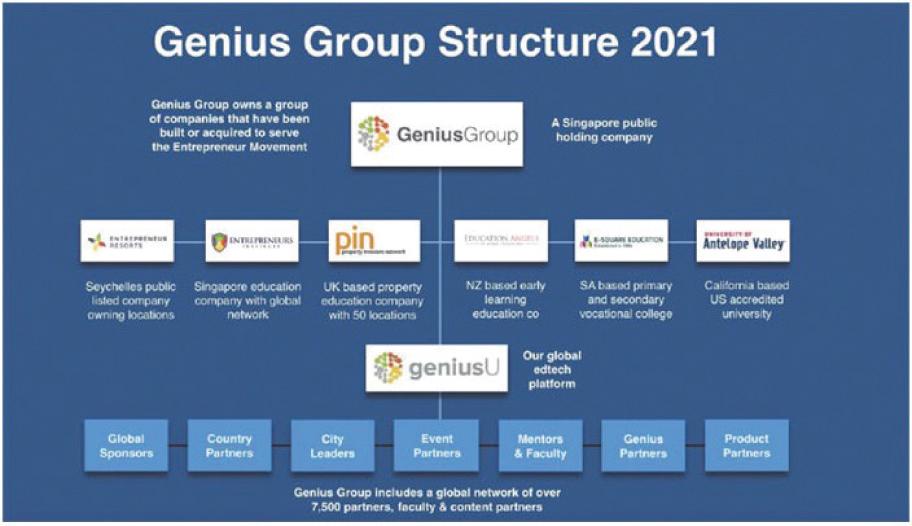

Genius Group Limited consists of the following companies:

- Entrepreneurs Institute is an online school for management and founders of startups

- GeniusU is a company with an AI-based online educational platform

- Entrepreneur Resorts is a co-working network in Bali, Singapore, and South Africa

- Education Angels is a New Zealand educational platform for children under 5 years

- E-Square Education Enterprises is a South African education campus for entrepreneurs

- The University of Antelope Valley is a Californian higher education institution for supplementary education

- Property Investors Network is a British platform for offline and online seminars dedicated to wise investments in real estate

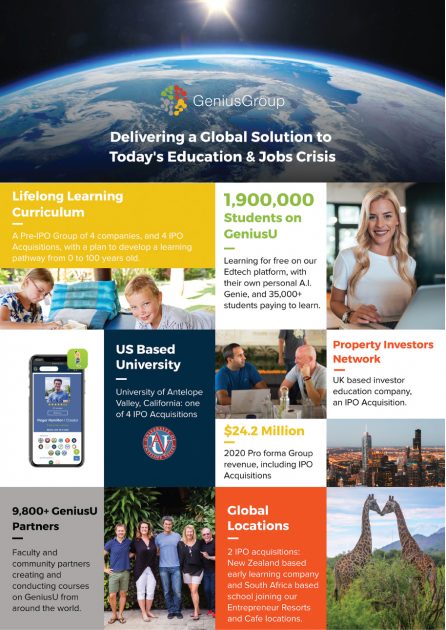

As we can see, the issuer has a diversified business. Genius Group operates in South Africa, the US, the UK, Singapore, and New Zealand. As of June 2020, the total number of students enrolled for courses on Genius Group Limited's platforms was almost 2 million.

The market and competitors of Genius Group

According to Holon IQ, the online education market might reach $10 trillion by 2030. The lion's share of the demand consists of specialists who require additional skills or want to change their occupation.

The World Bank states that the current number of employed people in the world is 3.5 billion. The International Labour Organisation believes that about 2 billion specialties might disappear by 2030 due to the global robotisation in economies all over the world.

Moreover, it's important to note that the cost of education has been steadily increasing, with no major setback in this market since 1980. In 2021, the total amount of student loan debt in the US was $1.6 trillion.

The issuer's key competitors are:

- Coursera

- Chegg

- Udemy

- Class Central

- FutureLearn

Financial performance of Genius Group

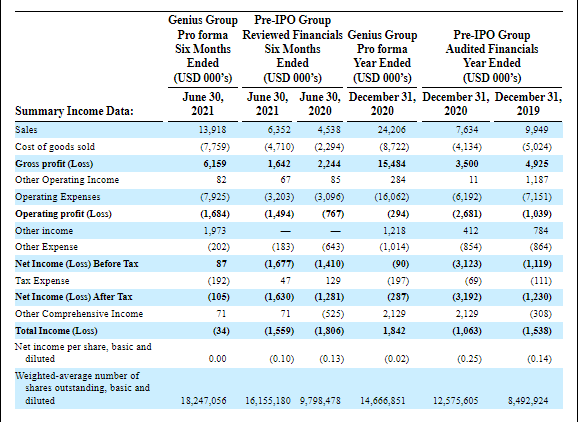

Genius Group is filing for the IPO without generating a stable net profit. For this reason, we will focus on analysing its revenue. In 2020, Genius Group's sales were $24.21 million – this is an 18% decline in comparison with 2019. It means that the coronavirus pandemic had a negative impact on the company's revenue.

In the first two quarters of 2021, the revenue was $13.92 million – this is a 14.6% increase compared with the same period of 2020. The expected revenue for the whole of 2021 is $27.79 million.

In 2020, the net loss was $1.8 million due to the increase in operational expenses. The issuer believes that at year-end 2021 the net loss will reduce to zero.

Genius Group Limited's total liabilities are $2.3 million, and the cash equivalents on its balance sheet are $0.94 million – this implies a negative cash position of $1.36 million.

If the company succeeds in avoiding the net loss in 2021, its overall financial health might be considered stable.

Strengths and weaknesses of Genius Group Limited

The advantages of investing in this stock are the following:

- A target market potential of over $10 trillion

- A diversified business model

- A high revenue growth rate

- Sound management

Among the investment risks, we would name:

- No net profits

- Well-known, strong competitors

- No big-name underwriters

IPO details and estimation of Genius Group Limited capitalisation

The underwriter of the IPO is ThinkEquity LLC. The issuer is planning to sell 7.27 million shares at the price of $5-6 per share. The IPO volume is almost $40 million.

If shares are sold at the highest price in this range, the company's capitalisation will reach $140.25 million. Genius Group Limited is planning to spend the funds raised through the IPO on future mergers and acquisitions.

To assess the company, we use a multiplier – the Price-to-Sales ratio (P/S ratio). A P/S value for the educational online platform sector could be 7-8 during the lock-up period. The issuer's P/S value is 5.19.

The upside for Genius Group Limited shares during the lock-up period might be 40% (7/5.19 * 100%). The stock can be considered for investments, but be aware that it could be highly volatile security.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high