IPO of Cariloha: “Green” Investments in The Future

4 minutes for reading

The trend of using eco-friendly products and materials has become increasingly popular and widespread over the last few years. Humans are becoming more and more responsible for their consumption, which is great.

Among other things, people are striving to protect the planet from pollution by using bulk materials that are easily recyclable. Such materials decompose quite fast and do not harm the environment. For example, many developed countries have banned plastic bags and disposable tableware a long time ago.

One of the companies, which successfully prove that the manufacturing business can be eco-friendly is Cariloha. The company is planning to go public by listing on the NASDAQ. The IPO date hasn’t been announced yet as the bookrunners are waiting for a more favourable moment. Today, we’ll tell you everything we know about the company.

The business of Cariloha

Founded in 2007, Cariloha Inc. designs and sells soft bedding, clothing, and bath apparel made from eco-friendly bamboo. One of the key distinctive features of the company’s products is the ecological properties of materials used in production.

The company is run by Jefferson Pedersen. He is also in charge of Cariloha Holdings, one of the major investors of Cariloha Inc. A special focus should be put on the fact that the manufacturer of environmental-friendly products has already attracted $7.8 million to its stock capital.

The issuer distributes and sells its goods via both online eCommerce channels and 64 retail showrooms.

In addition, Cariloha collaborates with cruise lines, which normally attract tens of thousands of new clients. However, this segment has lately been the weakest in the company’s business growth due to the travel restrictions during the coronavirus pandemic.

What are the prospects of Cariloha’s target market?

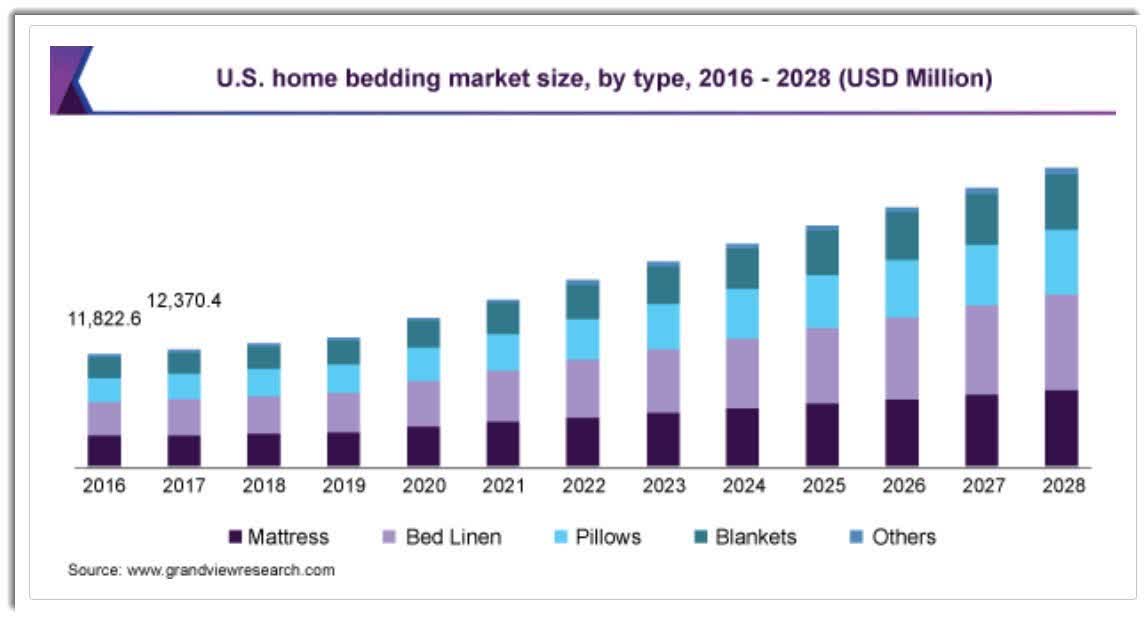

According to Grand View Research, the global market of soft bedding, clothing, and bath apparel was estimated at $74 billion in 2020. It is expected to reach $147 billion by 2028. As a result, the average annual growth rate could be 9%.

The key factor for target market growth is the housing boom, which has led to an increase in consumer spending on interior design items.

Take a look at the diagram that demonstrates the growth rate of the US home bedding market.

Cariloha’s key competitors are:

- Acton & Acton Ltd.

- American Textile Company

- Beaumont & Brown Ltd.

- Boll & Branch LLC

- WestPoint

- Pacific Coast Feather Company

- Hollander

- Portico Inc.

- Crane & Canopy

- Bombay Dyeing

Financial performance of Cariloha

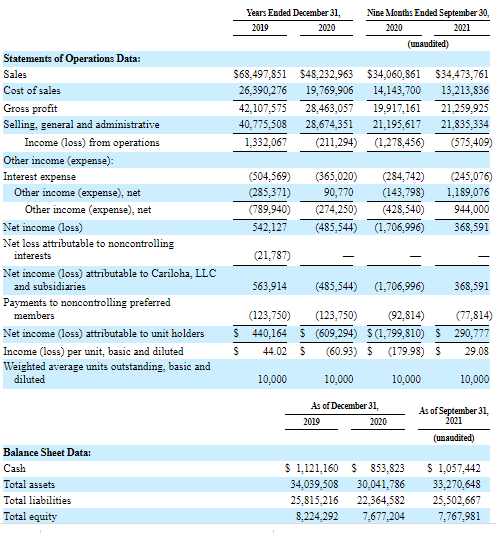

Let’s analyse the issuer’s financial health with its revenue. In 2020, sales were $48.23 million, which is a 41.73% decline compared to 2019.

In the nine-month period that ended on 30 September 2021, the company's sales were $34.47 million – this is a 1.21% increase in comparison with the same period of 2020. One may conclude that the company’s revenue is recovering after the COVID-19 pandemic but the process is extremely slow.

In 2019, the issuer’s net profit was $0.54 million; however, in 2020, Cariloha incurred a net loss of $0.49 million. In the first nine months of 2021, the issuer's net profit amounted to $0.37 million, representing a 122.0% increase in comparison with the same period of 2020.

So, here is another intermediate conclusion – the net profit growth with the sales statistics similar to 2020 indicates spending optimisation and an increase in business marginality.

As of 30 June 2021, the company's total liabilities were $25.5 million, and the cash equivalents on its balance sheet were $1.1 million – this implies a positive cash position of $1.2 million for the 12-months period that ended on the above-mentioned date.

Strengths and weaknesses of Cariloha

Now let's identify the strengths and weaknesses of Cariloha. Its strengths are:

- Prospective target market

- Net profits

- Sound management

- Media support

- Uncommon marketing policy

The risk factors of investing in Cariloha’s shares are the following:

- Weak revenue growth

- Unstable net profit growth

- Increase in operational losses

- Insignificant operating cash flow

- Strong competition

- Huge debt

What we know about the Cariloha IPO

The underwriters of the IPO are Roth Capital Partners, LLC, Oppenheimer & Co. Inc., and Craig-Hallum Capital Group LLC. The issuer is planning to sell two million shares at the price of $9-11 per share.

The IPO volume is almost $2 million. If shares are sold at the highest price in this range, the company's market capitalisation will reach $140.3 million. The funds raised through the IPO will help Cariloha clear debts and increase its operating capital.

To assess the company, we use a multiplier – the Price-to-Sales ratio (P/S ratio). The issuer's P/S value is 3.29 and might go up to 4 during the lock-up period, in which case the upside for Cariloha shares might be 21.58% (4/3.29 * 100%).

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high