How to Estimate the Market Price of Companies When Making Investment Decisions

8 minutes for reading

The price of a company often influences the decision of whether to invest in it or not. Of course, one can choose to neglect this factor and use, say, tech analysis instead; however, by knowing the real market price of a chosen company, an experienced investor can make conclusions about the results of their investments in the long run.

In this article, we will not analyse and evaluate companies for speculative or short-term trading. Our goal is to tell you how to determine the price of the company and your prospects for long-term investments. By long-term, we mean several years or even decades. This is the method with which the famous Warren Buffett chooses to invest.

Underestimated companies' stock price, if it rises, has more pips to cover, which can be used by an observant investor. As for overestimated companies, their prospects are more modest or they might even be lacking. The stocks of such companies might soon correct, which will lead to unreasonable losses or to freezing your investments.

Estimating the market price of a company

Several multipliers can be used for a thorough estimation of a company's price:

The P/E (Price to Earnings ratio) is a multiplier showing the under-or overestimated state of companies. By using the P/E multiplier, an investor can forecast when their money will pay back. The smaller the P/E ratio, the sooner this will happen. For more details, please refer to our previous articles where we discussed the P/E.

The P/S (Price to Sales ratio) is literally the market price of the company in relation to its annual revenue. Unlike the P/E, it can be applied to losing companies. A P/S value below 2 is considered good; the higher it is, the worse the investment in this company. An almost perfect value is one (1).

The P/BV (Price to Book ratio) indicates the size of the company's assets minus its commitments (debts). The multiplier compares the company's capital to its market capitalisation on the stock exchange. A P/BV value of one (1)means that currently, its stocks are undervalued (costing less than on the exchange). If the value is between one and zero, the company is overpriced. If the multiplier is zero, this signals that the company is not doing well, and this investment opportunity should be considered with caution.

Investors usually compare several companies from the same sector with the use of multipliers. The report of the previous period, current period, and forecasts are used for the estimation. By comparing the data, we can conclude which company is more attractive for long-term investments.

Peculiarities of multipliers

If you use multipliers, you need to take into account the following:

- For new and developing companies, multipliers can be faulty

- You cannot estimate the company by using just one index; your approach must be thorough

- Compare companies from one sector, take notice of their business, the number of employees, and their debts

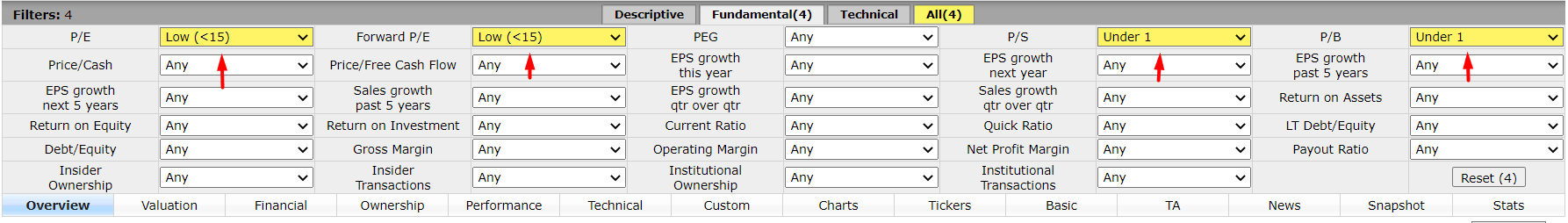

There are plenty of resources for calculating multipliers on the Internet. See below which indices you can use on Finviz.com (the data is given for clarity).

On the website, you can single out companies depending on their business, stock price range, and the country of registration. Note that it is for the investor to decide which data to base their decision on.

Making investment decisions

After analysing the multipliers, there is one main thing to be done – making the right decision. In this case, intuition plays one of the most important roles. However, we will talk about something else.

Having analysed the data, find out what the company does and when it was founded. Young companies can be appealing with quick yields but entail increased risks. An acceptable option is to invest in companies that had an IPO over five years ago.

The number of employees is also important, as the larger the company, the better. Large companies have fewer chances for bankruptcy than small businesses. However, there are always exceptions, so consider checking this parameter.

An example of an investment portfolio

See below an example of capital distribution in an investment portfolio. Take 100% of your investments and distribute them between the sectors that are the most attractive.

This list is just an example rather than an instruction:

- Heavy industry – 15%

- Cargo transportation, ground, air, water transportation – 15%

- Finance – 15%

- ETF – 15%

- Bonds – 15%

This does not necessarily mean that you should invest 15% in one instrument from each sector; instead, you can choose 5-7 companies (the number should be based on your needs) that have satisfactory parameters and look attractive. The remaining capital will remain free so that you could diversify risks or buy more assets.

What an investor should not do

When investing, make sure you are not using speculative principles:

- Do not aim at momentarily profits, you are not speculating

- Do not use leverage or loaned money

- Trading based on the news does not suit an investor because in such cases the price of assets can be extremely volatile, which might influence your decisions

- Beware of the oil market, as it entails a lot of speculative trades

- Make decisions based on your own analysis rather than other people's advice

- Beware of short trading Many companies grow in the future, while it is difficult to predict your losses in sales Example: A trader bought (opened a buying position) 100 stocks in A company for 10 USD each Later the company went bankrupt and the stocks dropped to zero. The losses of the trader will amount to 1,000 USD or 100% of their investment (the stocks reached the bottom). If the stock price grows, the trader will make a profit, closing the position. However, the size of the profit is unknown.

Here is an opposite example: a trader opened a selling position, i.e. sold 100 stocks for 10 USD each, and their price started decreasing. In this case, the trader makes money, their maximum profit will amount to 100% (conditionally) of their investment. If the stock price starts growing, where will it stop? There is no answer to this question, so your loss might be over 100%.

Diversify risks: your portfolio should include stocks from different sectors, ETFs, and bonds.

Summary

Investing is a type of passive income stream, and this is what most traders dream about, perhaps even most people; however, not everyone really succeeds in achieving this. An investment portfolio takes more than a day to build.

Based on multipliers, you can compose an investment portfolio for the long run by using your knowledge of what the multipliers mean. Never forget to compare companies with each other and the average values of the sector.

The portfolios of market whales are open to the public. Studying them will help you choose what is attractive to you.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high