Wearable Devices' IPO: Gadget Management With a Subtle Movement of a Finger

5 minutes for reading

Almost everyone in the modern world is using smart gadgets in their everyday life, from smartphones to electric kettles. Nonetheless, the methods to control them remain rather primitive. Leading technology companies are constantly working on creating ecosystems, and easy and convenient ways to manage them. Wearable Devices Ltd. develops a non-invasive neural input interface in the form of a band, which helps to resolve the control and synchronisation of devices. On 8 July, the company is planning to go public by listing on the NASDAQ under the "WLDS" ticker symbol.

What we know about Wearable Devices

Wearable Devices Ltd. is an Israeli company developing a wrist wearable band, which uses subtle finger movements to control digital gadgets. The company is now in transition from R&D to the commercialisation of the technology in its B2B products. The Wearable Devices' solution was first introduced to the market in 2014.

Under its development strategy, the issuer works with both B2B and B2C customers. At the moment, Wearable Devices is in the final production stage of its first B2C consumer product, Mudra Band. This device was developed for Apple Watch to provide contactless watch management. At the Consumer Electronics Show (CES) 2021, Mudra Band was rewarded for tech innovations and as the best wearable device.

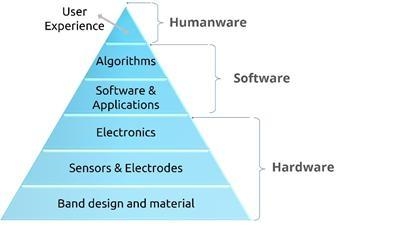

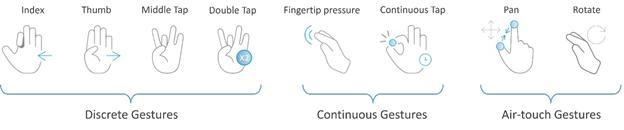

Wearable Devices develops gadgets that make the human hand a versatile input interface for contactless interaction with other devices through its proprietary platform, Mudra. As a result, a user can control household electronics, smart watches, smartphones, AR glasses, VR headsets, TVs, drones, etc.

The company has been selling its solution called Mudra Inspire to B2B customers as the first touchpoint with businesses since 2018, and this helped it to receive revenue at the early stages of development.

As of 30 June 2021, Wearable Devices had raised $7.5 million in investment, mostly from OurCroud.

The prospects of Wearable Devices’ target market

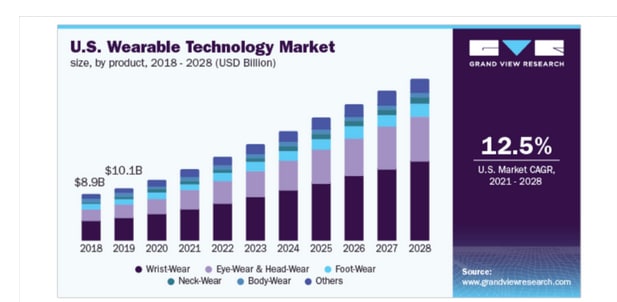

According to market research by Grand View Research published in 2021, the global market for all types of wearable technologies was estimated at $40.65 billion in 2020. By 2028, it might reach $114.3 billion. Consequently, the CAGR (Compound Annual Growth Rate) could be 13.8% from 2021 to 2028.

The main catalysts for this growth are the rising popularity in the use of connected devices in the context of the Internet of Things technologies, and improved technological offerings. Below, you can find the chart indicating the historical and projected future market trajectory in the US for the different wearable gadget categories:

The target market of Wearable Devices

The key competitors of Wearable Devices are:

- Apple

- Microsoft

- Razer

- Amazon

- Samsung

- CoolSo

- Pison Technology

- Neuralink

- NextMind

- Logitech International

How Wearable Devices performs financially

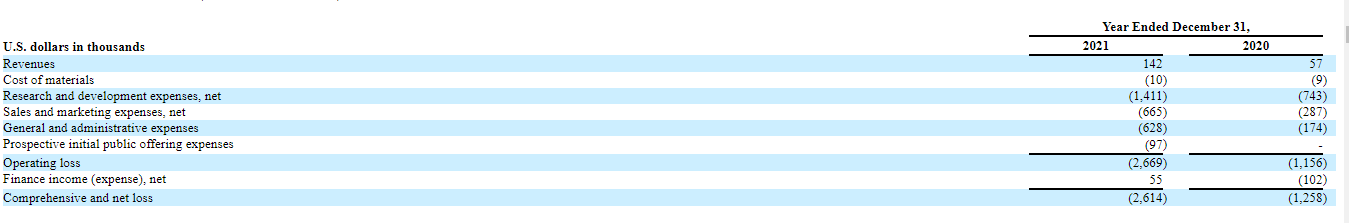

At the time of the IPO, the issuer had not generated any net profit; we will therefore analyse Wearable Devices' financial performance with its revenue.

The financial data from the S-1 form shows a significant increase in the company's sales in 2021 in comparison with 2020 – 149.12%, up to $142,000.

The financial performance of Wearable Devices

The net loss in 2021 was $2.62 million, which is a 109.06% increase in comparison with 2020. It soared due to growing operating loss - 130.71% to $2,670,000.

This implies a negative cash position of $0.65 million for the 12-month period that ended on 30 June 2021. At the end of 2021, Wearable Devices' total liabilities were $0.62 million, while the cash equivalents on its balance sheet were $2.9 million.

Strengths and weaknesses of Wearable Devices

The company's strengths are:

- High target market growth rate

- Highly diversified business

- Possible business expansion outside Israel

- High revenue growth rate

- Cooperation with Apple

Among the investment risks, we would name:

- Small revenue

- Increasing losses

- No net profits

What we know about the Wearable Devices IPO

The underwriter of the IPO is Aegis Capital Corp. The issuer is planning to sell 3.6 million common shares at the price of $5.2.5-7.2 per share, as well as one warrant. Gross revenue is expected to be about $22.3 million, not including conventional options sold by the underwriter. Active shareholders showed no interest in acquiring new shares at the IPO price.

Assuming the IPO is successful at the proposed price range, the issuer's value at the IPO excluding underwriter options might be approximately $55.9 million. The Price-to-Sales ratio (P/S ratio) multiplier might be off the scale – 349.37. Buying Wearable Devices shares might be considered a classic venture investment, which involves high risks.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high