IPO of Heart Test Laboratories: Artificial Intelligence Technology in ECG

5 minutes for reading

Cardiovascular diseases are one of the most common health concerns. The easiest method of studying the human heart, with no additional training required, is electrocardiography (ECG). In the past, it seemed like there was no way to improve diagnostic accuracy, but thanks to artificial intelligence technology there is a major breakthrough in this field.

In today’s article, we will take a closer look at Heart Test Laboratories Inc., a medical technology company that develops and manufactures new-generation ECG equipment. Heart Test Laboratories is planning to go public by listing on the NASDAQ under the “HSCS” ticker symbol.

What we know about Heart Test Laboratories

The issuer develops and manufactures ECG equipment and is also involved in enhancing the ECG procedure to detect coronary vascular diseases. Heart Test Laboratories’ mission is to make electrocardiography a more effective and valuable tool for first-aid treatment.

Equipment and tools designed by Heart Test Laboratories are currently in the process of certification by the US Food and Drug Administration (FDA).

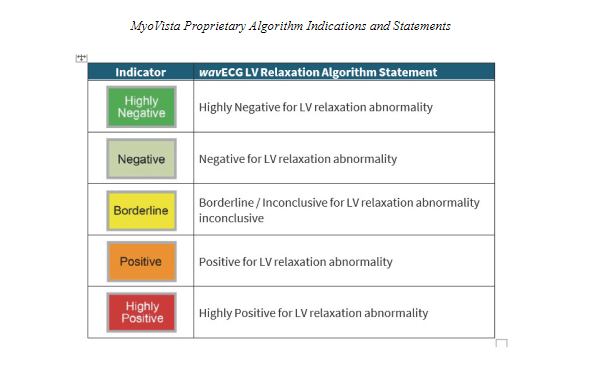

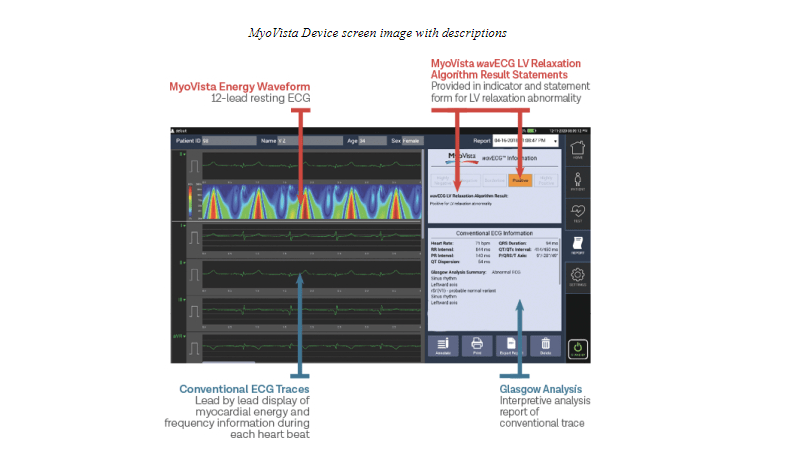

The company’s leading product, MyoVista, is an upgraded ECG tool that uses artificial intelligence technology for providing heart diagnostics information. Conventionally, such information is acquired through cardiovascular imaging, which is a more invasive procedure. MyoVista also offers standard ECG analysis information in the same test.

The apparatus is still awaiting approval for sales by the FDA – the company’s success and wealth depend on the regulator’s approval, and also on financing its major validation clinical trial. Thereafter, Heart Test Laboratories will require additional financing to launch MyoVista sales in the US, maintain floating capital, and pursue further research in the field.

As of 31 January 2022, Heart Test Laboratories had raised $53 million in investment, mostly from Front Range Ventures LLC, and John Adams, a former director of the company.

The prospects of Heart Test Laboratories’ target market

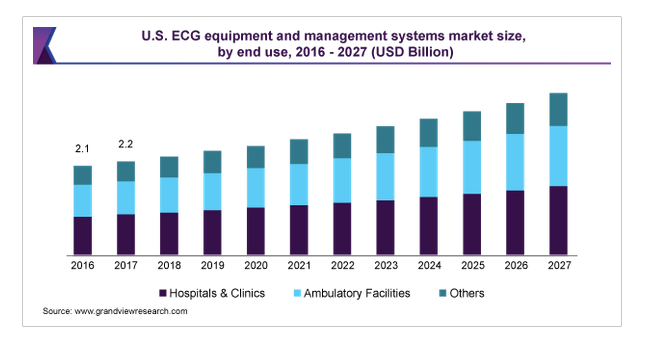

According to market research by Grand View Research published in 2020, the global ECG equipment market was estimated at $5.6 billion in 2019. From 2020 to 2027, it is expected to expand at a Compound Annual Growth Rate (CAGR) of 6.1%.

The main catalysts for this growth are the increasing number of patients with cardiac arrhythmia and the demand for diagnostic tools, cutting-edge medical equipment, and ECG monitoring technologies – all of which will contribute to the expansion of the market in the future.

Heart Test Laboratories’ key competitors are:

- General Electric

- Philips

- Nihon Kohden

- Bio Telemetry

- Hill-Rom

- CardioComm Solutions

- Device Technologies

How Heart Test Laboratories performs financially

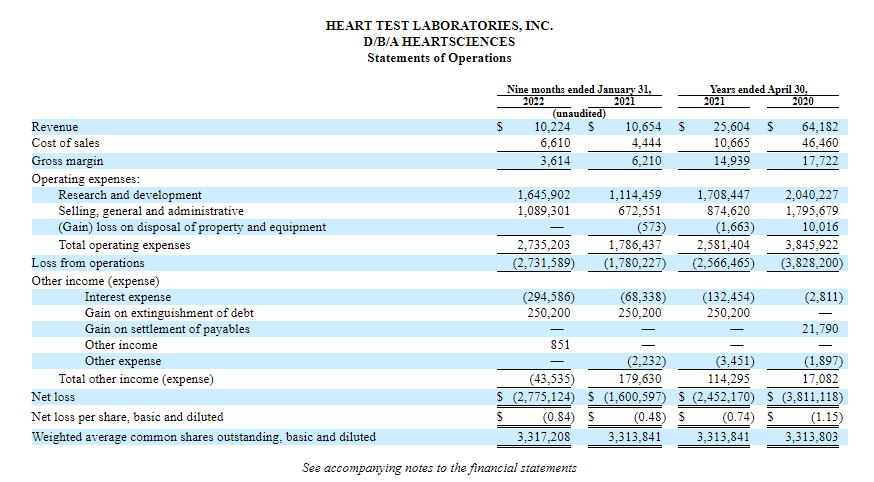

At the time of the IPO, the issuer had not generated any net profit; we will therefore analyse Heart Test Laboratories' financial performance with its revenue.

The financial data from the S-1 form shows a drop in the company’s sales in the nine-month period that ended on 31 January 2022 in comparison with the same period of 2021 – 4.2%, down to $10,224.

In the 12-month period that ended on 30 April 2021, the issuer’s revenue was $25,604, representing a 60.11% decline in comparison with 2020. Heart Test Laboratories supplies small pilot batches, and this explains why the revenue is rather low.

The company’s net loss skyrocketed due to the rise in R&D expenses. From May 2021 to January 2022, the net loss amounted to $2.78 million, which is a 73.75% rise. This implies a negative cash position of $3.2 million for the 12-month period that ended on 31 January 2023.

As of 31 January 2022, Heart Test Laboratories’ total liabilities were $6.7 million, while the cash equivalents on its balance sheet were $1.3 million.

Strengths and weaknesses of Heart Test Laboratories

The company's strengths are:

- High target market growth rate

- Demand for ECG equipment

- Possible business expansion outside the US

- Own production facilities

- Innovative technologies

The list of weaknesses is much shorter: small revenue and no net profits.

What we know about the Heart Test Laboratories IPO

The underwriter of the IPO is Benchmark Company LLC. The issuer is planning to sell 1.75 million common shares at the price of $4.5-5 per share, as well as one warrant. Gross revenue is expected to be about $8.75 million, not including conventional options sold by the underwriter.

The warrant under the “HSCSW” ticker symbol will be executed at the IPO price. The underwriter can buy up to 263K additional shares within 30 days. Assuming the IPO is successful at the proposed price range, the issuer's value at the IPO excluding underwriter options might be approximately $40.55 million. The Price-to-Sales ratio (P/S ratio) multiplier might be off the scale, high above 10,000.

Buying Heart Test Laboratories shares might be considered a classic venture investment, which is not suitable for all investors.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high