Warren Buffett's Investments in the Last Quarter

8 minutes for reading

With Q2 2022 now over, it's time for hedge funds to reveal the trades of the quarter. The info is published six weeks after the quarter is over but remains in force. Today, we will again take a look at Warren Buffet's investment portfolio, and find out what has changed.

In Q2 2022, no new stocks were added to the portfolio of Berkshire Hathaway Inc. (NYSE: BRK-A). Only the part taken up by certain stocks grew or shrank, while certain assets were just wiped out.

Which stocks were given away by Berkshire Hathaway?

The fund sold the shares of Verizon Communications Inc. (NYSE: VZ) in which the first investments were made in Q3 2020. The average purchase price amounted to 58.71 USD. The chart shows that the trust has made no profit on this trade.

Moreover, Berkshire Hathaway fully wiped out its position in the stock of Royalty Pharma plc (NASDAQ: RPRX). In Q3 2021, the trust bought 13 million shares. In Q4, as the price was rising, the trust gradually started selling the shares, eventually fully closing the position in the last quarter.

Which shares became less numerous in the portfolio?

The following shares were partially sold from the portfolio: STORE Capital Corporation, General Motors Company, The Kroger Co., and U.S. Bancorp. Let's take a closer look at these companies.

STORE Capital

Berkshire Hathaway has been selling the shares of STORE Capital Corporation (NYSE: STOR) for two months. Warren Buffet first invested in this company in 2017, then added up to his position three years later. He bought a total of 24 million shares.

Some 10 million shares were sold in Q1 this year, with 8 million more in Q2. The trust is now holding only 6 million STORE Capital shares. By studying the chart, we can conclude that the investment has yielded a profit.

General Motors

The number of General Motors Company shares (NYSE: GM) in the Berkshire Hathaway portfolio has dropped by 14%. Warren Buffett has been related to the car-making giant since 2013 when GM recovered from bankruptcy. Since then, while the number of GM shares in the investment portfolio of the fund has been growing and falling, it has never been sold fully. The volume of the assets is currently 52.8 million shares.

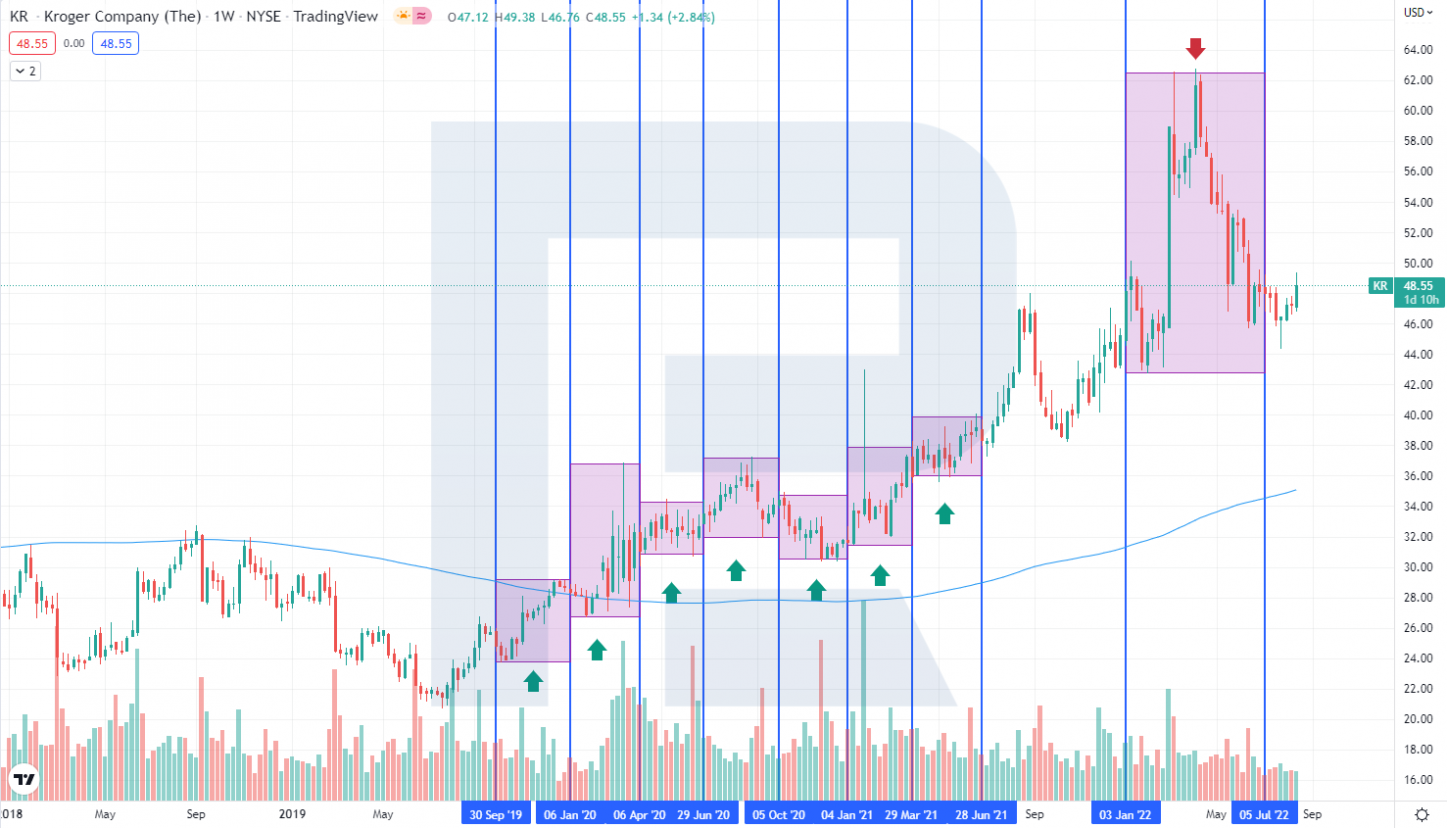

The Kroger

The number of The Kroger Co. shares (NYSE: KR) in the portfolio dropped by 9%. However, the remaining number of shares is still three times bigger than the initial investment. At the end of 2019, 18.9 million shares were bought, with the volume in the portfolio later reaching 61.4 million securities. The fund started selling the shares in Q1 2022, and it now holds 52.4 million Kroger Co. shares.

U.S. Bancorp

The list of sales is closed by financial company U.S. Bancorp (NYSE: USB). The number of its shares in the portfolio dropped by 5%. Buffett has been holding U.S. Bancorp shares since 2013. Thereafter, he bought 79.3 million shares. Their number in the portfolio kept growing year by year, reaching 131.9 million shares in 2020. Berkshire Hathaway started selling them gradually at the beginning of Q1 2021, finally bringing the number to 119.8 million shares.

Which shares were added up?

In this category belong the shares of such companies as Apple Inc., Ally Financial Inc., Celanese Corporation, Occidental Petroleum Corporation, Markel Corporation, McKesson Corporation, Activision Blizzard Inc., and Chevron Corporation. Let's find out whether the number of shares in the portfolio has changed significantly.

Apple

The number of Apple Inc. shares (NASDAQ: AAPL) grew from 890 million to 894 million securities. Buying Apple stock is an old tradition at Berkshire Hathaway, with this tech company's securities being purchased almost every quarter. It is worth noting that Warren Buffett makes 800 million USD on Apple dividends only.

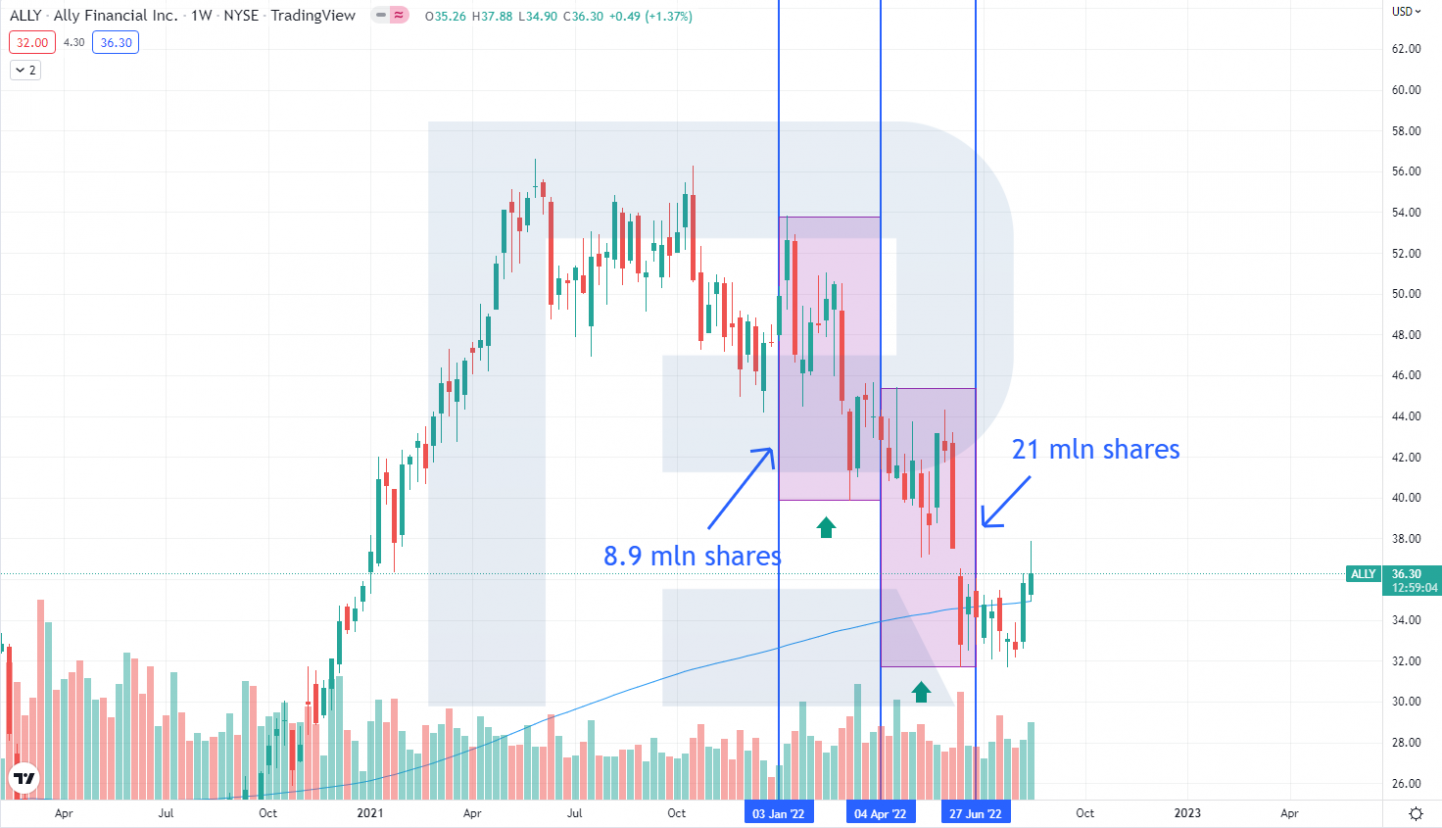

Ally Financial

The number of Ally Financial Inc. shares (NYSE: ALLY) in the portfolio rocketed 234% to 30 million shares. The first purchases happened in Q1 this year, and it seems that investments in the company will keep growing.

Celanese

The number of Celanese Corporation shares (NYSE: CE) in the Berkshire Hathaway portfolio increased 16% to 9.1 million securities. Buffett started investing in this international chemical company at the beginning of the year.

Occidental Petroleum

Investment in Occidental Petroleum Corporation (NYSE: OXY) grew by 16%. Obviously, the fund is counting on the oil and gas sector, but this is not the only reason for investing. Occidental Petroleum is on the list of projects that deal with carbon capture and participates in the state programme of tax incentives.

Buffett started buying Occidental Petroleum shares in 2019. By now, he has invested 9.3 billion USD in the company, and it seems he will not stop here.

Berkshire Hathaway filed an application to the Federal Energy Regulatory Commission (FERC) for purchasing more than 50% of Occidental Petroleum shares, which was approved. It might be that the trust is planning to buy the whole of the oil company. As you know, Berkshire Hathaway holds 20.2% of Occidental Petroleum shares.

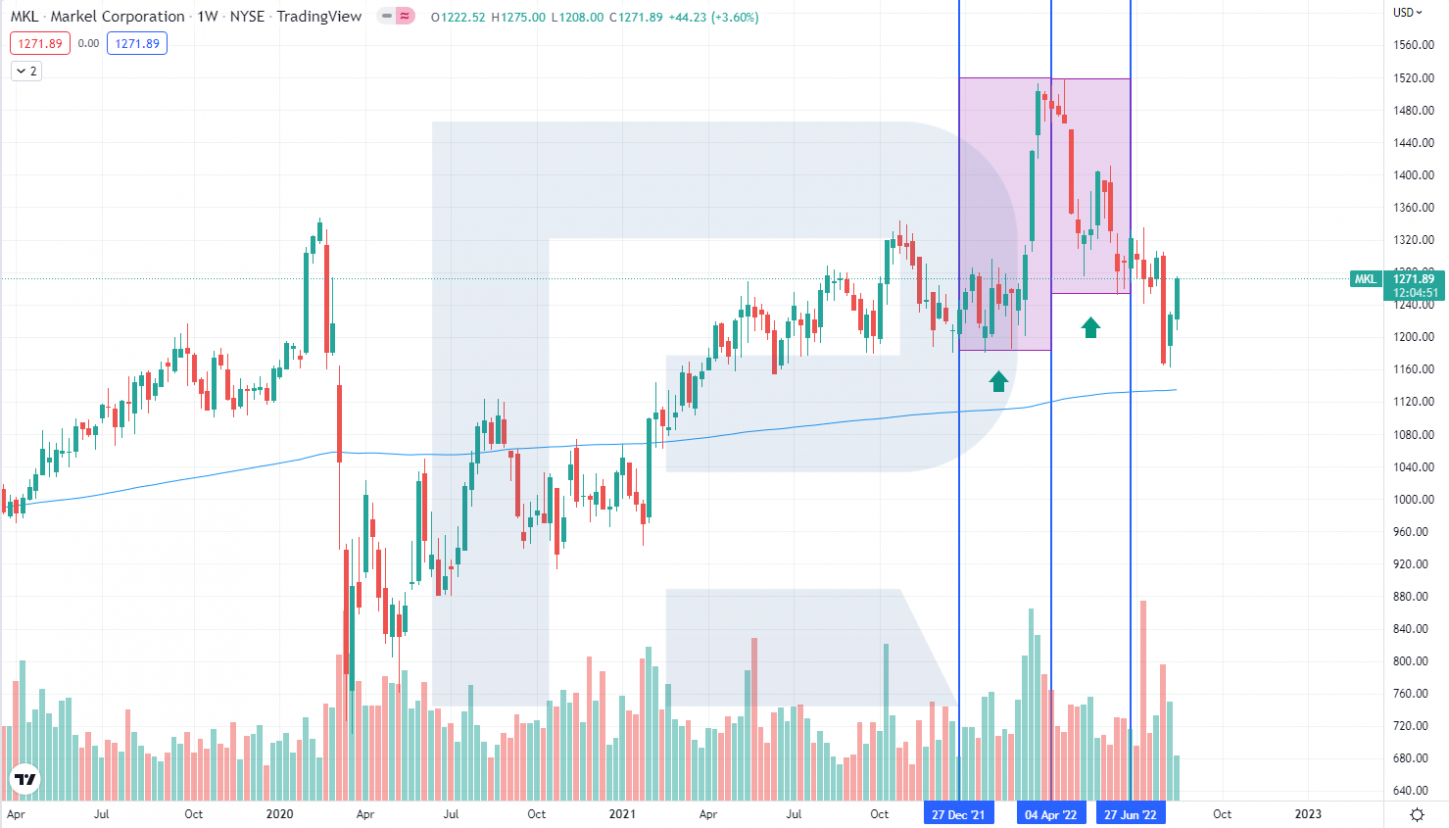

Markel

Gradually, the number of Markel Corporation shares (NYSE: MKL) in the portfolio is also growing: in Q2, 47 thousand shares were added, with the overall number reaching 467, 661 shares. This is one of the smaller purchases of the trust: the investment is sized 604 million USD, which accounts for 0.35% of the portfolio.

On the chart, we can see that the shares were bought at their all-time highs. This must be the reason for the investment being so modest. If the quotes decline, the investment volume will presumably increase.

McKesson

The investment volume in McKesson Corporation (NYSE: MCK) increased 10% to 3.1 million shares. The investment history of Berkshire Hathaway in the American pharma company started in Q1 this year. The quotes are now 8.5% higher than the highs of Q2.

Activision Blizzard

Buffett began investing in Activision Blizzard Inc. (NASDAQ: ATVI) in 2021. In the last quarter, he added 4 million shares to his portfolio, meaning he now holds 68.4 million securities, which makes up for 5.3 billion USD.

Chevron

Warren Buffett added 2.2 million more shares to the 159 million shares of Chevron Corporation (NYSE: CVX) already in the portfolio. The overall investment amount is 23.7 billion USD. The weight of the shares in the portfolio has amounted to 7.8%, and thus investments in the oil and gas sector – Occidental Petroleum and Chevron – totally account for 10.9% of the company's portfolio.

Warren Buffett invested in Chevron for the first time in 2020, after the crash of oil prices. Since then, he has bought more shares of the company almost every quarter. In Q2, the quotes were at their all-time highs, and even this never stopped Buffett from purchasing more.

Closing thoughts

If we look at share price charts, we might notice that Warren Buffett never rushes to sell shares even if their price gets much lower than the average buy price. However, he decided against resigning with losses in Verizon shares and fully wiped the position away. It might be because his long-term views on the company have changed.

The reason for selling Royalty Pharma stock is not that obvious. The company might seem unsuitable for long-term investing.

As for the shares that became less numerous in the portfolio, this might be attributed to the fact that they were just taking up a part of the profit. The shares of GM, Kroger, and U.S. Bancorp were sold at their all-time highs. The only question emerges regarding the STORE Capital stock: the fund bought them at their local lows, but Buffett started getting rid of them when they failed to renew their all-time high in 2021.

Among the purchases of the fund, the stocks of the following three companies stand out: Ally Financial, Celanese Corporation, and Activision Blizzard. The impression is that this is a classic example of investing in falling prices: Buffett bought these shares when other investors rushed at getting rid of them.

Moreover, the interest of the fund in the oil and gas sector is noticeable. In the example of Occidental Petroleum and Chevron Corporation, we see the readiness of the fund to buy shares at their all-time highs.

Amid the coronavirus pandemic, buying McKesson Corporation stock seemed a very logical strategy. This representative of the pharma sector might make a real profit from the growth of spending in the global healthcare system. Warren Buffett, obviously, buys the shares even at their all-time highs.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high