How Will the S&P 500 Perform in 2024?

9 minutes for reading

The S&P 500 index (SPX, US500) rose by 23.3% based on the 2023 results. It is worth noting that it ended 2022 with a 19.7% decline. On 15 January 2024, we analysed the index’s performance over the past four years, aiming to identify the key growth drivers, and reasons behind declines, and to project how the index might perform this year.

The S&P 500 returns since 2020

From 1 January 2020 to 31 December 2023, the S&P 500 index surged by 45.7%. During this period, the US economy underwent the challenges of the COVID-19 crisis, witnessing a sharp reduction in interest rates from 1.75% at the beginning of 2020 to 0.25% by the end of the year. Subsequently, rates increased to 5.25% by December 2023.

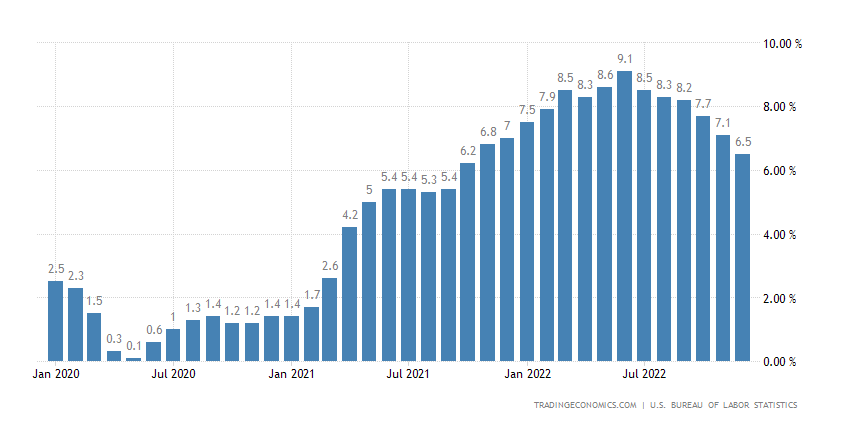

The rate cuts were conducted along with an unprecedented quantitative easing (QE) program, followed by a quantitative tightening (QT) program. In July 2022, inflation reached a 50-year record high of 9.1%. All these events were likely to impact the SPX performance substantially.

2020: reasons behind the S&P 500 decline and growth

In Q1 2020, the US economy grappled with the coronavirus pandemic, prompting Donald Trump to declare a health emergency and impose quarantine restrictions. Educational institutions closed, public events were banned, and citizens were advised to stay home. These restrictions consequently resulted in a sharp decline in business activity and a 34.9% drop in the S&P 500, tumbling from 3,391 on 20 February 2020 to 2,208 points on 23 March 2020.

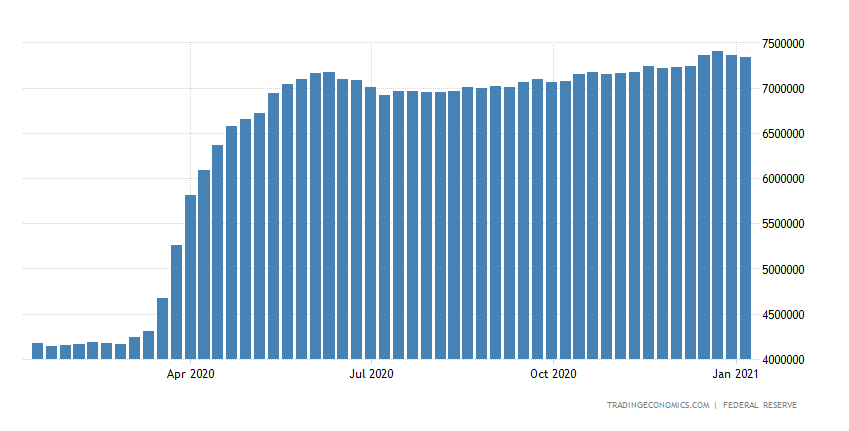

To revive the economy, the US Senate passed a 2 trillion USD relief bill, and the Federal Reserve reduced the interest rate from 1.75% to 0.25% across two meetings in March. The regulator embarked on a quantitative easing program, which expanded its balance sheet from 4.1 trillion USD in January to 7.1 trillion USD in June 2020.

These actions by the Federal Reserve likely instilled confidence in investors, and despite the index decline in February and March, positive returns of 16.0% were recorded at year-end.

2021: the S&P 500 growth drivers

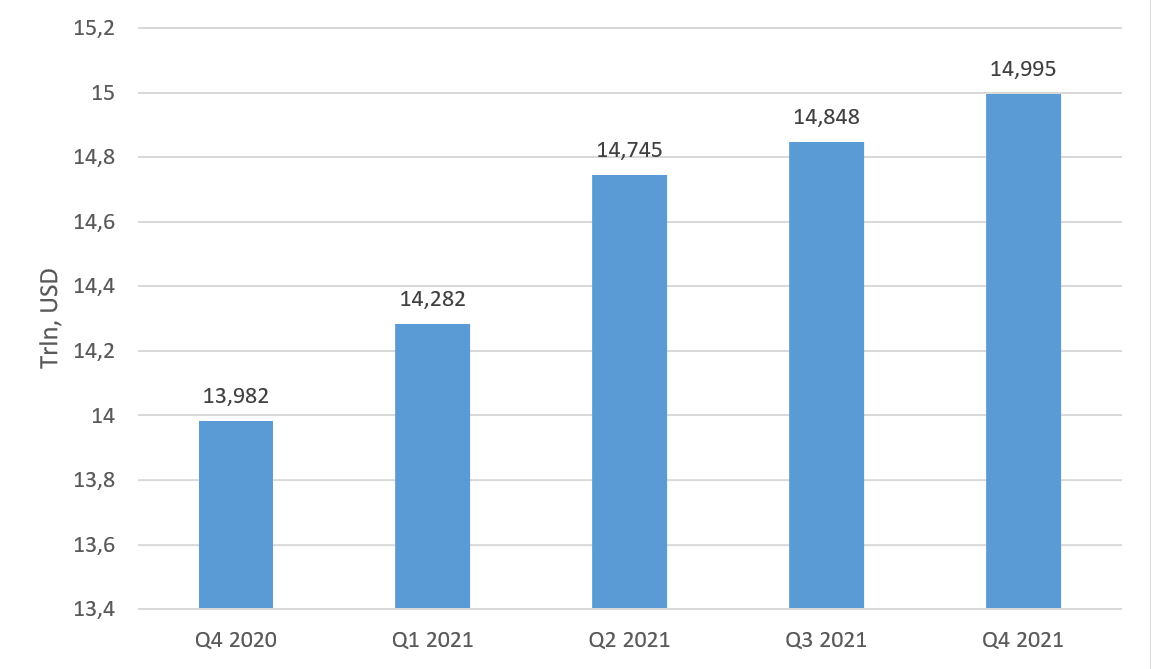

The business environment experienced nearly perfect conditions entering 2021. A near-zero interest rate enabled low-cost borrowings, and with the ongoing quantitative easing program, the Federal Reserve became the primary purchaser of commercial bonds. In addition, restrictions related to the COVID-19 pandemic were lifted, leading to an uptick in consumer spending.

The index gained 27.2% in 2021, reaching a record 4,800 points.

2022: reasons behind the S&P 500 decline

A surge in consumer spending and borrowings available at a minimal interest rate propelled inflation: based on December 2020 results, the indicator stood at 1.4%, while in December 2021, it reached 7.0%, significantly exceeding the Federal Reserve’s target of 2%.

The US economy started 2022 with inflation running at 7.0%, which continued to rise, reaching 9.1% in July, marking a 50-year record.

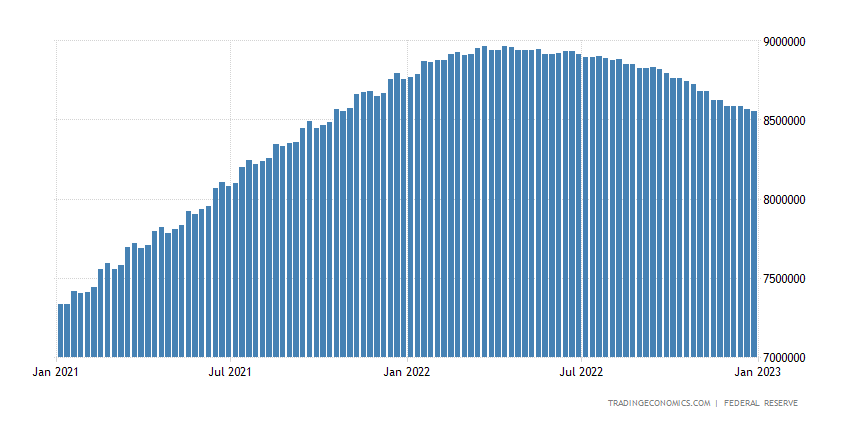

The Federal Reserve was forced to take measures to combat inflation, and discussions about monetary policy tightening and initiating a quantitative tightening program emerged at press conferences. Having said this, the regulator acted, raising the interest rate from 0.25% to 0.75% in March 2022. By the end of 2022, the interest rate reached 4.5%. In addition, the quantitative tightening program kicked off in June, confirmed by the Federal Reserve’s balance sheet reduction from 8.9 trillion USD in April 2022 to 8.5 trillion USD in early January 2023.

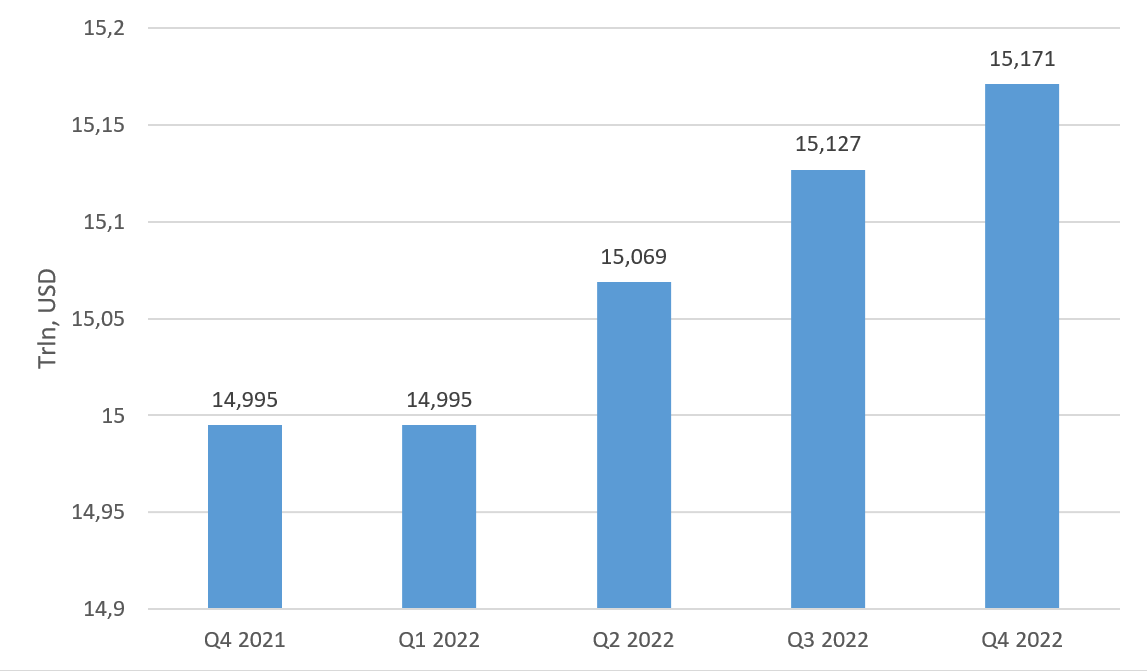

Consumer spending growth also slowed sharply in 2022. The figure was 14.99 trillion USD in Q1 and 15.17 trillion USD by Q4, showing an increase of merely 1.1%.

Investors were likely prepared for rate hikes and the beginning of the quantitative tightening program, prompting them to start locking in profits generated in 2021. It is worth noting that businesses face a higher financial load in a high-interest rate environment. This situation adversely affected S&P 500 quotes, leading to a 19.7% drop to 3,844 points by the end of 2022.

2023: S&P 500 growth drivers

Rate hikes continued in 2023, with the QT program remaining in effect. However, inflation fell from 9.1% in June 2022 to 6.4% in January 2023 and continued its downward trajectory. Since the Federal Reserve’s actions aimed to reduce inflation, market participants began to anticipate the end of the monetary tightening cycle when the figure decreased.

Overall, 2023 became unconventional in terms of market participants’ reactions to economic news. For example, increased unemployment and bankruptcies were positively perceived since it should have prompted the Federal Reserve to ease monetary policy.

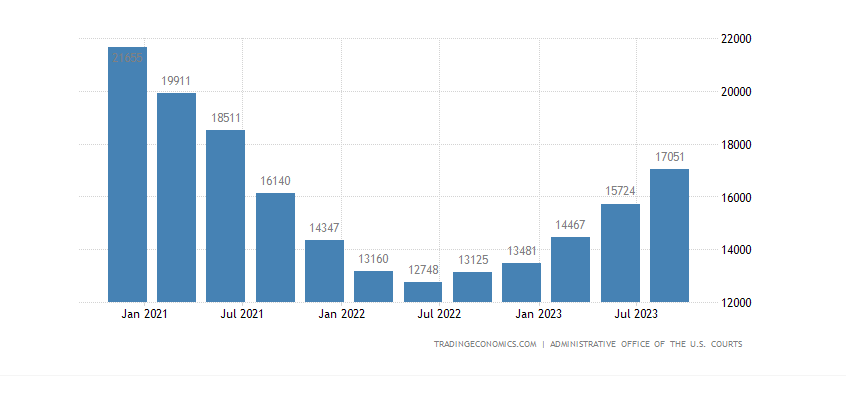

High interest rates resulted in high borrowing costs and debt servicing, leading to an increase in bankrupt companies. Thus, 13,125 companies went bankrupt in Q4 2022, while their number reached 17,051 in Q4 2023, marking a growth of 29.9%.

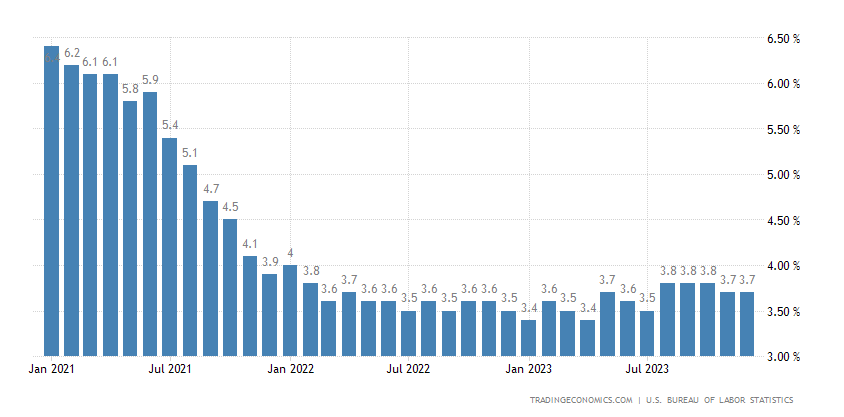

A rise in bankruptcies entailed an increase in the unemployment rate. In January 2023, it dropped to 3.4% and started to go up slowly, hitting 3.7% in December 2023.

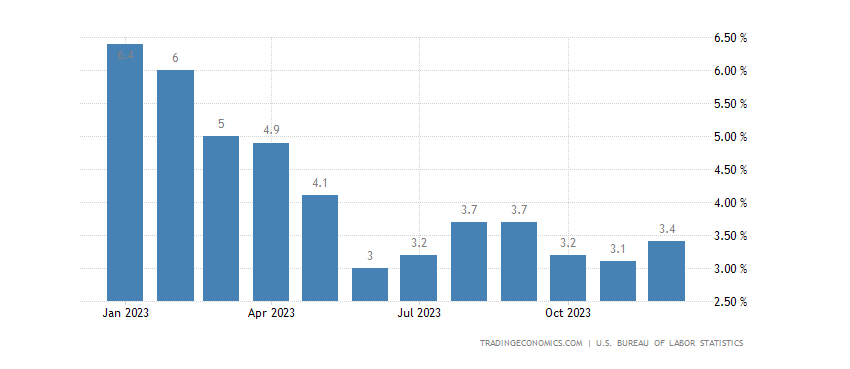

Inflation fell from 6.4% in January to 3.4% in December 2023.

News about oncoming economic problems in the country drove up the S&P 500 by 23.2% in 2023.

The S&P 500 largest gainers in 2023

The S&P 500 basket includes shares in representatives of various economic sectors. According to Visual Capitalist, sector performance in 2023 was as follows:

- Information technology +56.4%

- Communication services +54.4%

- Consumer discretionary +40.3%

- Industrials +16.0%

- Materials +10.2%

- Financial +9.9%

- Real estate +8.3%

- Health care +0.3%

- Consumer staples −2.3%

- Energy −4.8%

- Utilities −10.4%

NVIDIA Corporation (NASDAQ: NVDA) and Advanced Micro Devices Inc. (NASDAQ: AMD) stood out in the information technology sector, showing an increase in returns of 232.9% and 123.2%, respectively.

In the communication services sector, Meta Platforms Inc. (NASDAQ: META), Netflix Inc. (NASDAQ: NFLX), and Alphabet Inc. (NASDAQ: GOOG) enjoyed the highest returns of 188%, 63%, and 57%, respectively.

The gainers in the consumer discretionary sector in terms of the annual return increase were Tesla Inc. (NASDAQ: TSLA) and Amazon.com Inc. (NASDAQ: AMZN), with 109.4% and 78.2%, respectively.

Factors that might propel the S&P 500 in 2024

1. Moderate growth of unemployment. Jerome Powell, the Fed’s chair, set a goal of bringing inflation down to 2% but doing it in a way that avoids tipping the country’s economy into a recession.

The leading indicators the regulator monitors are the labour market and the inflation rate. A rise in the unemployment rate may indicate declining consumer demand, accompanied by a potential drop in inflation.

As mentioned above, unemployment in the US reached a low of 3.4% and rose to 3.7% in December 2023. At this stage, the indicator seems to have stopped falling.

2. A drop in inflation to 2%. Rising inflation at the end of 2023 following a June meeting presents a mixed situation. Either this is another wave that could cause the Fed to revert to tightening monetary policy, or it is a temporary surge related to the winter holidays and increased consumer spending. If inflation continues moving towards 2%, it may signal a softer monetary policy stance by the Federal Reserve.

3. Interest rate reduction. The Federal Reserve completed a series of interest rate hikes in July 2023, keeping it at 5.5% at two meetings. Comments from the Fed’s officials on future actions regarding the interest rate can hardly be called unambiguous. In 2024, market participants will probably have to develop and adjust their investment strategy based on mere assumptions.

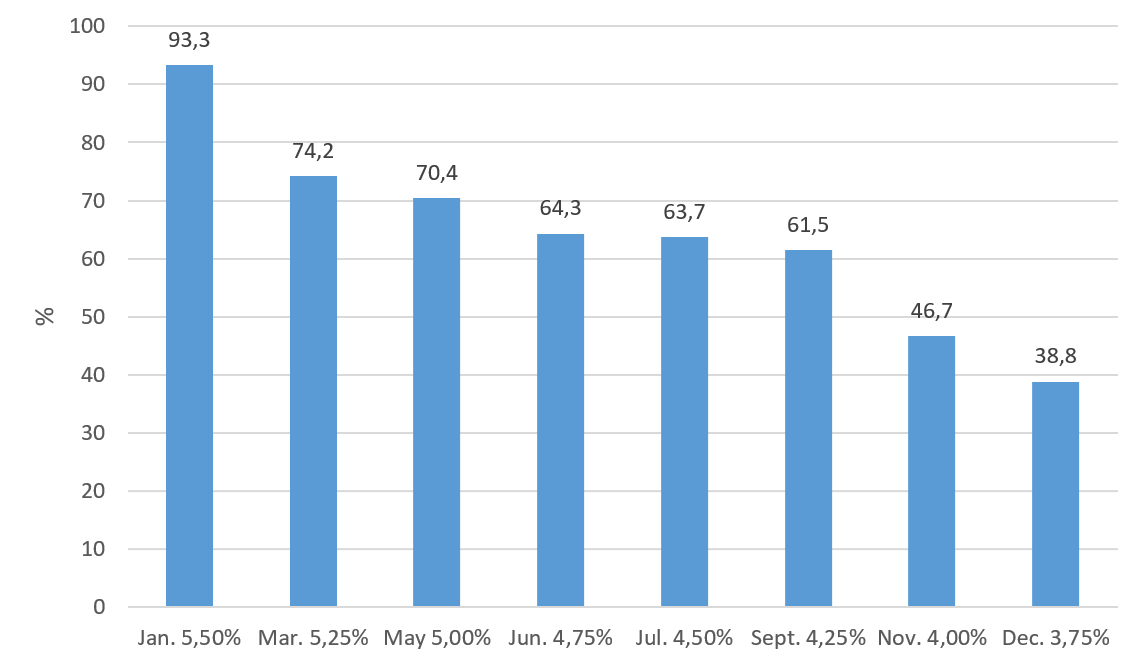

Below is the CME FedWatch Tool data on possible interest rate changes in 2024. The forecasts are based on the prices of futures contracts for federal government bonds.

Factors that might impede the S&P 500 growth in 2024

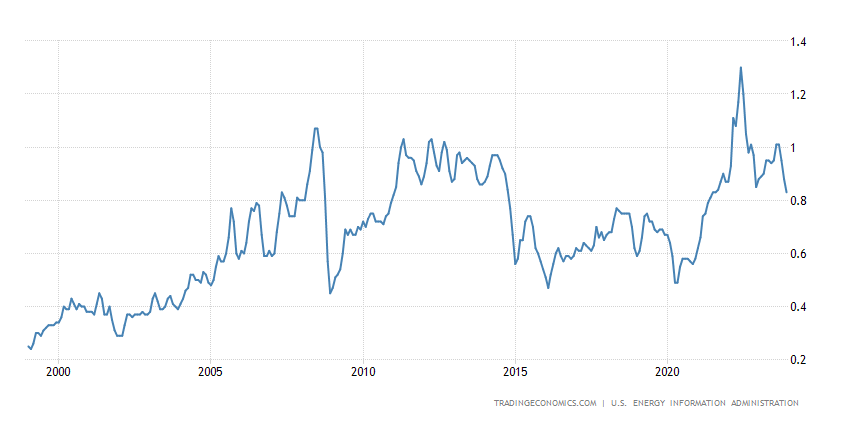

1. Rising oil prices. US inflation may be influenced not only by consumer spending but also by an increase in energy prices, impacting product costs and their delivery. In June 2022, when inflation peaked at 9.1%, the WTI oil price reached 123.85 USD per barrel, exceeding the average 2019 price by 115%. Gasoline prices in the country soared to a 25-year record of 1.3 USD per litre.

The chart shows that gasoline prices began decreasing afterwards, accompanied by an inflation rate cut.

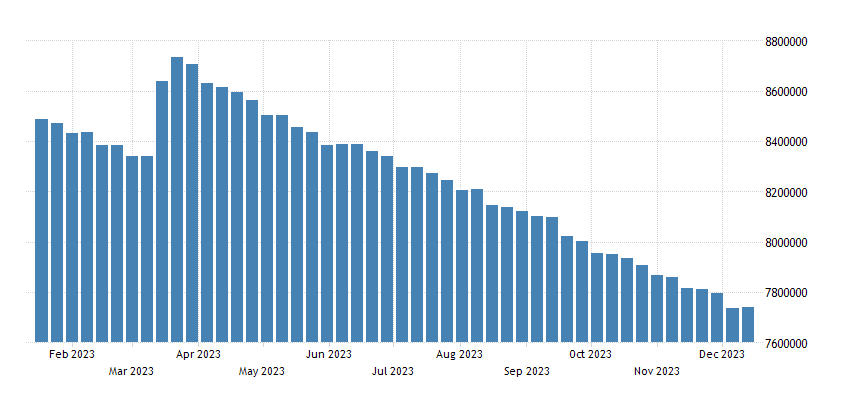

2. A black swan. It can be assumed that the Federal Reserve will refrain from reducing the interest rate until signs of imminent issues in the US economy appear. When forecasting the market environment in 2024, it might be prudent to factor in the risks of a potential black swan. Notably, the headline-making bankruptcy of Silicon Valley Bank became such an event in 2023, leading to the regulator being forced to suspend the QT program. This can be seen from a surge in the Federal Reserve’s balance sheet in March and April 2023.

Technical analysis of the S&P 500 index

Following a 50% correction to 4,100 points, the S&P 500 surged towards its all-time high of 4,800. At the time of writing, the index is testing this resistance level.

Under current conditions, quotes could probably fall to the nearest support level at 4,600 points. Subsequently, the price will likely rebound from this level, resuming growth.

If the S&P 500 quotes break above the all-time high of 4,800 points, this could trigger their further growth to the next Fibonacci level at 1.618, corresponding to the 5,230-point mark.

Technical analysis of the S&P 500 index*

Conclusion

Considering information about the S&P 500’s performance over the last four years, it can be assumed that the index tends to rise amid a soft monetary policy and a quantitative easing program. The Fed managed to reduce the inflation level in 2023, and the monetary tightening program could give way to the easing program, potentially impacting the S&P 500 quotes positively.

The probability of a black swan event should not be ruled out in 2024, which may adversely affect the index quotes in the short term but subsequently lead to more active actions of the Federal Reserve to support the US economy. In such a scenario, a decline in the S&P 500 may be short-lived.

The most pessimistic scenario for the US economy and the index could be the resumption of growth in oil prices and the inflation rate. In this case, the regulator will likely be forced to take unprecedented measures to tighten monetary policy. Presumably, this may lead to a surge in debt expenses in the US budget, which, in turn, may drive up taxes for businesses. In this scenario, the S&P 500 will have little chance of ending the year with positive returns.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

The stock charts in this article are provided by the TradingView platform, which offers a wide range of tools for analysing the financial markets. It is a convenient, high-tech online market data charting service that allows users to perform technical analysis, research financial data, and communicate with other traders and investors.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high