Reverse Stock Split: All You Need to Know

6 minutes for reading

This article is dedicated to such a phenomenon of the stock market as a reverse stock split: why public companies use this process, and how it happens exactly. Also, there will be examples of stock consolidation, i.e., reverse stock split.

What is a reverse stock split?

A reverse stock split, also known as consolidation, means that the issuer consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable shares. While the number of securities held by shareholders is cut down, the shareholders get to keep the same part of the share capital as before the split. The main goal is to increase the share price.

The reverse split coefficient represents the ratio by which the number of securities will be cut down. For example, if the coefficient is 2:1, an investor who used to have 20 shares of the company that cost 10 USD each will have 10 shares left in their portfolio with a value of 20 USD each.

A company that has decided on a reverse stock split must issue a press release in advance, announcing the split coefficient and terms alongside other useful information about the consolidation.

Why do companies carry out reverse splits?

- The issuer is in financial trouble, and the board of directors is trying to keep the company afloat

- The share price is falling all too fast, nearing the minimum admissible on the exchange. If the price steps over this threshold, the platform will have to initiate sales in this stock to avoid such issues, so, the issuer performs a reverse stock split to artificially increase the share price

- There is a threat that competitors might buy the shares at a low price and intervene with management processes

- The issuer attempts to increase its weight in the eyes of investors. Large investment funds and corporations tend not to trust companies with low share prices. Shares that cost less than 5 USD are usually called Penny Stock

- On the verge of a merger, the company wants to equal its share price to that of the other company it cooperates with

How is a reverse stock split carried out?

- The board of directors decides that consolidation is necessary and raises the topic at the shareholders' meeting

- At the meeting, the shareholders vote for or against the idea

- The number of shares drops by the reverse split coefficient, and the operation is registered by the regulator

- Old shares get exchanged for new ones, or get converted

- The management writes a report about the operation and changes the company charter

- All information gets to the State Register

Companies that carried out a reverse stock split in 2022

Large corporations with a normal share price don't usually carry out stock splits because they do not need to artificially increase the share price which is already high.

As you know, a high share price scares away potential investors and decreases liquidity. Therefore, companies run up to the reverse stock split to stay afloat.

Let's take a look at how consolidation was carried out in 2022 by such companies as REX American Resources Corporation, D-Wave Quantum Inc., and Nutriband Inc.

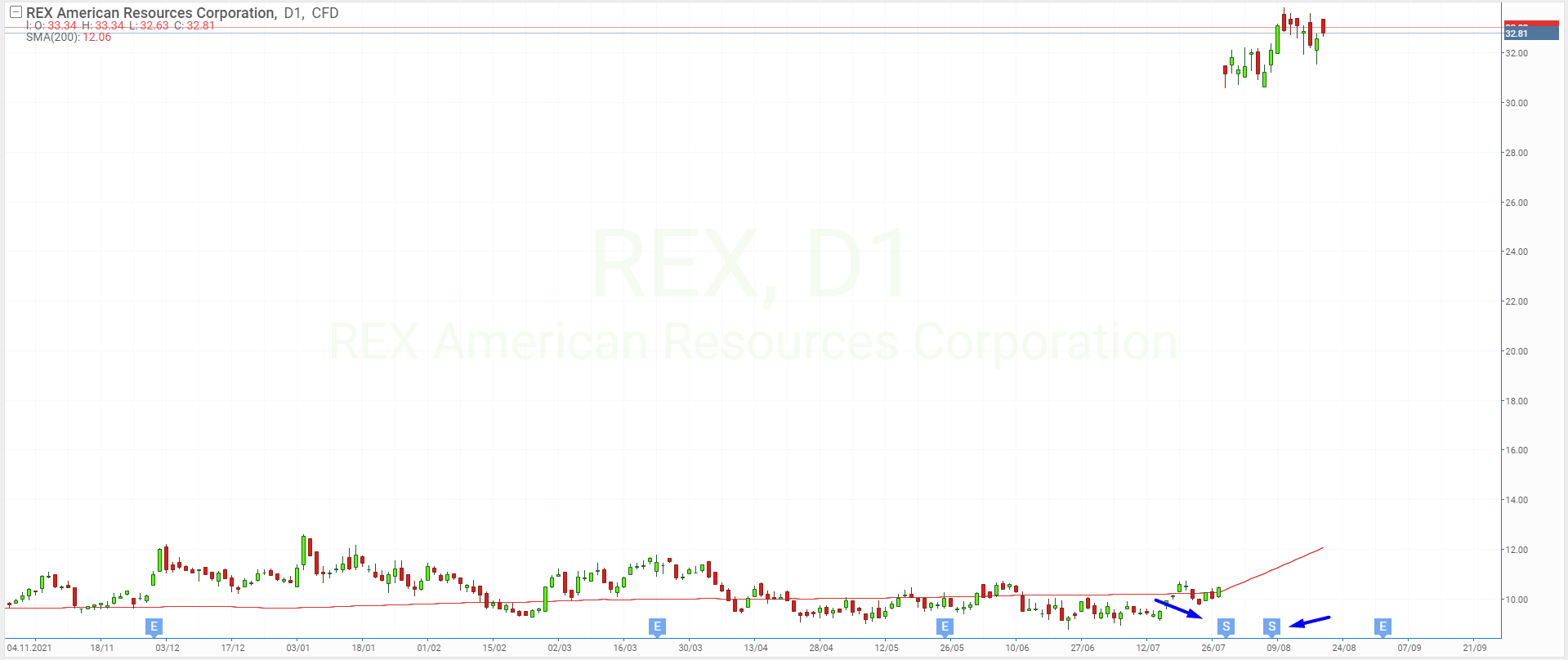

REX American Resources

REX American Resources Corporation (NYSE: REX) produces and sells ethanol in the US. Its capitalisation amounts to 582.7 million USD. This summer, the company carried out a reverse stock split at the ratio of 3:1, which made the shares grow from 10.46 USD to 31.45 USD. When the article was being prepared, there were 17.9 million shares of REX American Resources Corporation in turnover, and the quotes were in the process of correcting.

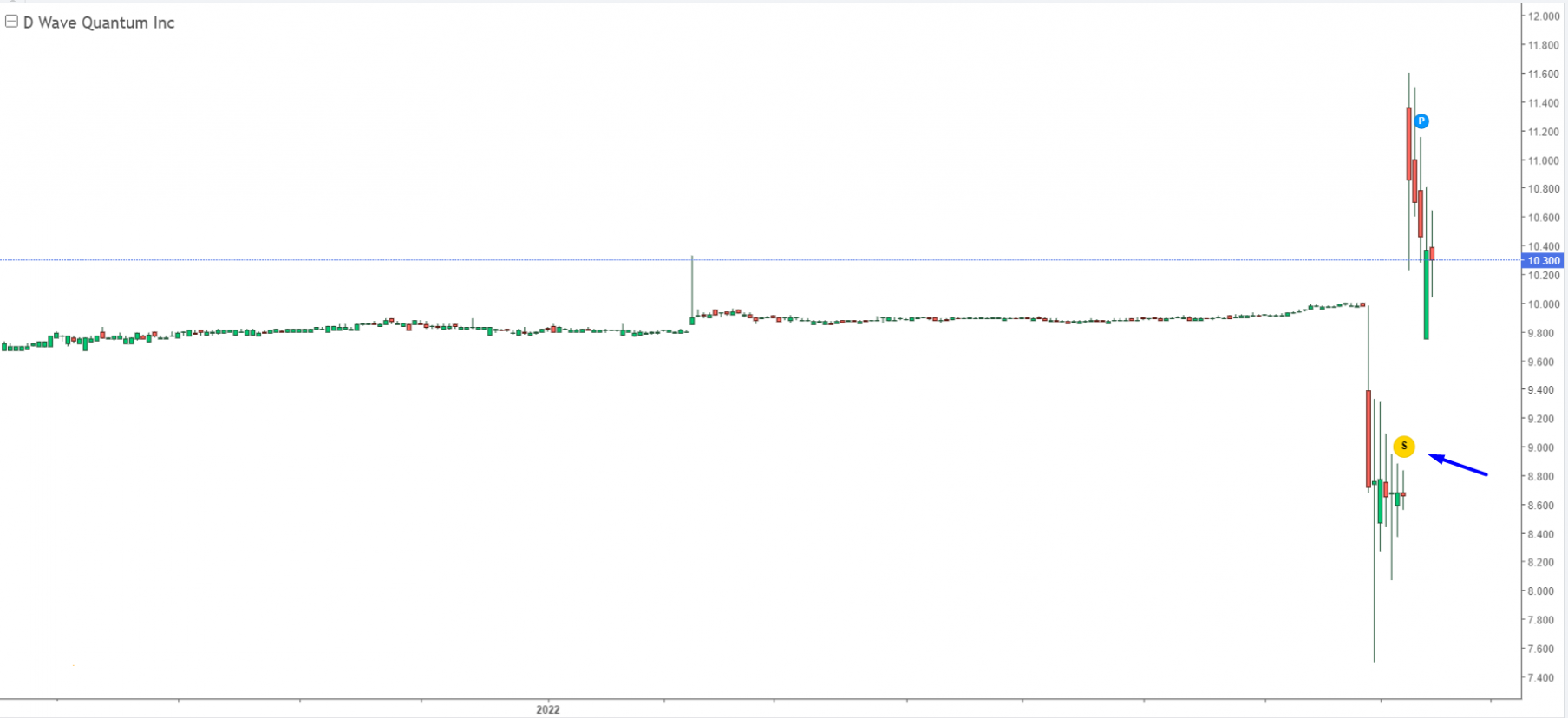

D-Wave Quantum

D-Wave Quantum Inc. (NYSE: QBTS) works in the tech sector, namely, with computer equipment. Its capitalisation amounts to 424.8 million USD. At the beginning of August, D-Wave Quantum Inc. carried out a reverse split of shares at 1.454:1, in an attempt to artificially make the shares pricier and more attractive to investors, hoping to improve its finances. This let the quotes return to 10.3 USD. When the article was being prepared, D-Wave Quantum Inc. had 37.5 million shares in turnover.

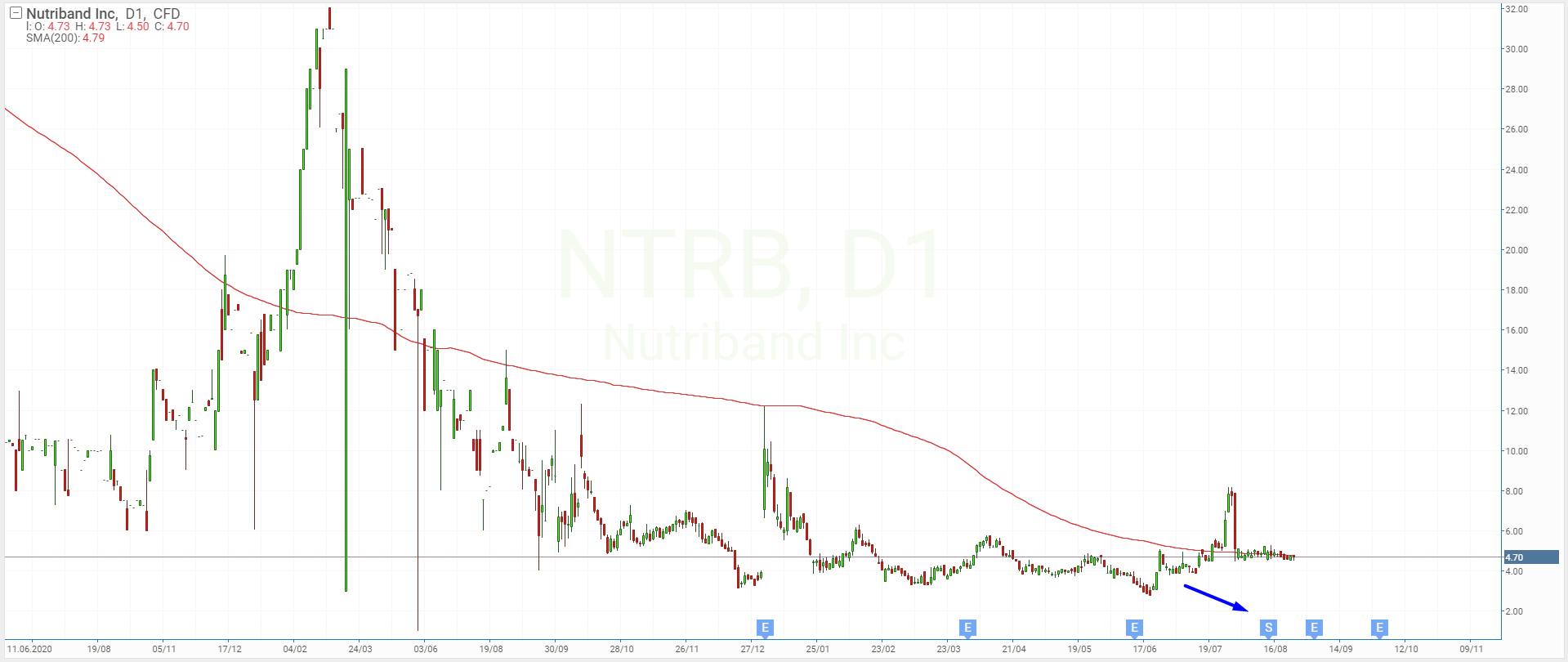

Nutriband

Nutriband Inc. (NASDAQ: NTRB) represents the biotech sector. It primarily specialises in the development and sales of trans-dermal pharmaceutical products. Its capitalisation amounts to 39.7 million USD. The coefficient of the recent reverse split was 1.167:1.

How to make money on a reverse stock split

Before a reverse stock split is carried out, the shares of the company might start falling because some investors will be getting rid of them to avoid risks. Other investors who have gotten into the financial details of the company and the real reasons for the split will have a chance to buy the shares at a lower price.

After the consolidation, if the financial performance of the company is good, the quotes have a chance to recover.

If the investor has a block of shares of a company that is planning a reverse stock split, they might try speculations. In other words, they can sell the shares at a good price before the decline, and buy them back at a better price after it falls.

The best times for selling and buying will have to be forecasted based on the available details, and this is the most universal and reliable way.

Yet, one more investment option is to get rid of the asset before the company carries out a stock split and find a riskier option. Mind that the reverse split marks hard times for the company, and there is a risk that the quotes will continue to fall after the operation.

Closing thoughts

A reverse stock split requires quite a lot of free cash from the company, which might give a negative impression to potential investors. The chances for making easy money are small while the risks of losses are high.

To keep your money safe, analyse fundamental information about the company before the split and base your decisions on it.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high