Top 5 Stocks of October: Leaders of Growth and Decline

8 minutes for reading

The Top 5 list of companies that demonstrated the most noticeable growth in October features RPC Inc., Patterson-UTI Energy Inc., Halliburton Company, Vertiv Holdings Co, and ChampionX Corporation.

Meanwhile, the leaders of decline last month were Albertsons Companies Inc., Crown Holdings Inc., First Republic Bank, Marvell Technology Group Ltd., and Estée Lauder Companies Inc.

Selection criteria

- The stocks are trading on the NYSE and NASDAQ

- The stock price is above $2

- The companies are not funds

- Their market capitalisation is more than $2 billion

- Their average trading statistics for the last 30 days are more than 750,000 stocks

Growth and decline were expressed in percent, as the difference between the closing price on 30 September and 31 October 2022. The market capitalisation of each company was valid at the moment when the article was being prepared.

Stocks with the biggest growth in October

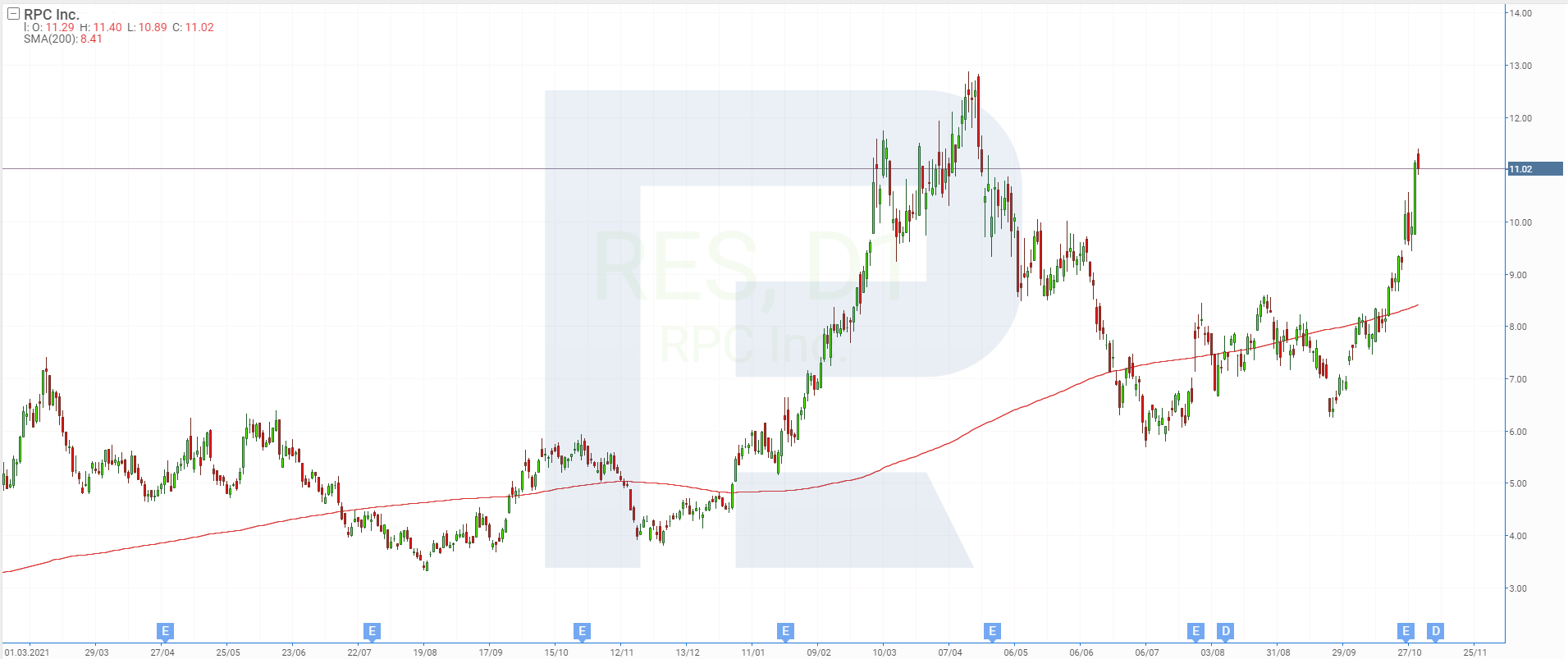

1. RPC – 60.6%

Founded in: 1984

Registered in: the US

Head office: Atlanta, Georgia

Sector: oil and gas equipment and services

Platform: NYSE

Market capitalisation: $2.4 billion

RPC Inc. provides a wide spectrum of specialised oil and gas services to companies that engage in exploring, developing, and mining oil and gas fields.

Over October, the share price of RPC Inc. (NYSE:RES) skyrocketed 60.6% from $6.93 to $11.13. It seems that one of the factors that fuelled growth was the strong financial report for Q3, 2022, which was published on 26 October.

Revenue in July-September, compared to the statistics of the same months last year, increased 104% to $459.6 million; net profit skyrocketed 1216.7% to $69.3 million, and EPS rose 1,500% to $0.32.

2. Patterson-UTI Energy – 51.1%

Founded in: 1978

Registered in: the US

Head office: Huston, Texas

Sector: oil and gas well drilling

Platform: NASDAQ

Market capitalisation: $3.8 billion

Patterson-UTI Energy Inc. provides contract services for well drilling on the ground to US and overseas oil and gas companies. The company specialises in drilling and injection, directional drilling, and equipment leasing.

Over the last month, the stock of Patterson-UTI Energy Inc. (NASDAQ:PTEN) saw a 51.1% growth from $11.68 to $17.65. The company's results for July-September this year are impressive. Revenue increased by 103.3% to $727.5 million, net profit went up 174% to $61.5 million, and EPS rose 163.6% to $0.28.

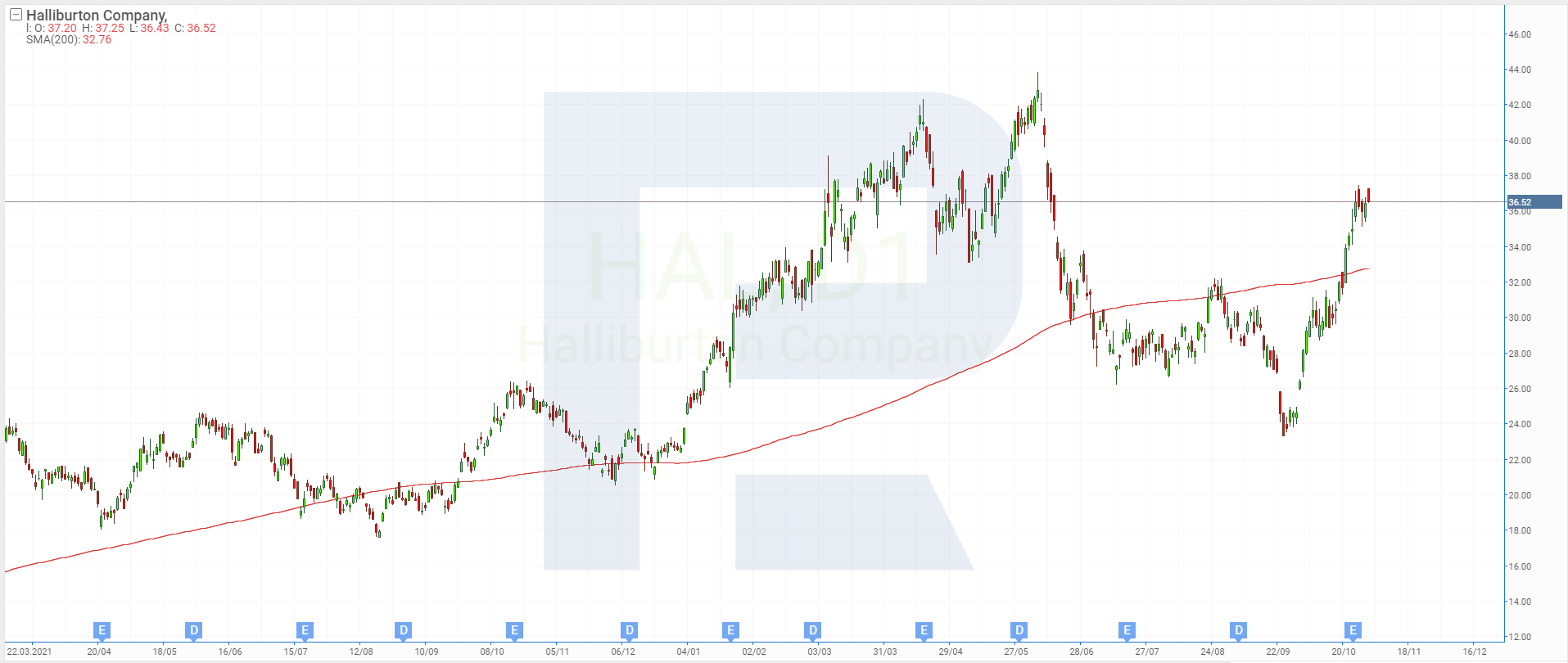

3. Halliburton Company – 47.9%

Founded in: 1919

Registered in: the US

Head office: Huston, Texas

Sector: oil and gas equipment and services

Platform: NYSE

Market capitalisation: $33.1 billion

The Halliburton Company is one of the world’s largest suppliers of products and services for the energy sphere. It explores and develops fields, drills and equips wells, and engages in their maintenance and liquidation, as well as in mining optimisation.

Last month, the quotes of the Halliburton Company (NYSE:HAL) recorded a 47.9% growth from $24.62 to $36.42. The quarterly statistics published on 25 October exceeded Wall Street expectations.

The Halliburton Company reported that its revenue in July-September had reached $5.4 billion, net profit rose to $549 million, and EPS to $0.6. These results, compared to Q3 last year, translate into a growth of 5.6%, 369.2%, and 400%, respectively.

4. Vertiv Holdings – 47.2%

Founded in: 1946

Registered in: the US

Head office: Columbus, Ohio

Sector: electric equipment

Platform: NYSE

Market capitalisation: $5.4 billion

Vertiv Holdings Co designs, produces, and maintains equipment and software for digital infrastructure, CPUs, communication networks, and commercial and industrial buildings.

In October, the shares of Vertiv Holdings Co (NYSE:VRT) grew by a record 47.2% from $9.72 to $14.31. The stock quotes were pushed up by the news about a management reshuffle.

At the beginning of the month, it became known that Rob Johnson was leaving the post of director, retiring due to some health issues. He was replaced by Giordano Albertazzi, who previously was responsible for the markets of South and North America.

5. ChampionX – 46.2%

Founded in: 2017

Registered in: the US

Head office: Woodlands, Texas

Sector: oil and gas equipment and services

Platform: NASDAQ

Market capitalisation: $5.7 billion

ChampionX Corp designs and produces equipment for field exploration, drilling, and transportation of oil and gas. One of the company’s businesses is the creation of innovative technologies for the optimisation and automation of mining.

On 25 October, the company published its financial report for July - September 2022. The revenue of ChampionX Corp. in Q3 increased 24.8% to $1 billion. Meanwhile, the net profit dropped by 60.4% to $23.2 million, and EPS fell by 60.7% to $0.11. This did not stop the share price of ChampionX Corp. (NASDAQ:CHX) from growing 46.2% from $19.59 to $28.64.

Stocks with the biggest decline in October

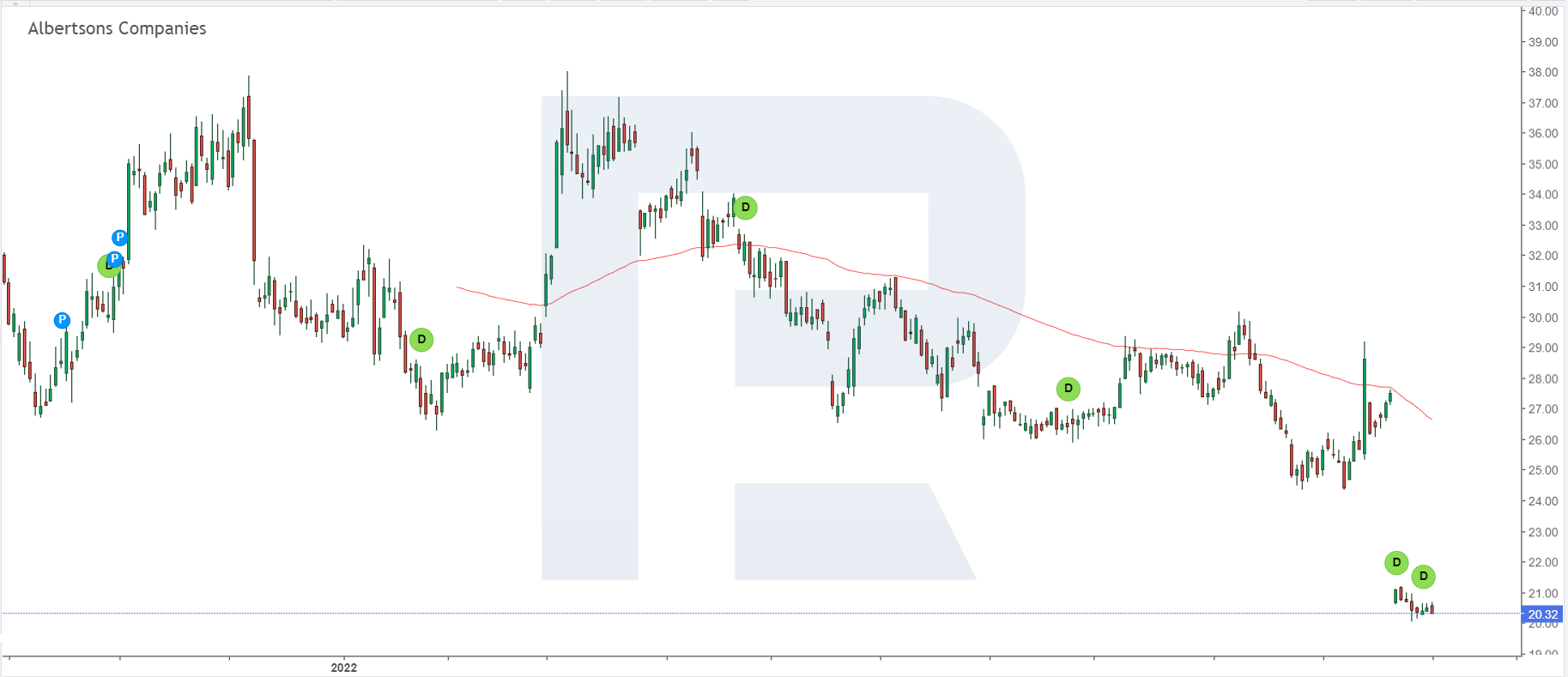

1. Albertsons Companies – 17.5%

Founded in: 1935

Registered in: the US

Head office: Boise, Idaho

Sector: retail sales

Platform: NYSE

Market capitalisation: $11 billion

Albertsons Companies is one of the largest retailers of food and medicines in the US. It owns more than 20 brands, a chain of 2,200 supermarkets, and 1,700 drugstores.

In October, the stock of Albertsons Companies (NYSE:ACI) recorded a 17.5% decline, with the share price dropping from $24.86 to $20.51. On 21 October, it became known that the already announced merger with The Kroger Company, another large supermarket chain, would be thoroughly inspected by regulators.

It might happen that both companies will have to sell a part of their shops for the agreement to get approved, and Albertsons Companies will need to stop paying special dividends of $6.85 per share.

2. Crown Holdings – 15.35%

Founded in: 1892

Registered in: the US

Head office: Yardley, Pennsylvania

Sector: consumer industry

Platform: NYSE

Market capitalisation: $8.4 billion

Crown Holdings Inc. designs, produces and sells packaging for the food and light industries. Moreover, it provides expendables and equipment for metallurgy, building, and agricultural industries.

Over the past month, the quotes of Crown Holdings Inc. (NYSE:CCK) dropped by 15.35% from $81.03 to $68.59. The main reason for the decline was the fact that the Q3 results turned out much worse than the consensus forecast due to weakened consumer demand.

Crown Holdings Inc.'s revenue increased by 11.6% to $3.26 billion, net profit rose 20.6% to $158 million, and EPS went up 34.2% to $1.06. Analysts had forecast the revenue to reach $3.32 billion and the EPS to hit the price of $1.79.

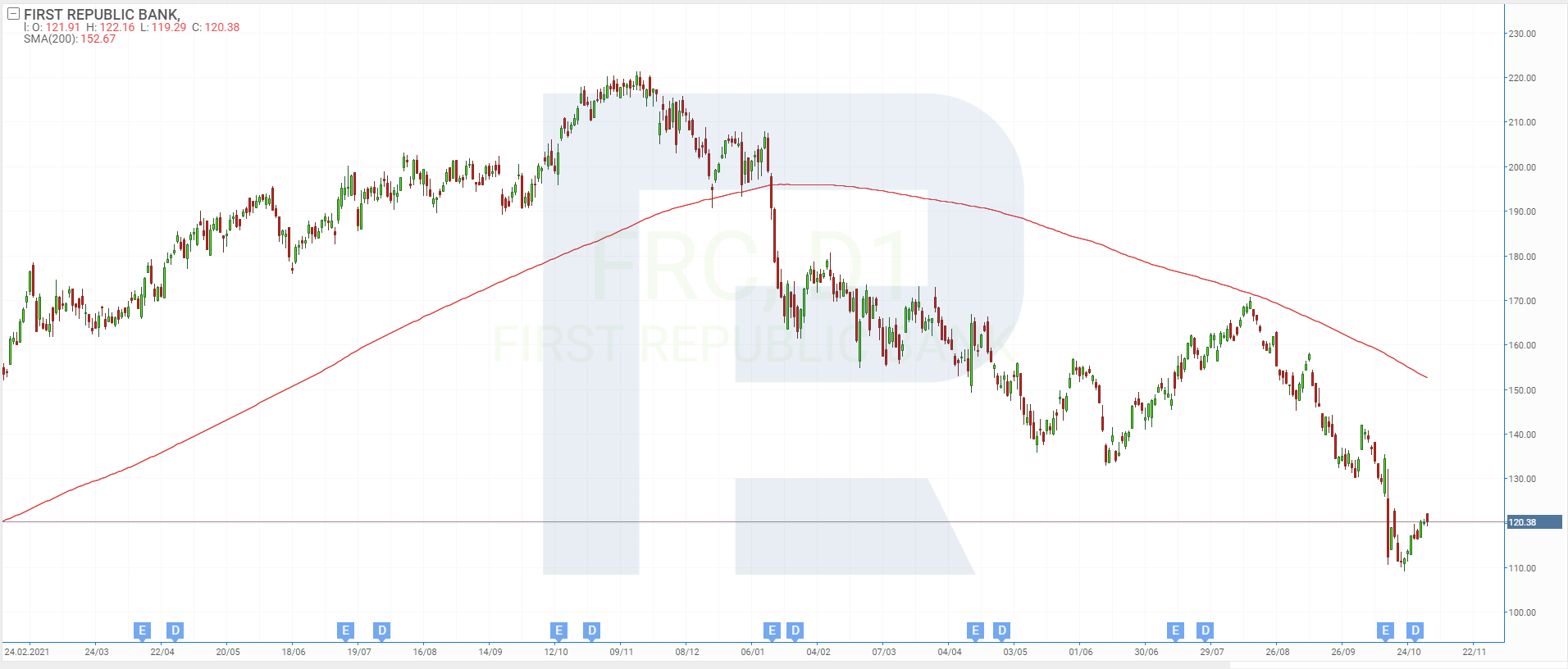

3. First Republic Bank – 8%

Founded in: 1985

Registered in: the US

Head office: San Francisco, California

Sector: financial services

Platform: NYSE

Market capitalisation: $21.9 billion

First Republic Bank provides banking services for individuals. It operates in two sectors – commercial banking and asset management.

In October, the shares of First Republic Bank (NYSE:FRC) dropped by 8% from $130.55 to $120.1. On 14 October, the company presented its financial report for Q3 of this year.

Revenue increased to $1.51 billion, net profit to $445 million, and EPS to $2.23. Growth amounted to 35.8%, 20.3%, and 14.9%, respectively. However, the revenue had been expected to reach $1.54 billion.

Moreover, Zacks Equity Research experts believe that the serious increase in expenses on the extension of the business of First Republic Bank might have a negative effect on the net profit in the nearest future.

4. Marvell Technology Group – 7.5%

Founded in: 1995

Registered in: the US

Head office: Wilmington, Delaware

Sector: electronic technology

Platform: NASDAQ

Market capitalisation: $33.8 billion

Marvell Technology Group Ltd. specialises in data transportation, storage, processing, and protection. The company develops, produces, and sells a wide spectrum of innovative semiconductor solutions for data centres, cloud storage, and industrial plants.

In October, the stock quotes of Marvell Technology Group Ltd. (NASDAQ:MRVL) recorded a 7.5% decline from $42.91 to $39.68. There were no noticeable events in that month that could explain such a decline. It could possibly be attributed to the shortage of accessories, and supply issues.

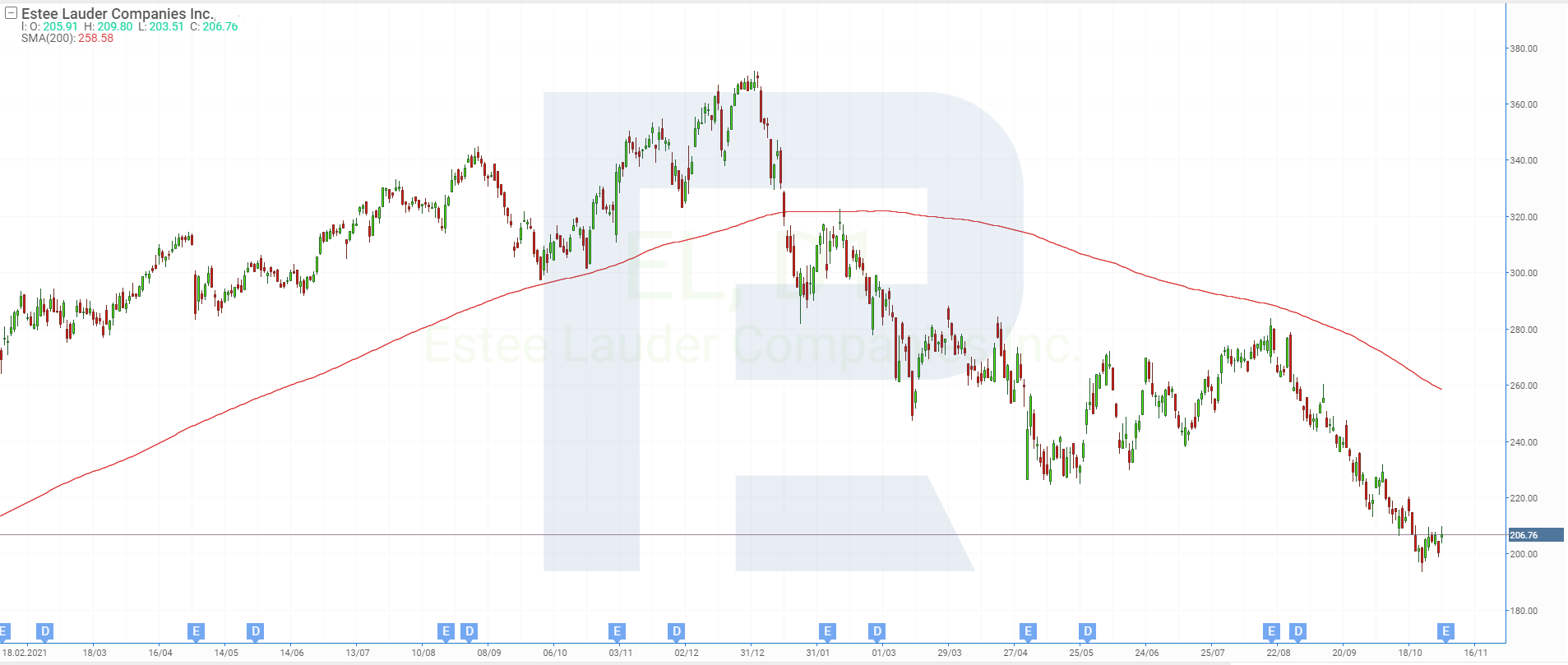

5. Estée Lauder Companies – 7.1%

Founded in: 1946

Registered in: the US

Head office: New York, New York

Sector: non-durable consumer goods

Platform: NYSE

Market capitalisation: $71.6 billion

Estée Lauder Companies Inc. is a large producer of makeup products, perfumes, and hair cosmetics. The company owns over 20 brands, including Estée Lauder, Aramis, Clinique, Lab Series, Origins, M•A•C, Bobbi Brown, La Mer, and Aveda.

Over October, the shares of Estée Lauder Companies Inc. (NYSE:EL) dropped from $215.9 to $200.49, losing 7.1%. The decline can be explained by shrinking consumer demand, the tightening of coronavirus restrictions in China, and remaining logistics issues as a consequence of COVID-19.

Which stocks demonstrated the most noticeable dynamics in October?

The leaders of share price growth were RPC Inc., Patterson-UTI Energy Inc., Halliburton Company, Vertiv Holdings Co, and ChampionX Corporation. All of them except Vertiv Holdings Co work in oil and gas mining, and their quarterly reports for July-September turned out strong due to the high prices of hydrocarbons.

The most noticeable decline, on the other hand, was demonstrated by the shares of Albertsons Companies Inc., Crown Holdings Inc., First Republic Bank, Marvell Technology Group Ltd., and Estée Lauder Companies Inc. All the shares from the anti-rating had their individual reasons for falling.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high