Top 5 Stocks of July: Leaders of Growth and Decline

8 minutes for reading

The Top 5 list of companies whose shares demonstrated the most prominent growth in July features AMTD Digital Inc., Pagaya Technologies Ltd., Getty Images Holdings Inc., Silvergate Capital Corporation, and Enovix Corporation. On the other hand, the leaders of decline are Snap Inc., Newmont Corporation, XPeng Inc., Hayward Holdings Inc., and Cincinnati Financial Corporation.

Selection criteria

- The stocks are trading on the NYSE and NASDAQ

- The share price is above $5

- The companies are not funds

- Their market capitalisation is more than $2 billion

- Their average trading statistics for the last 30 days is more than 750,000 shares

The stocks with the most prominent growth in July

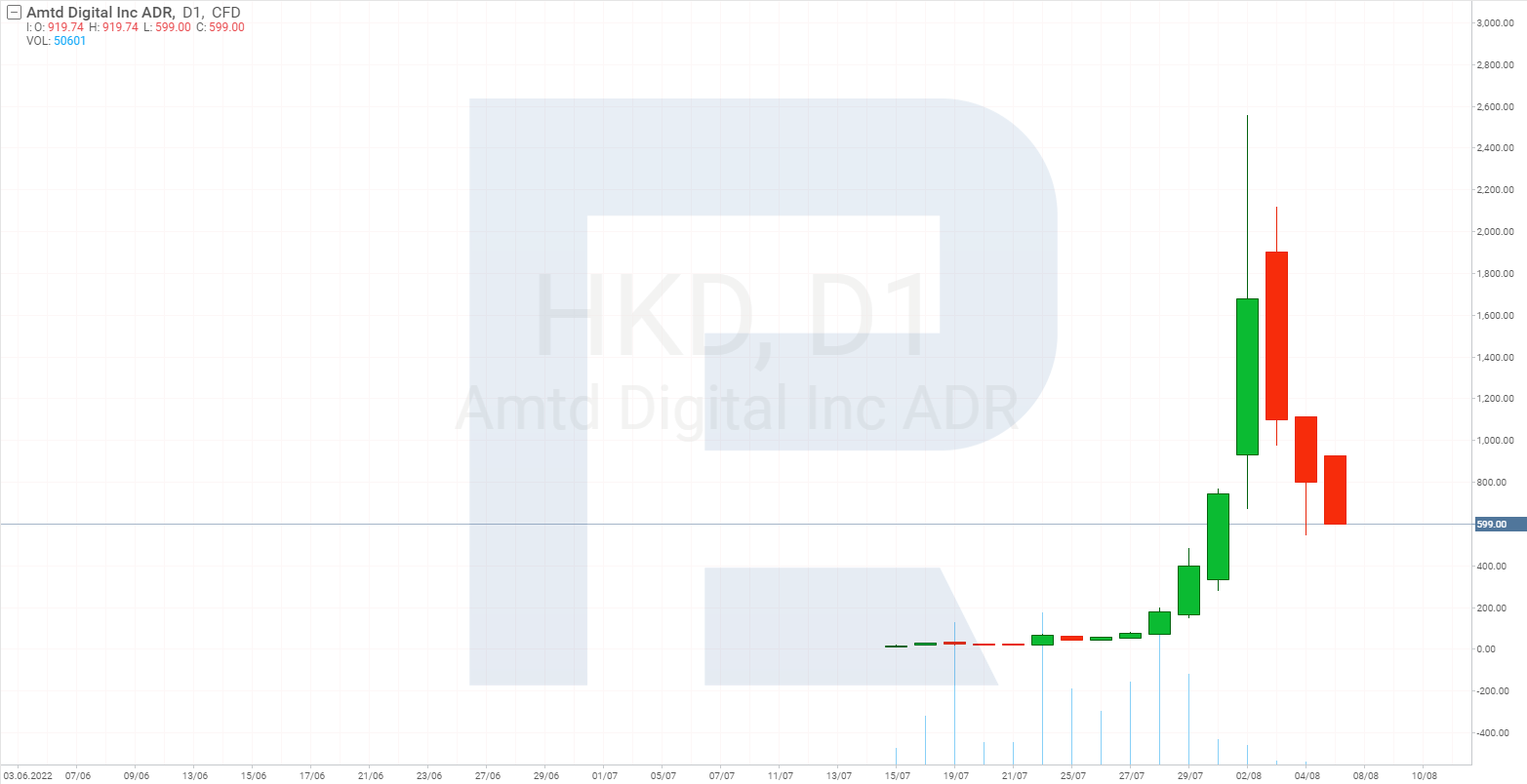

1. AMTD Digital – 2976.9%

Founded in: 2019

Registered in: China

Head office: Hong Kong

Sphere: financial technology

Platform: NYSE

Market capitalisation: $133.5 billion

AMTD Digital Inc. owns a digital platform providing financial, media, marketing, and investment solutions. The shares of the fintech company started trading on the American exchange in July. By the end of the month, the share price of AMTD Digital Inc. (NYSE:HKD) skyrocketed 2976.9%.

This phenomenal growth is attributed to the actions of private investors from a Reddit community. While the supply was limited, they managed to create agitation around AMTD Digital, which caused the surge in the stock quotes.

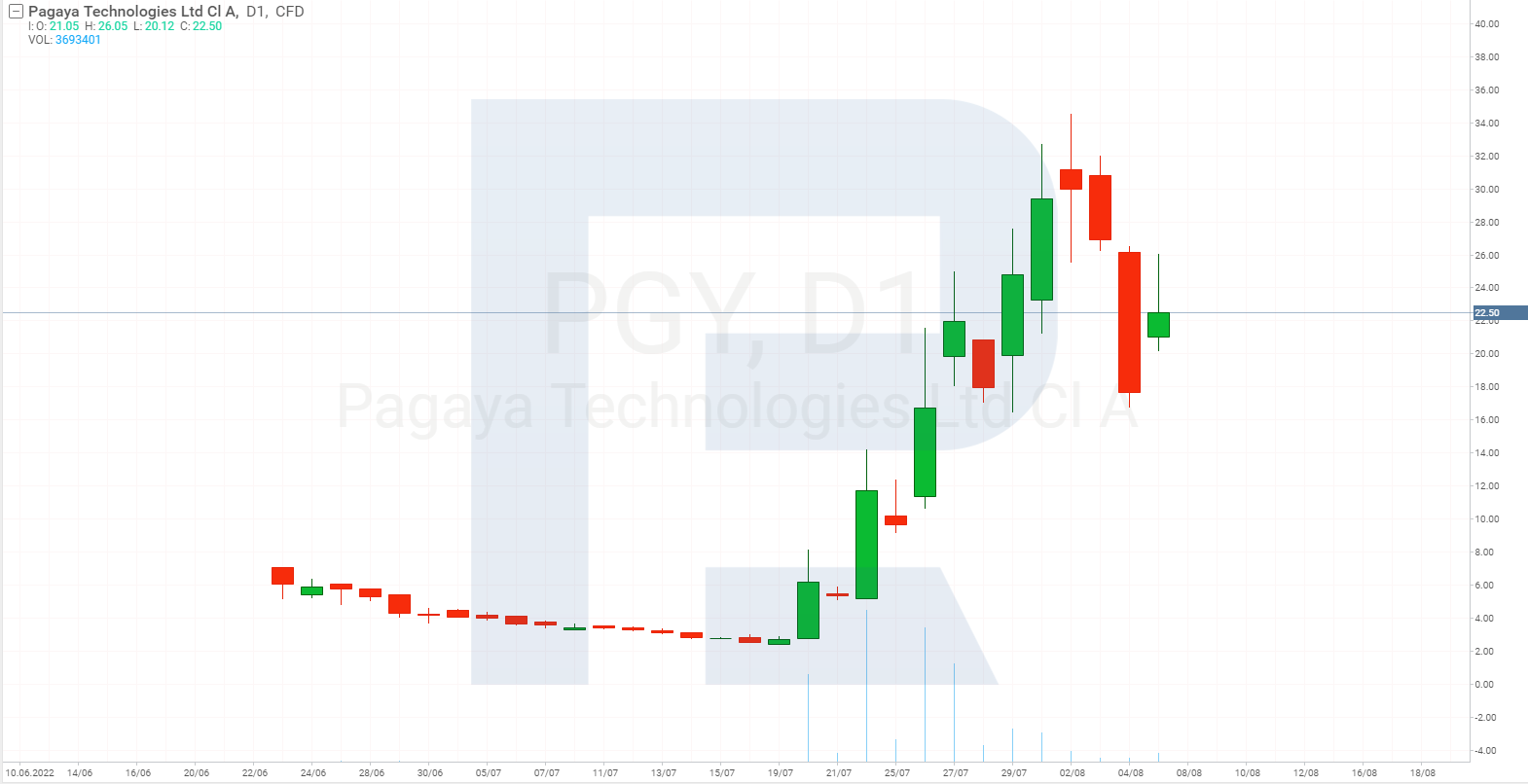

2. Pagaya Technologies – 493.8%

Founded in: 2016

Registered: Israel

Head office: Tel Aviv

Sphere: financial technology

Platform: NASDAQ

Market capitalisation: $12.2 billion

Fintech company Pagaya Technologies Ltd. designs software for financial institutions, integrating AI in its products. It actively works in both the Israel and US markets.

In July, the shares of Pagaya Technologies Ltd. (NASDAQ:PGY) recorded a 493.8% growth from $4.18 to $24.82. During the month, the most noticeable price surges were noticed on 20, 22, and 26 July when the stock quotes recorded 129,63%, 118,88%, and 73,11%, respectively.

The abrupt growth of Pagaya Technologies Ltd. shares started after the company presented a prospectus of potential stock sales. As you remember, the company entered NASDAQ by a merger with a SPAC.

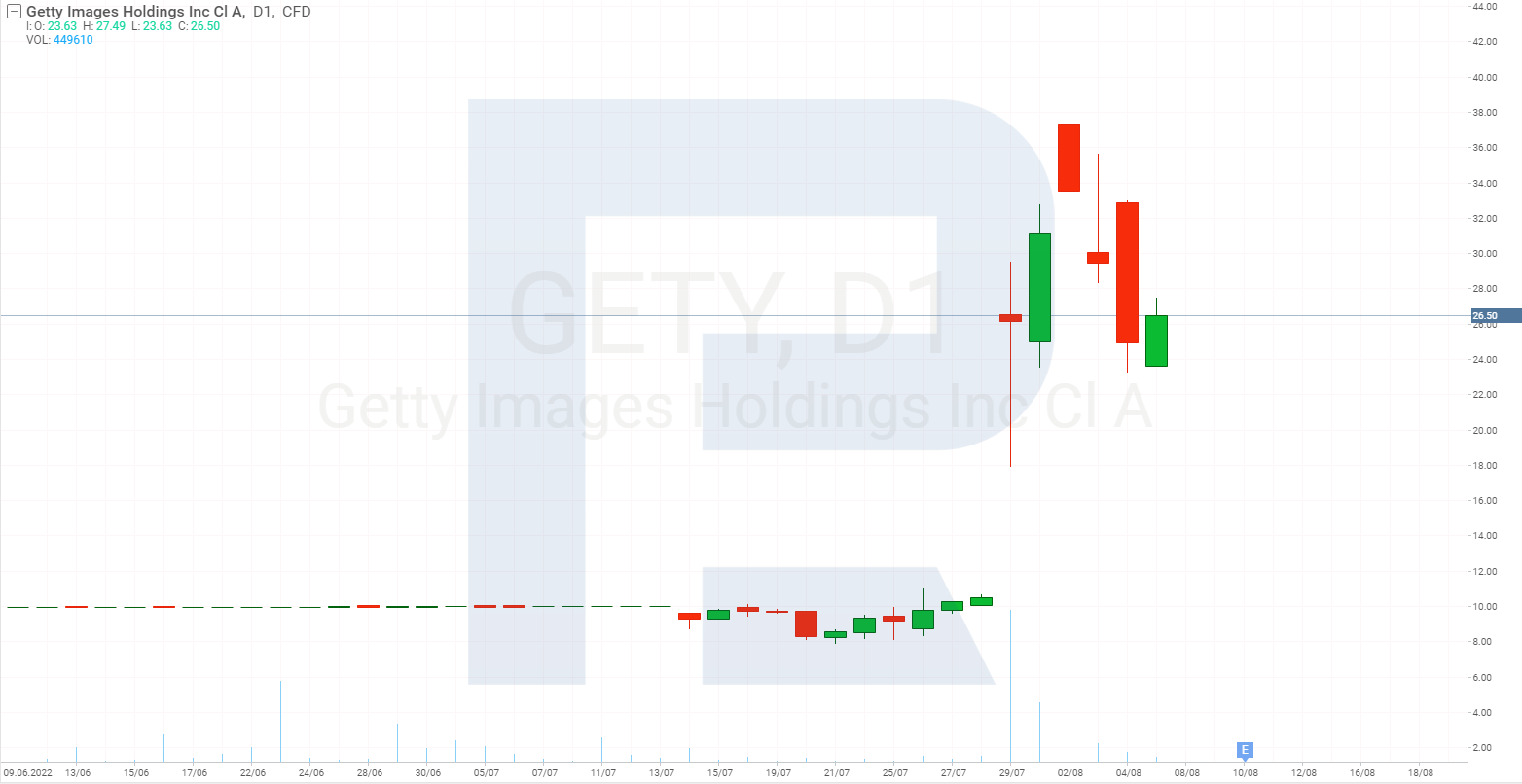

3. Getty Images Holdings – 161.8%

Founded in: 1995

Country of registration: US

Head office: Seattle, Washington

Sphere: commercial services

Platform: NYSE

Market capitalisation: $2.7 billion

Getty Images Holdings Inc. creates and distributes photo, video, and audio content. It owns one of the world’s largest online picture banks, providing paid and free licenses for the content.

On 22 July, the company announced the completion of a merger with CC Neuberger Principal Holdings. Thanks to this agreement, on 25 July the shares of Getty Images Holdings Inc. (NYSE:GETY) started trading on the NYSE. And on 29 July, they already reached the price of $26.15, growing 149.05%. The monthly growth amounted to 161.8%.

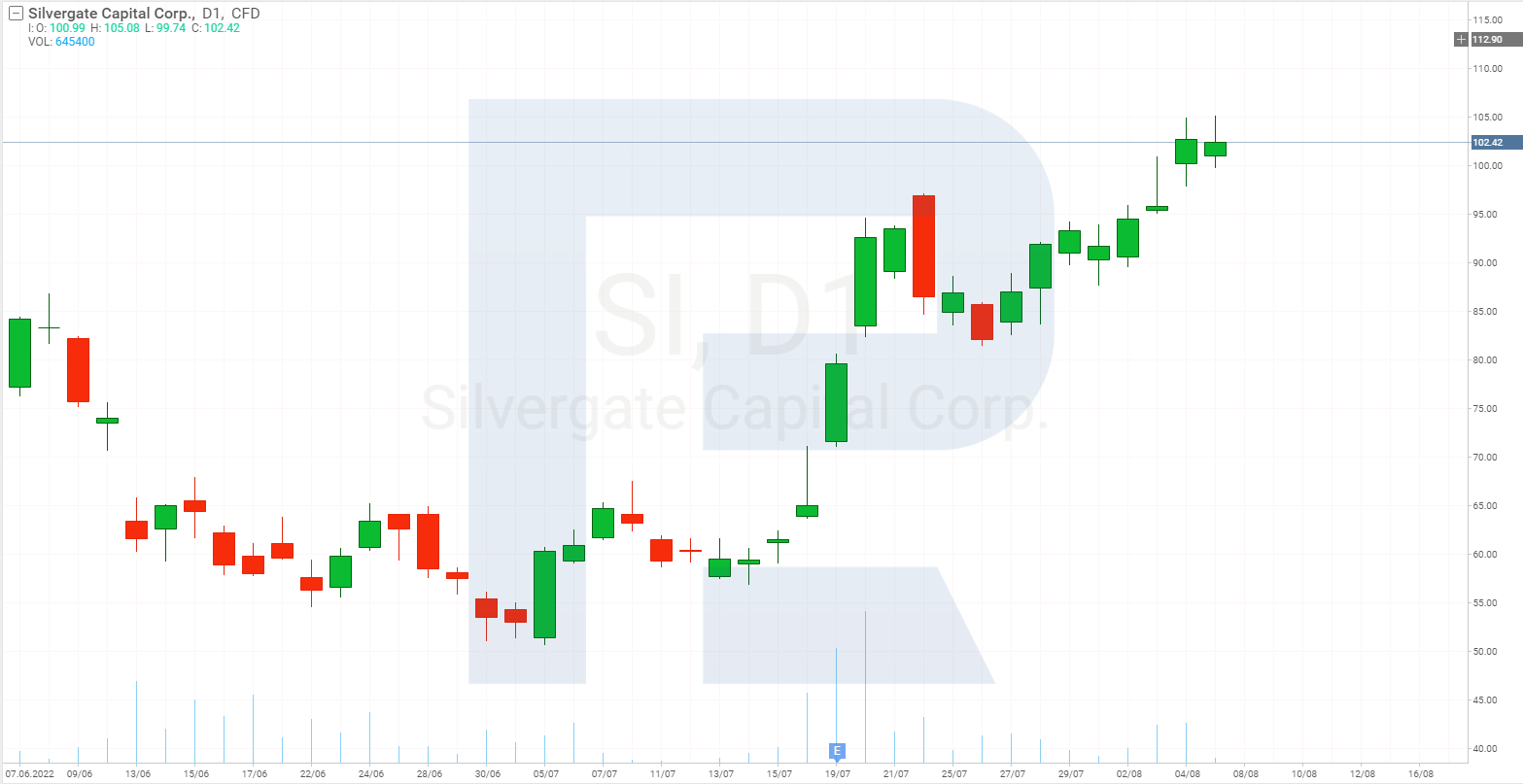

4. Silvergate Capital – 74.3%

Founded in: 1998

Country of registration: US

Head office: La Jolla, California

Sphere: financial services

Platform: NYSE

Market capitalisation: $3.8 billion

Silvergate Capital Corporation provides innovative technologies and financial solutions and services in the sphere of digital currencies. It owns a commercial bank, Silvergate Bank.

Over the last month, the share price of Silvergate Capital Corporation (NYSE:SI) recorded a 74.3% growth from $53.53 to $93.29. The movements of the stock quotes were probably impacted by the financial report for Q2 2022.

The company reported an 84.7% growth in the net profit to $38.6 million, compared to the statistics of last year, and the EPS rose 41.3% to $1.13. Seeing the quarterly report, Wells Fargo analyst Jared Shaw lifted the target share price of Silvergate Capital Corporation from $100 to $115.

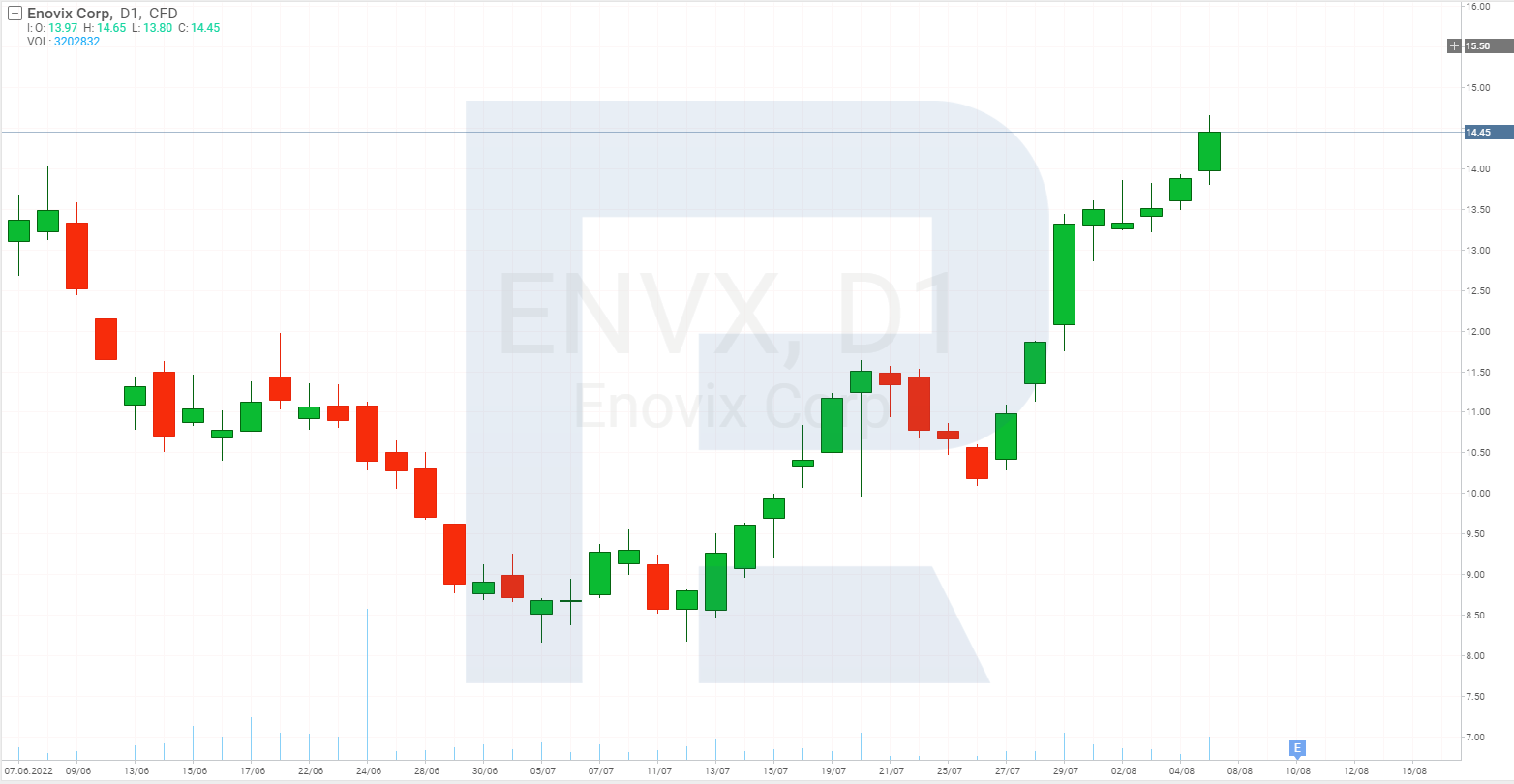

5. Enovix Corporation – 49.5%

Founded in: 2007

Country of registration: US

Head office: Fremont, California

Sphere: electric equipment

Platform: NASDAQ

Market capitalisation: $2.2 billion

Enovix Corporation designs, develops and sells new-generation Lithium-ion batteries. Over July, the growth of the share price of Enovix Corporation (NASDAQ:ENVX) amounted to 49.5%, from $8.91 to $13.32.

The main trigger for the growth was an agreement with EDOM Technology Co., Ltd, a large distributor of electronics from Taiwan. Cooperation with EDOM can speed up the growth of Enovix Corporation's business and expand the sales market.

The stocks with the most noticeable decline in July

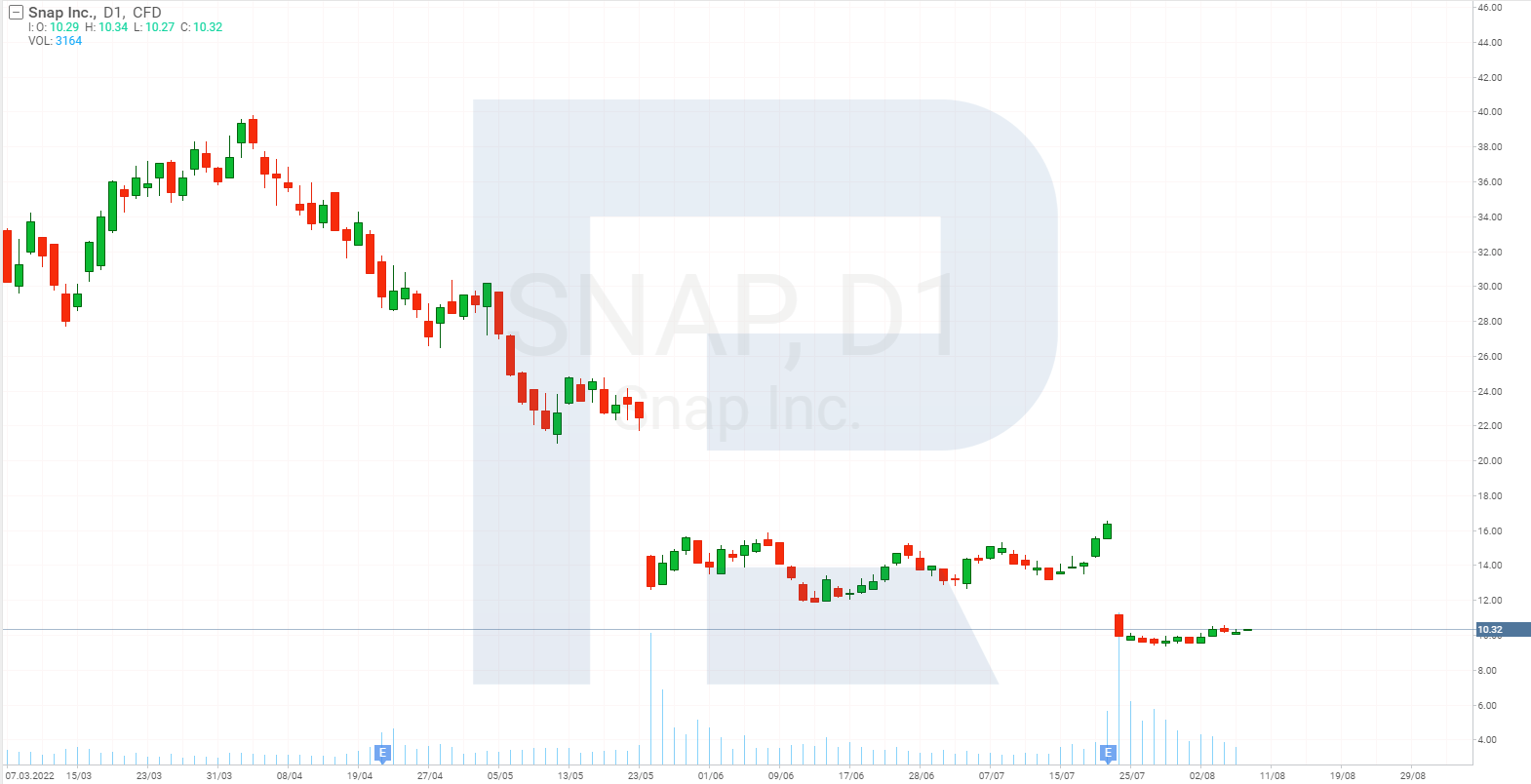

1. Snap – 24.8%

Founded in: 2010

Country of registration: US

Head office: Santa Monica, California

Sphere: Internet content and information

Platform: NYSE

Market capitalisation: $16.9 billion

The shares of Snap Inc. (NYSE:SNAP), which owns the popular messenger Snapchat, demonstrated a serious decline in July – falling 24.8% from $13.13 to $9.88. According to analysts, the main reason for the decline was the weak report for Q2 2022.

On 21 July, Snap Inc. announced that the earnings over April-July this year, compared to the statistics of the same months last year, grew 13% to $1.1 billion. As you remember, in Q1 they recorded a 38% growth. Net loss grew 178% to $422.1 million, and loss per share rose 118% to $0.02. Moreover, the management of Snap Inc. refused to make a forecast for Q3.

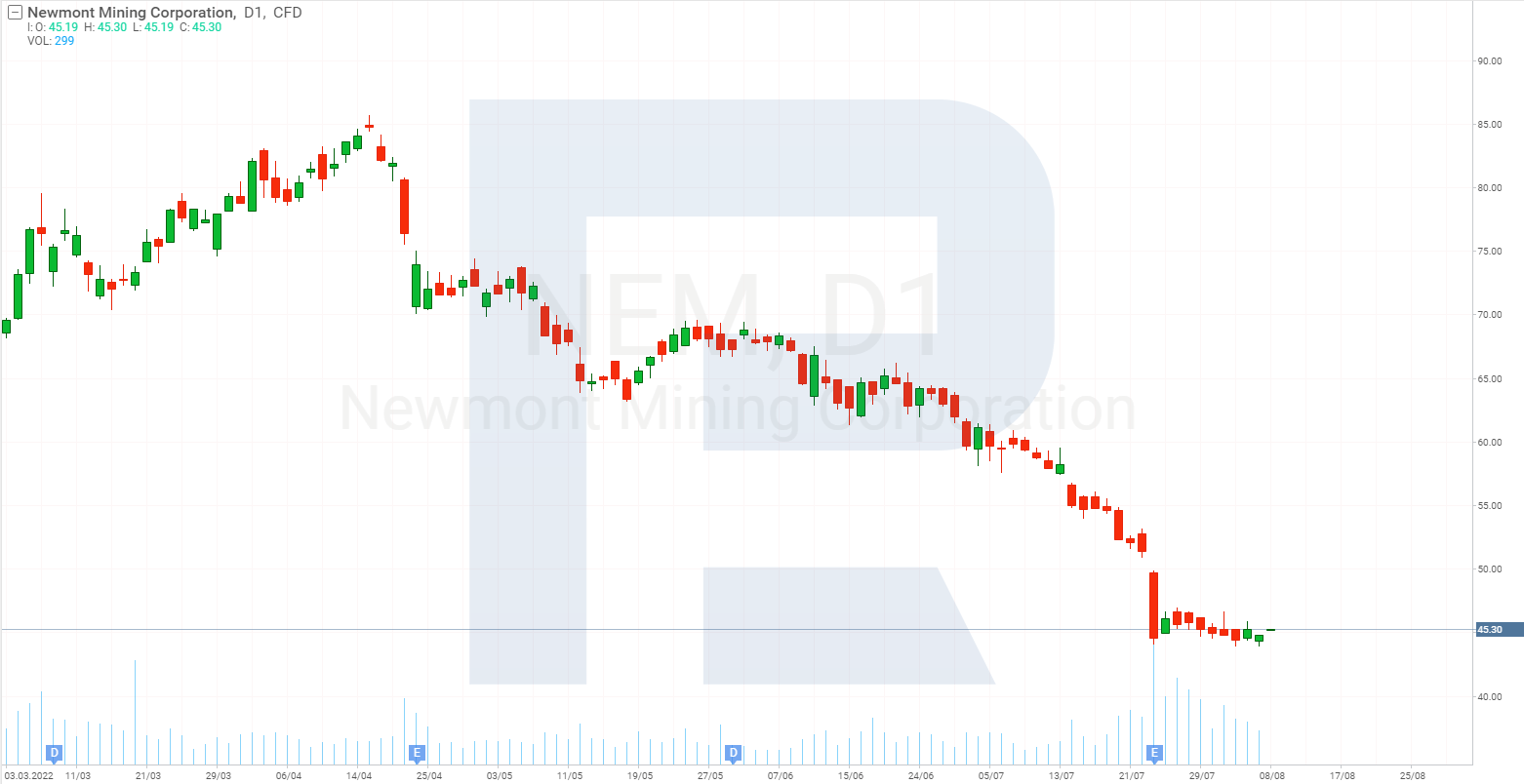

2. Newmont – 24.1%

Founded in: 1916

Country of registration: US

Head office: Denver, Colorado

Sphere: gold mining

Platform: NYSE

Market capitalisation: $35.9 billion

The share price of mining company Newmont Corporation (NYSE:NEM), which specialises in gold exploration and mining, dropped 24.1% from $59.67 to $45.28 in July. And again, the decline was caused by the poor quarterly report.

Earnings in Q2 dropped 0.2% to $3.6 billion, net profit declined 40% to $387 million, and EPS dropped 39.5% to $0.49. Wall Street experts had forecast earnings of $3.04 billion and EPS of $0.63.

With the price of gold in the market falling, and mining becoming costlier, the statistics presented by Newmont Corporation made a negative impression on investors.

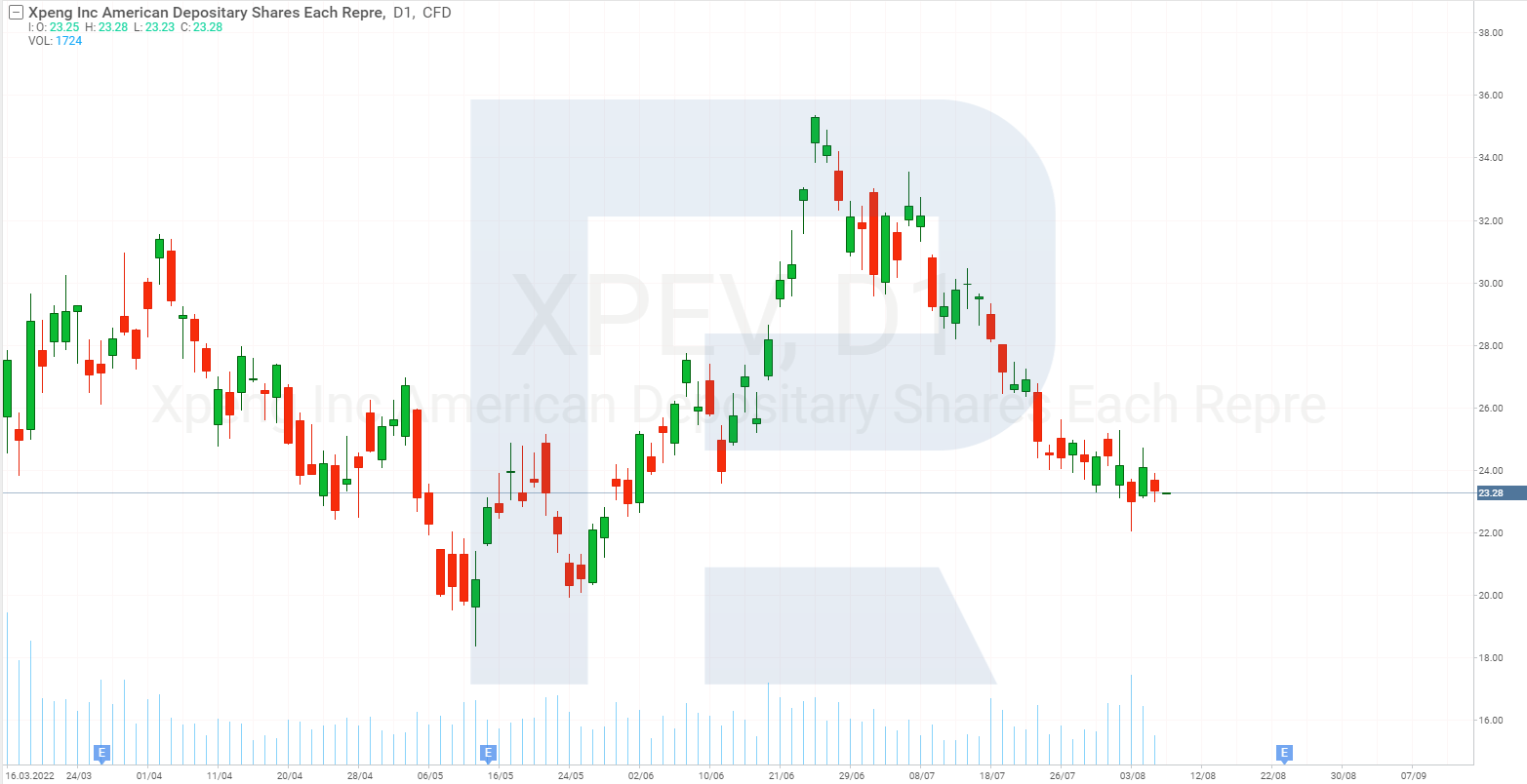

3. XPeng – 23%

Founded in: 2015

Registered in: China

Head office: Guangzhou

Sphere: car industry

Platform: NYSE

Market capitalisation: $55.8 billion

XPeng Inc. designs, develops, produces and sells electric cars. July was not the best month for the company: its quotes dropped 23% from $31.74 to $24.43.

The shares of Xpeng Inc. (NYSE:XPEV), alongside the shares of other car makers from China, headed down due to new limitations imposed in the country during the coronavirus pandemic.

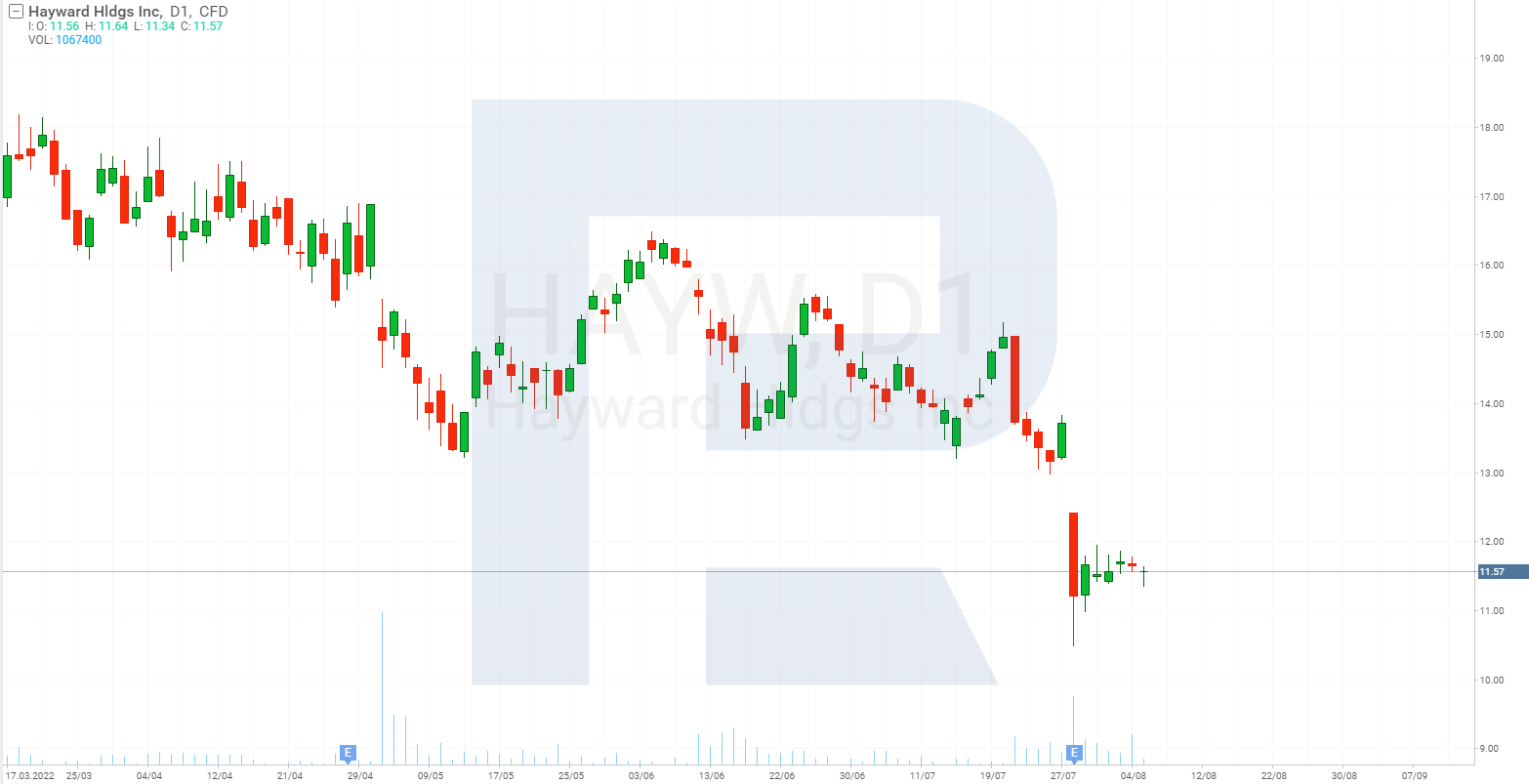

4. Hayward Holdings – 18.9%

Founded in: 1925

Country of registration: US

Head office: Charlotte, North Carolina

Sphere: electric equipment

Platform: NYSE

Market capitalisation: $2.5 billion

Hayward Holdings Inc. designs, produces and sells electric equipment for the cleaning, heating, lighting and functioning of swimming pools. Its products are sold in the US, European, and Asian markets.

The published report for Q2 2022 did not live up to analysts' expectations and made the quotes of the company fall: at the end of the month, the share price of Hayward Holdings Inc. (NYSE:HAYW) dropped 18.9% from $14.39 to $11.67.

Earnings in April-June grew 9.6% to $399.4 million, net profit rose 25.5% to $66.3 million, and EPS surged 31.8% to $0.29. Compared to the forecasts of experts, earnings were 7% inferior while EPS was 17% inferior.

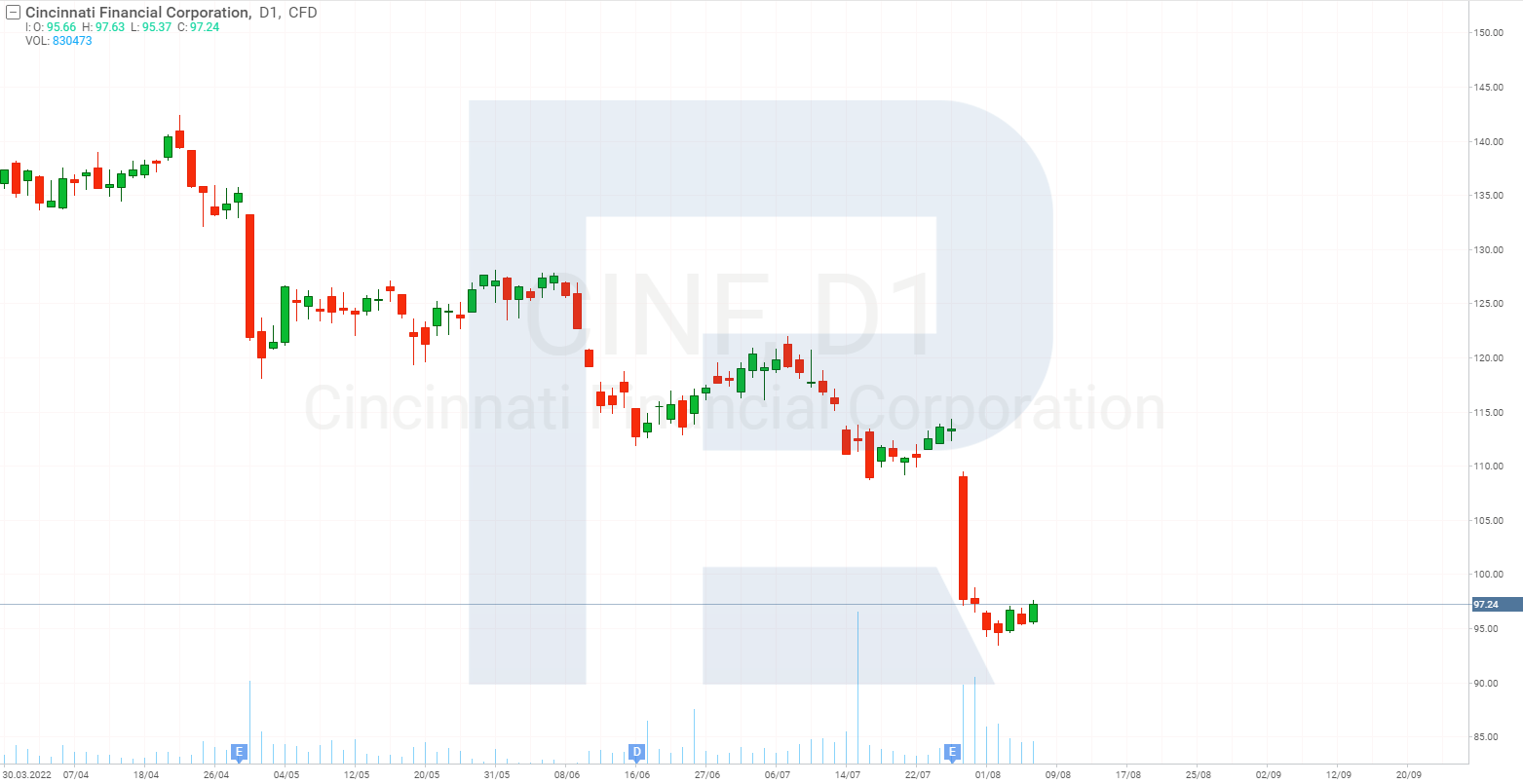

5. Cincinnati Financial – 18.2%

Founded in: 1950

Country of registration: US

Head office: Fairfield, Ohio

Sphere: insurance

Platform: NASDAQ

Market capitalisation: $15.2 billion

Cincinnati Financial Corporation specialises in the insurance of private and commercial property, investments, and life. In July, the decline of the share price of Cincinnati Financial Corporation (NASDAQ:CINF) reached 18.2%; it dropped from $118.98 to $97.34.

The reason for the decline is the financial result of Q2 2022: in April-June, the company paid more insurance than the amount received in bonuses. Earnings of Cincinnati Financial Corporation dropped 64% to $820 million, while the net loss grew 214.9% to $808 million, and loss per share rose 217.4% to $5.06.

Which stocks demonstrated the most noticeable dynamics in July?

The leaders of share price growth in July were AMTD Digital Inc., Pagaya Technologies Ltd., Getty Images Holdings Inc., Silvergate Capital Corporation, and Enovix Corporation.

On the other hand, the leaders of the decline were Snap Inc., Newmont Corporation, XPeng Inc., Hayward Holdings Inc., and Cincinnati Financial Corporation.

While leaders of growth had individual reasons for such behaviour of the stock prices, the decline of the shares in the July anti-rating was mostly attributed to the poor quarterly reports.

* – Past performance is not a reliable indicator of future results or future performance.

This material and the information contained therein are for informational purposes only and should in no way be construed as providing investment advice for the purposes of the Investment Companies Act 87 (I) 2017 of the Republic of Cyprus, or any other form of personal advice or recommendation relating to certain types of transactions in certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high