Healthcare Sector: Top 5 Stocks

5 minutes for reading

Over the last three months, the most noticeable stock growth in the healthcare sector was demonstrated by Immunovant Inc., Prothena Corporation plc, Roivant Sciences Ltd., Horizon Therapeutics plc, and Vaxcyte Inc.

Selection criteria

- Sector: healthcare

- Companies are not funds

- Stocks are trading in the NYSE or NASDAQ

- Stock price is more than $2

- Capitalisation is more than $2 billion

- Average trading statistics of the last 30 days is more than 500,000 stocks

Growth was expressed in percent, as the difference between the opening price on 15 September and the closing price on 15 December 2022. The market capitalisation of each company was valid when the article was written.

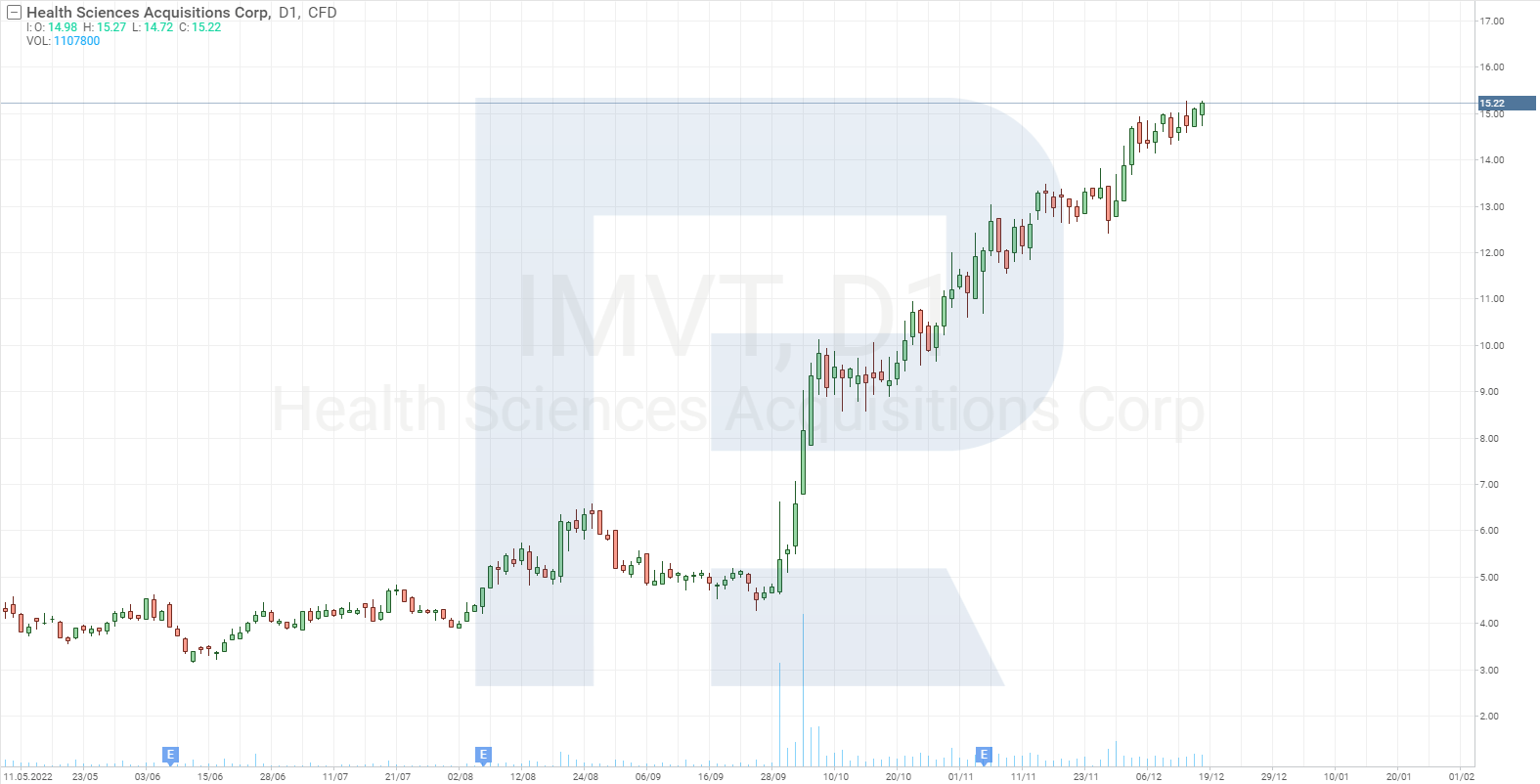

1. Immunovant – 201.8%

Founded in: 2018

Registered in: the US

Head office: New York, New York

Platform: NASDAQ

Market capitalisation: $2 billion

Immunovant Inc. is a biopharma company that designs innovative drugs for autoimmune diseases. Its main product is batoclimab.

Over three months, the share price of Immunovant Inc. (NASDAQ:IMVT) skyrocketed 201.8%, from $5.04 to $15.21. The company made progress in researching batoclimab, which is meant to help patients with thyroid diseases, myasthenia gravis, chronic inflammatory demyelinating polyneuropathy, Graves' disease, and autoimmune hemolytic anemia.

Moreover, at the beginning of October, Immunovant Inc. announced the public placement of 12.5 million stocks, which accounts for 10.7% of the already issued shares.

Deep Track Capital, Logos Capital, TCGX, Frazier Life Sciences, BVF Partners LP, and Commodore Capital immediately expressed their desire to buy all the newly placed stocks. The gross proceeds of the operation amounted to $75 million. The money was used for further research of batoclimab.

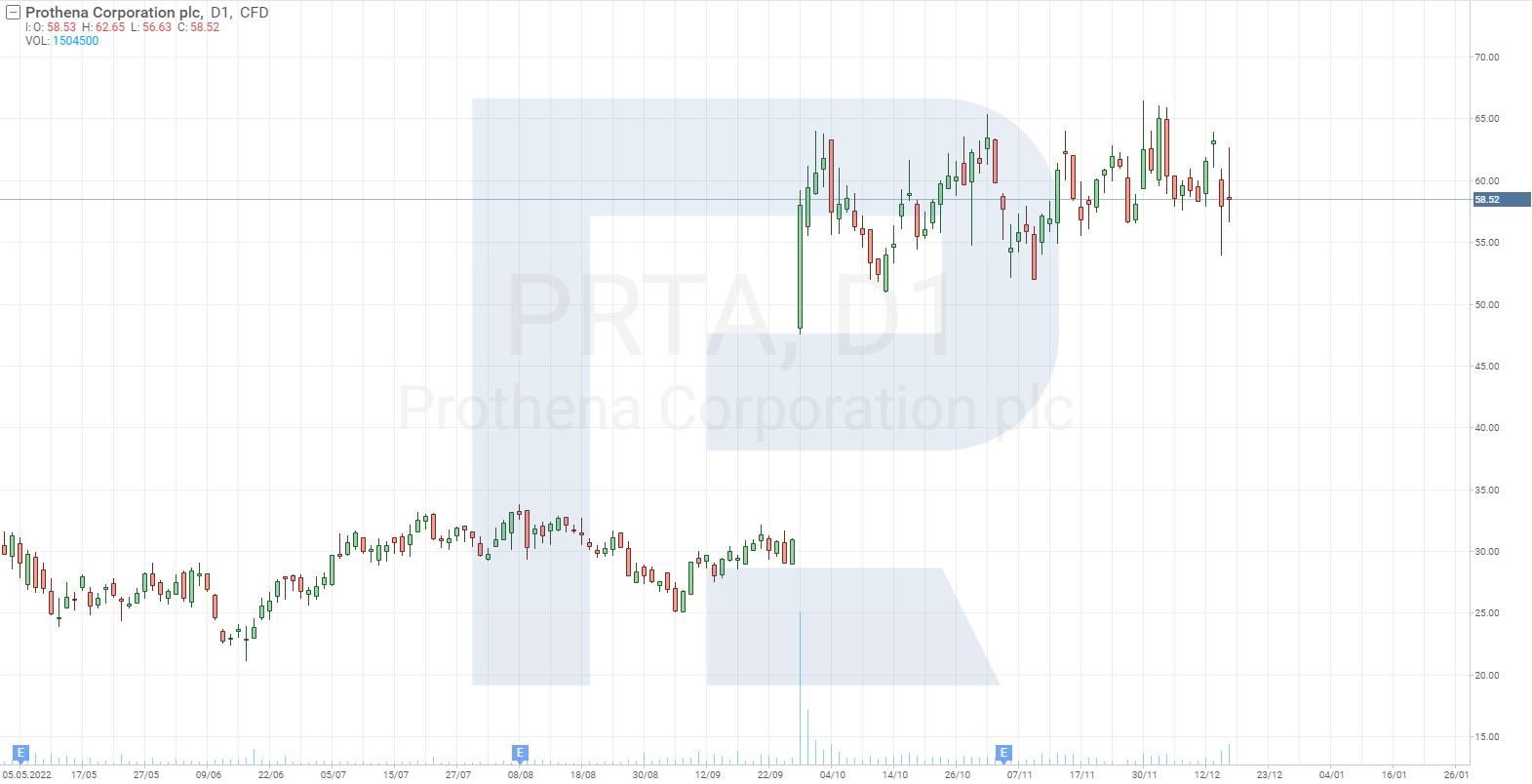

2. Prothena Corporation – 100.1%

Founded in: 2012

Registered in: Ireland

Head office: Dublin, Ireland

Platform: NASDAQ

Market capitalisation: $2.9 billion

Prothena Corporation plc specialises in late-stage clinical tests and experimental methods of curing rare neurodegenerative diseases.

Since 15 September, the stocks of Prothena Corporation plc (NASDAQ:PRTA) recorded 100.1% growth, from $29.25 to $58.52. This growth was mainly fuelled by the positive testing results of the new drug against Alzheimer’s disease, lecanemab, which was developed by two other representatives of the pharma sector: Biogen Inc. and Eisai Co. Ltd.

On 28 September, following the good news about the successful tests of lecanemab, the shares of Prothena Corporation plc which works on a similar drug surged 87.52% to $58.

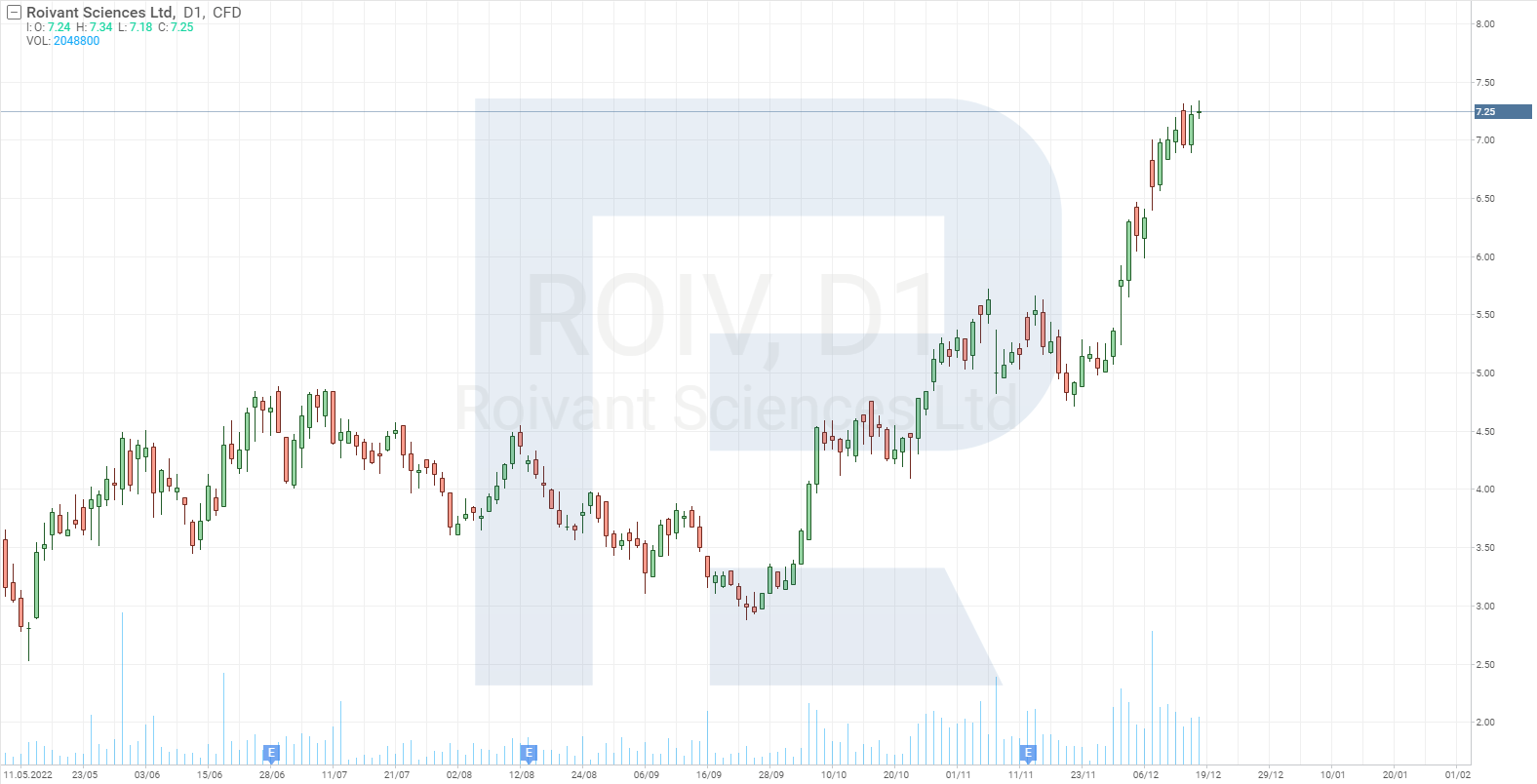

3. Roivant Sciences – 97.3%

Founded in: 2014

Registered in: the UK

Head office: London, UK

Platform: NASDAQ

Market capitalisation: $5.2 billion

Roivant Sciences Ltd is a biotech company that creates drugs against immune system diseases, cancer, hematologic, dermatologic, and other diseases.

From mid-September to mid-December, the shares of Roivant Sciences Ltd (NASDAQ:ROIV) recorded a 97.3% growth from $3.67 to $7.24. At the beginning of the month, it was heard that Roivant Sciences Ltd together with Pfizer Inc. was creating a new company specialising in treating fibrosis and inflammatory diseases.

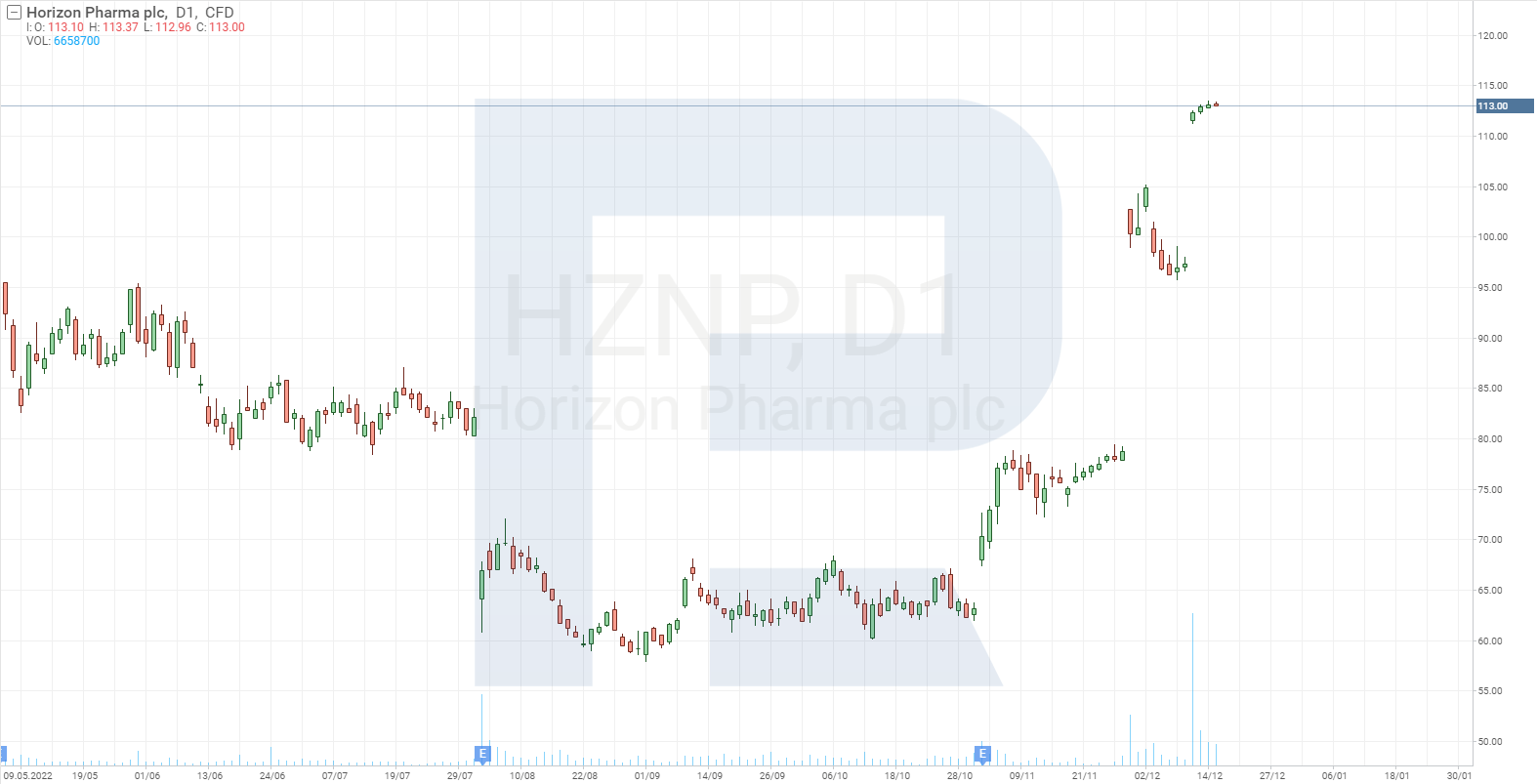

4. Horizon Therapeutics – 76.3%

Founded in: 2005

Registered in: Ireland

Head office: Dublin, Ireland

Platform: NASDAQ

Market capitalisation: $25.5 billion

Horizon Therapeutics plc is a biotech company specialising in drugs against rare, autoimmune, and grave inflammatory diseases.

Over three months, the stocks of Horizon Therapeutics plc (NASDAQ:HZNP) grew by 76.3%, from $64.11 to $113. At the end of November, the company announced that it was discussing mergers with Amgen Inc. (NASDAQ:AMGN), Johnson & Johnson (NASDAQ:JNJ), and Sanofi (NASDAQ:SNY).

In the middle of December, the information got confirmed that Amgen Inc. was planning to buy Horizon Therapeutics plc. The possible agreement amounts to $27.8 billion. The sale is subject to approval from the shareholders of Horizon Therapeutics plc and thereafter by the regulators of Ireland and other countries, including the US.

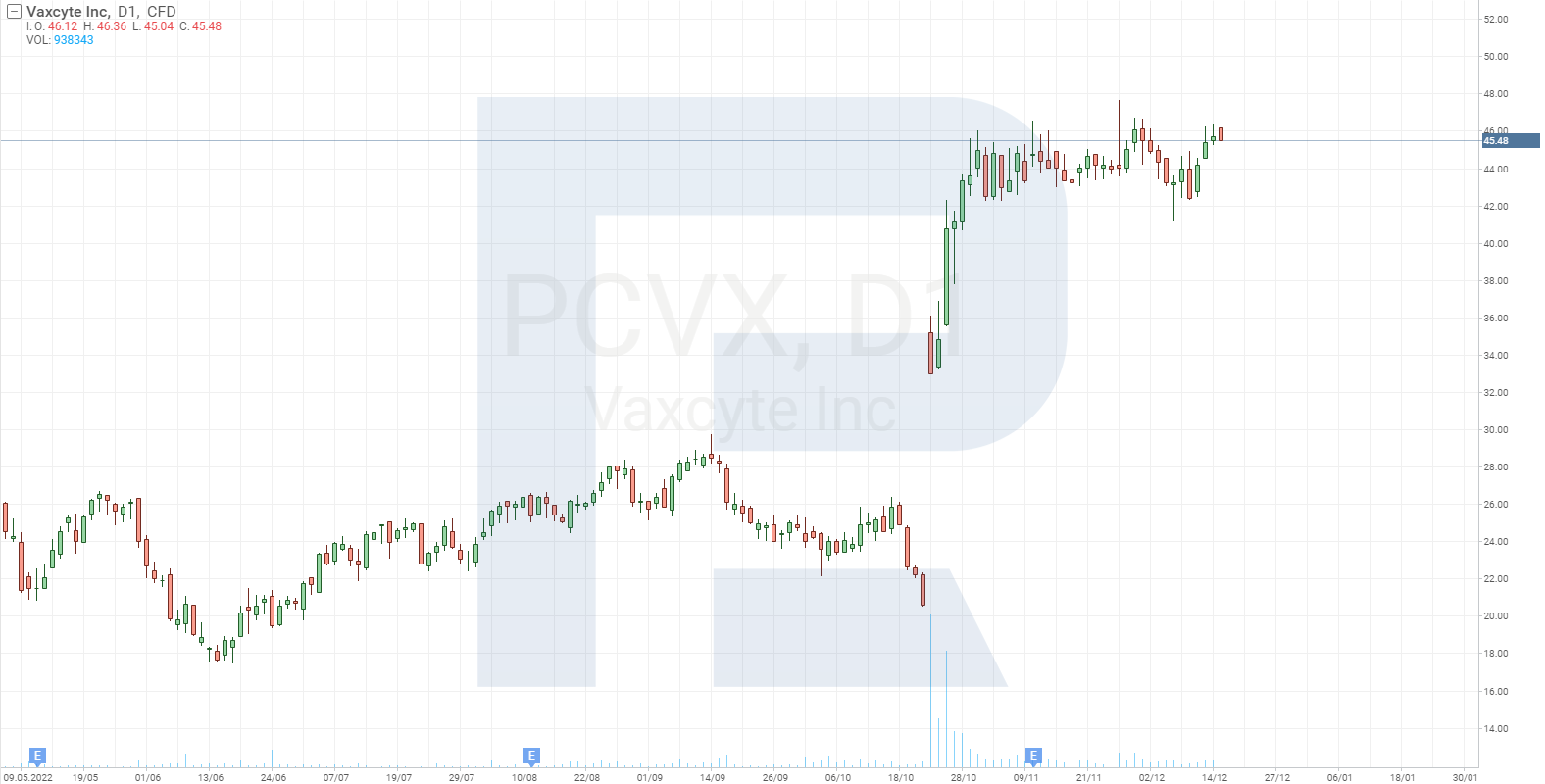

5. Vaxcyte – 60.9%

Founded in: 2003

Registered in: the US

Head office: San Francisco, California

Platform: NASDAQ

Market capitalisation: $3.7 billion

Vaxcyte Inc. is a biotech company that until May 2020 used to be called SutroVax Inc. It specialises in innovative vaccines against bacterial infections.

Over three months, the shares of Vaxcyte Inc. (NASDAQ:PCVX) saw 60.9% growth, from $28.26 to $45.48. At the end of October, the company reported positive test results of the VAX-24 vaccine against pneumonia.

What influenced stock price growth in the healthcare sector?

From mid -September to mid-December, the leaders of stock price growth were Immunovant Inc., Prothena Corporation plc, Roivant Sciences Ltd., Horizon Therapeutics plc, and Vaxcyte Inc.

The growth of these companies' stocks was fuelled mainly by the positive test results of new drugs, and their agreements on partnerships or mergers with other large companies.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high