IPO of bioAffinity Technologies: Cancer Diagnostics

4 minutes for reading

The scientific medical community has proved that any type of cancer can be treated more effectively in its early stages. In view of this, particular emphasis must be laid not only on complex therapy processes but also on rapid diagnostics.

In today's article, we'll take a closer look at the company that's engaged in the development of rapid diagnostic tests for lung cancer and other severe early-stage diseases. bioAffinity Technologies is planning to go public on the NASDAQ on 2 June under the "BIAF" ticker symbol.

What we know about bioAffinity Technologies

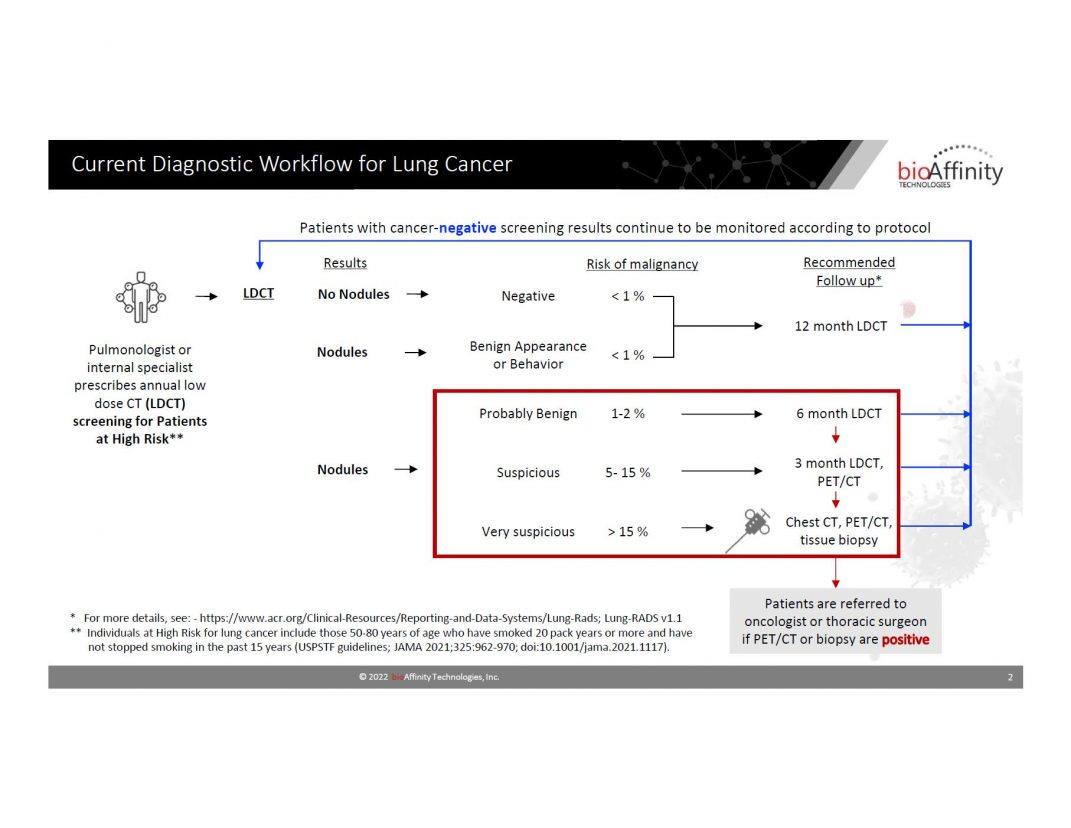

The issuer develops rapid diagnostic tests for severe early-stage diseases. The company is currently focused on the market approval of its diagnostic tests for lung cancer. bioAffinity Technologies is exploring various collaboration options to detect lung cancer in its early stages and develop and commercialise its treatment in safer and more effective ways.

The licensed Precision Pathology Services CyPath Lung test is intended for determining the presence of lung cancer cells in a patient's sputum. Through the agreement with GO2 Partners, the company has already produced 3,000 patient collection kits.

CyPath Lung is expected to significantly improve the overall accuracy of the diagnosis. It may help to reduce the number of fatalities, invasive procedures, and anxiety levels among oncology patients associated with these, while also making the treatment more affordable.

bioAffinity Technologies is planning to develop diagnostic tests for detecting also other types of cancer, such as prostate and bladder cancer.

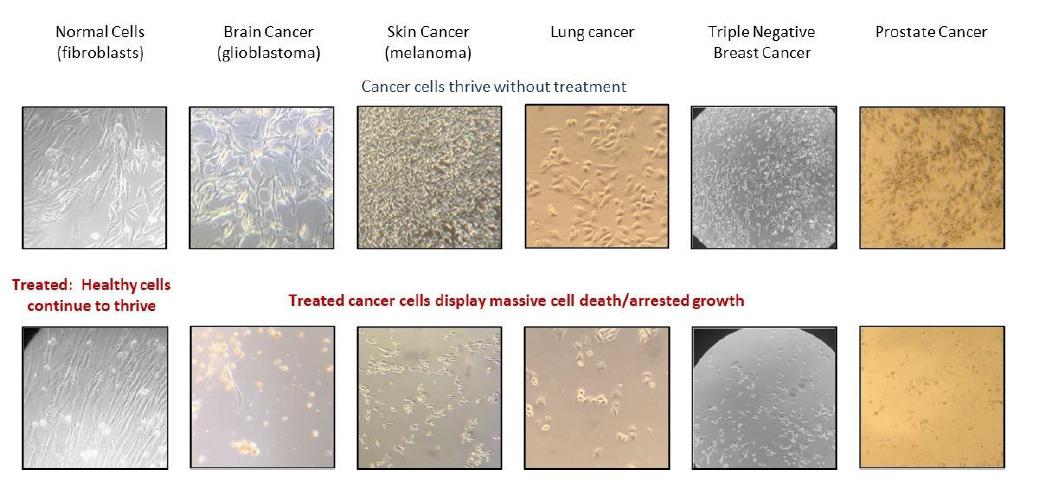

The company founded a subsidiary firm, OncoSelect Therapeutics, which will develop wide-platform technologies for creating special-purpose therapies for the treatment of cancer.

As of 31 December 2021, the amount of investment raised by bioAffinity Technologies was $17.3 million. The anchor investors were Harvey Sandler Revocable Trust and Nathan Perlmutter.

The prospects of bioAffinity Technologies’ target market

According to Fortune Business Insights, the global market for lung cancer screening was estimated at $2.6 billion in 2020. By 2028, it might reach $4.85 billion. Consequently, the CAGR (Compound Annual Growth Rate) could be 8.1%.

The key factor that drives the expected market growth is the increase in lung cancer cases due to the continued widespread consumption of tobacco products.

In addition, the Covid-19 pandemic slowed down the growth of the industry, with the number of people screened for lung cancer having decreased significantly due to the global lockdowns.

The company's key competitors are probably LungLife AI, SanMed Biotech, Biodesix, and Veracyte.

How bioAffinity Technologies performs financially

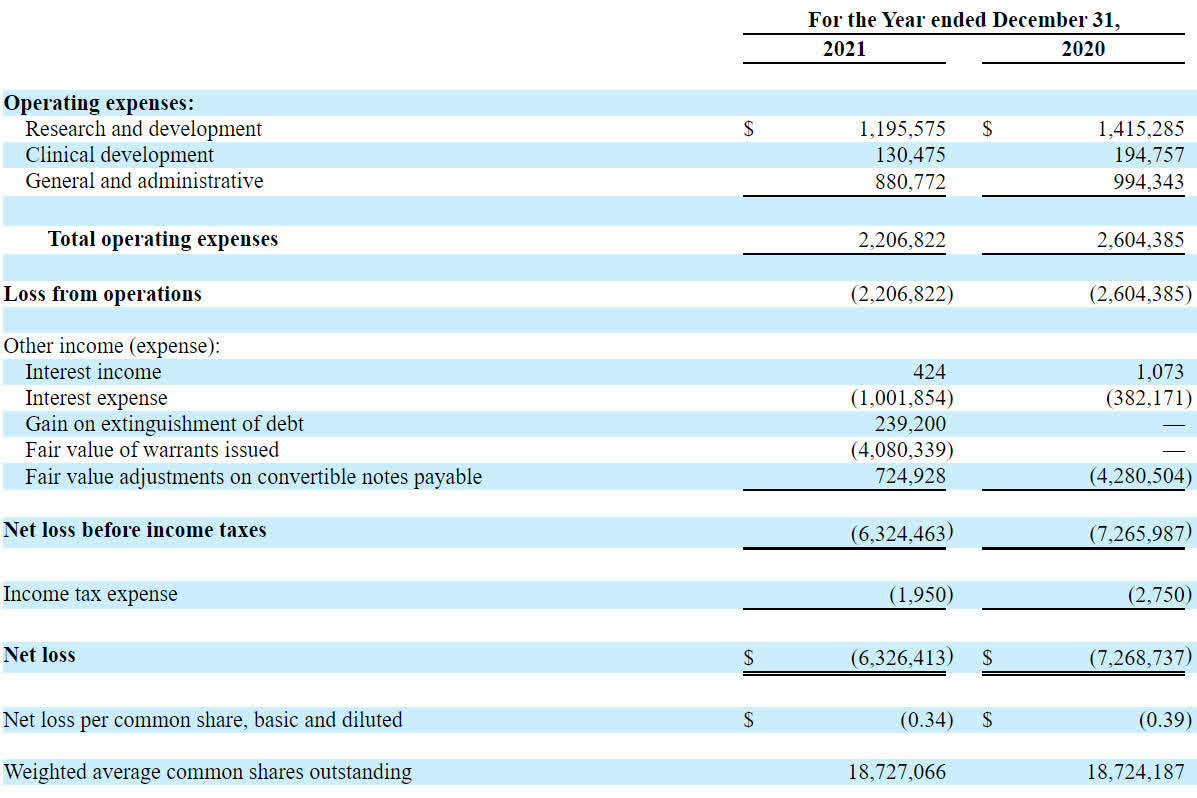

The financial data from the S-1 form shows that the company has no revenue, but has a lot of expenses spent on scientific research projects and design and development activities, as well as business development and expansion.

As of 31 March 2022, bioAffinity Technologies' total liabilities were $14 million, and the cash equivalents on its balance sheet were $1 million. The company's financial health is rather typical for pharmaceutical companies whose products are in the developmental/approval stage.

Strengths and weaknesses of bioAffinity Technologies

The company's strengths are:

- High target market growth rate

- High demand for rapid tests

- Possible business expansion outside the US

- Own production facilities

- Sound management

Among the investment risks, we would name:

- No revenue

- Incomplete product certification

- Most products are at the early development stage

What we know about the bioAffinity Technologies IPO

The underwriter of the IPO is WallachBeth Capital LLC. The issuer is planning to sell 1.5 million common shares at the price of $6.75 per share. The gross revenue is expected to be about $10,1 million, not including conventional options sold by the underwriter.

None of the existing or prospective investors has expressed interest in buying shares at this price.

The offer will include one warrant exercisable at 120% of the IPO price immediately upon receipt of the warrant. The warrants will trade under the "BIAFW" ticker symbol.

Assuming the IPO is successful at the proposed price range, the issuer's value at the IPO, excluding underwriter options, might be approximately $52 million.

The ratio between floating and outstanding shares (excluding underwriter options) will be about 16.6%. A reading under 10% is usually considered a low-float stock, which might be subject to significant price volatility.

Buying bioAffinity Technologies shares might be considered a classic venture investment, which is not suitable for all investors.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high