Fertiliser Prices Are Soaring, Reaching a Record High: Which Supplier Companies to Look Out For

6 minutes for reading

Since 2021, fertilisers have become 120% more expensive on average, with the price of potassium chloride, which is the most widespread potash fertiliser, having risen 175%. This is driven by several factors, including surging input costs, supply disruptions initially caused by the pandemic and also following the recent sanctions imposed on Belarus and Russia, and the export restrictions in China.

Russian and Belarusian manufacturers in the fertiliser market account for about 40% of the market share. Supplies from other countries are not able to rapidly compensate for such large volumes. Currently, active manufacturers around the world do not have enough power for producing and refining large quantities of crude materials.

Consequently, companies need to invest in increasing their production power and volume of crude materials. However, this entails developing new deposits, purchasing new equipment, and optimising logistics - which process might take years.

Nevertheless, where there's demand there's also supply. This article puts forward the companies that produce potash fertilisers. They're the ones that can benefit from the current shortage.

Canada - the world's largest supplier of fertilisers

Canada is the leader in the worldwide market of potash fertilisers. According to the information from the Ministry of Energy in the country, there are about 1.1 billion metric tons of potassium oxide in the Saskatchewan province.

Such amounts could satisfy the demand from all the farmers around the world for several hundreds of years. However, nowadays only a minor part of the deposit is being developed.

The Top 3 list of the largest companies working on Canadian deposits features Nutrien Ltd, Mosaic Company, and BHP Billiton Ltd. Let's take a closer look at each one of them below.

Nutrien Ltd - the world's leading producer of potash fertilisers

Nutrien Ltd (NYSE: NTR) was founded in 2018 as a result of a merger of Potash Corporation, which used to own huge fertiliser deposits, and Agrium Inc., which had a vast farmer-oriented retail chain.

Currently, Nutrien Ltd is the worldwide leader in the production of potash fertilisers, and the number three manufacturer of nitrogen fertilisers. It sells its products in 18 countries and employs more than 23,000 people.

In May, the management of Nutrien Lts declared that by the end of 2022 it planned to ramp up its production by one million tons to reach 15 million tons a year, and to be producing 18 million tons a year by 2025. Moreover, the company considers constructing the world's largest plant for the production of pure ammonia that's used in nitrogen fertilisers. Construction will last from 2024 to 2027. The plant will cost about two billion USD.

In its latest quarterly report, Nutrien increased its yearly EPS forecast from 10.2-11.8 USD to 16.2-18.7 USD. The management expects the demand for its products and prices to remain high.

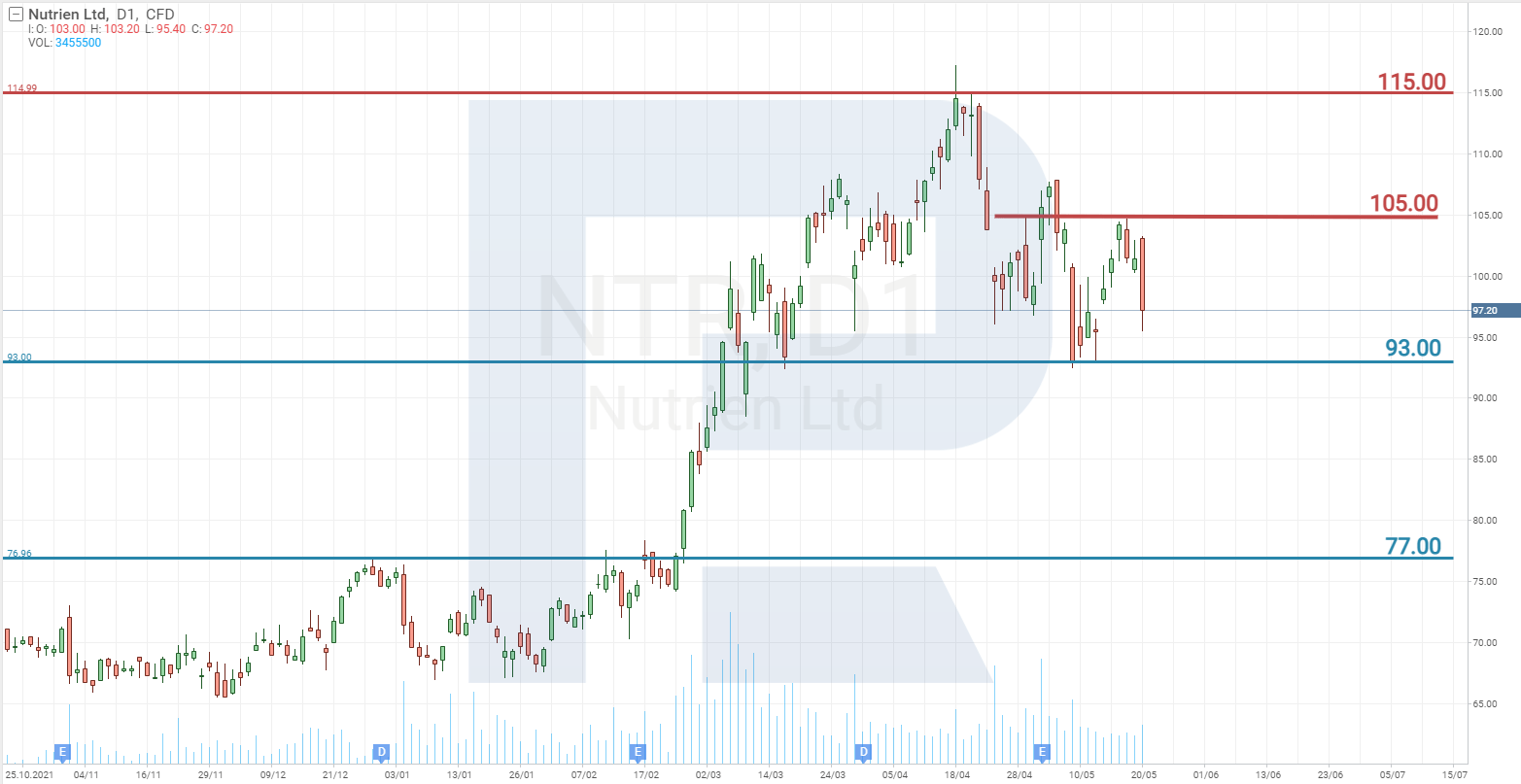

On 25 February, the shares of Nutrien Ltd renewed their all-time high, breaking the resistance level of 77 USD, and headed further upwards. By 18 April, the share price increased 52%, after which it corrected. For now, the shares cost almost 100 USD each. The nearest support level is 93 USD, the resistance level is 105 USD, and the high is 115 USD.

Mosaic Company - manufacturer of phosphate and potash fertilisers

The Mosaic Company (NYSE: MOS) from the US manufactures and sells phosphate and potash fertilisers. It was formed out of a merger of two companies: IMC Global and a Cargill subdivision. Today Mosaic owns six potassium deposits, five of which are on the Canadian territory.

In 2021, the company untimely closed two mines in Canada, which made its stock price fall 20%. However, Mosaic Company very quickly launched a new one within the country, which now enables the company, in the times of increased demand and high prices for fertilisers, to benefit from the situation.

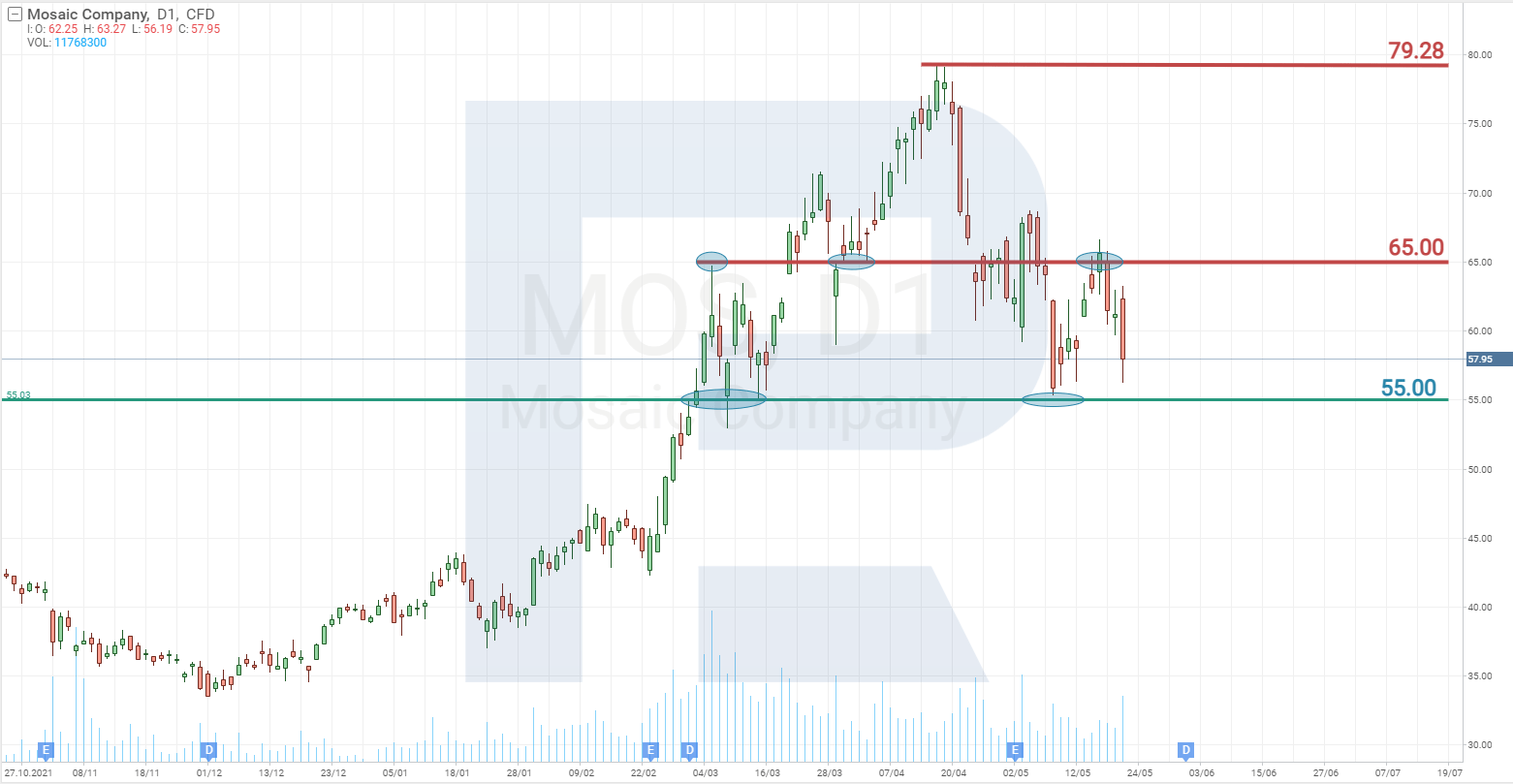

Currently, the shares of Mosaic are trading 90% above the 2021 level. The nearest support level is 55 USD, and the nearest resistance level is 65 USD. The all-time high was set on 18 April at 79.28 USD.

BHP Billiton - the largest mining company in the world

BHP Billiton Ltd (NYSE: BHP) makes 97% of its earnings by selling oil, gas, copper, iron ore, and coal. However, the corporation aims at entering the market of fertilisers, and is building a gigantic potash mine in Canada. This project will require about 5.7 billion USD.

BHP Billiton is bringing to life an ambitious plan of transitioning from the supply of fossil fuel to growing potash mining. The company sells its oil and gas assets to Australian Petroleum Ltd.

The shares of BHP Billiton can be regarded as a long-term investment because the company is focusing on potash mining as its core business, considering the rising demand.

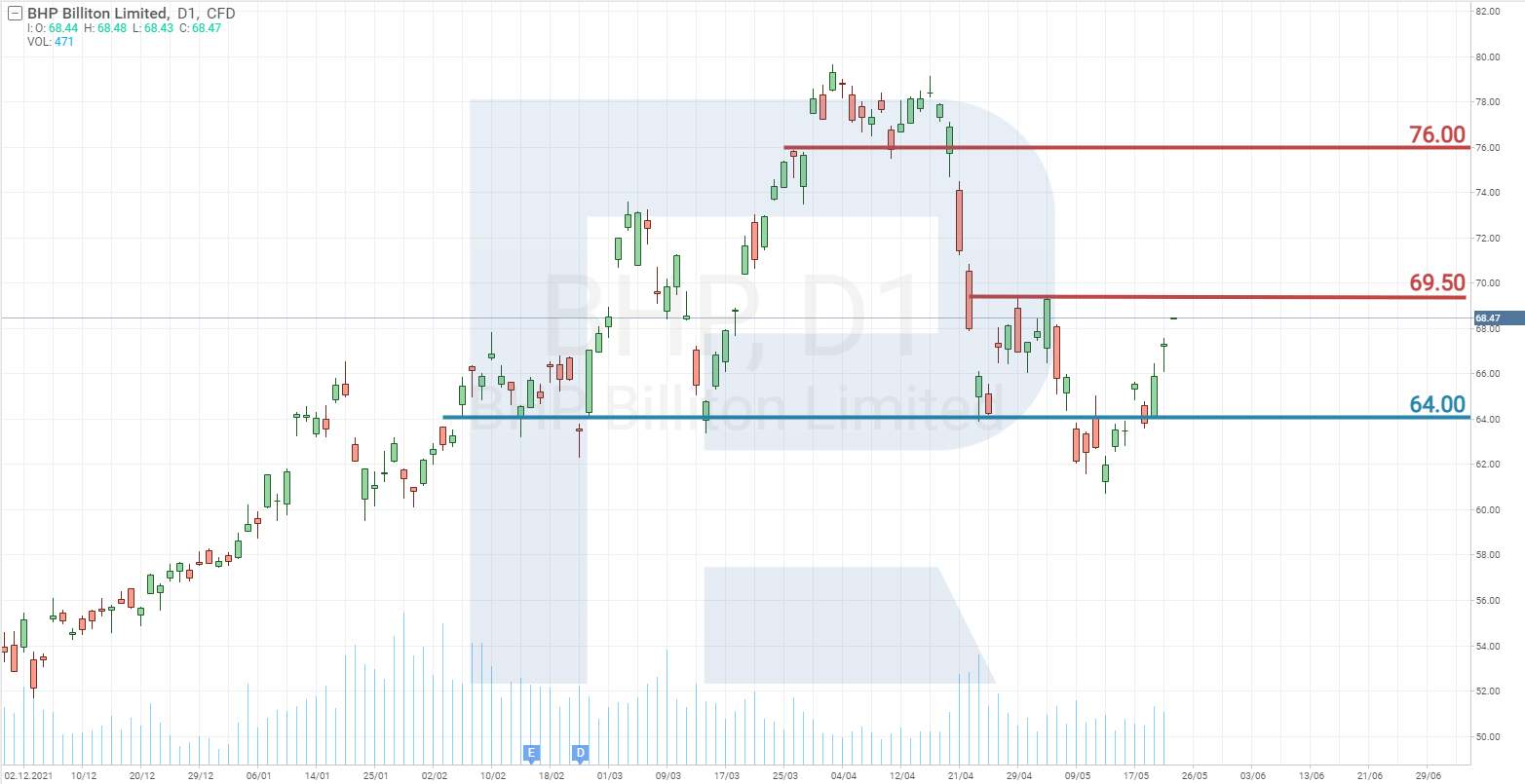

The shares of BHP Billiton have corrected from an all-time high of 15% and are now trading at 68 USD. The nearest support level is 64 USD and the nearest resistance level is 69.5 USD. An all-time high is set at 79.66 USD.

Risks of investing in this market

A large Belarus company, Belaruskaliy, that has had sanctions imposed on it, sells potash mineral fertilisers for 60% less than Russian and Canadian companies.

By offering potash fertilisers at a cheaper price, this supplier attempts to bring down the price for this product, thereby saving its part of the market. If the price for the products falls, this will have a negative impact on the earnings of companies that mine crude materials in Canada, and will result in slowing down investments in the sector.

Another risk is associated with lifting the sanctions from Russia and Belarus when the military action in Ukraine comes to an end. Consequently, the supply in the fertiliser market will increase, sending prices down.

Moreover, supplier companies that were under sanctions will most likely start dumping the market to offload their stocked products and gain back their lost market share.

Closing thoughts

Since 1900, the population on Earth has increased from 1.5 billion to 7.9 billion. According to the UN, the number might increase to 9.7 billion by 2050. The more people, the higher the demand for food, hence, cultivated areas and demand for agricultural fertilisers will be growing stably and actively.

The developmental prospects of the market are confirmed by the fact that the world's largest mining company, BHP Billiton, has given this market sector great consideration and plans to mine potash for making fertilisers.

* - Past performance does not reflect future returns

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high