Which Sector in the US May Turn Out Recession-Proof?

6 minutes for reading

Bloomberg economists have forecast a recession in the US economy in the upcoming 12 months. By their model, the probability of this event is 100%. While this is bad news for market participants, it provides a good reason for the Federal Reserve System to soften the credit and monetary policy, which may support stock indices.

To our mind, one sector that may turn out resilient to the economic downturn is the electric energy supply. Let's get acquainted with the leaders of the sphere.

What signals recession?

A recession is an economic drawdown after growth, characterised by high levels of inflation and unemployment. Hence, the key parameters for understanding the situation are industrial production volumes, unemployment, and inflation rates.

Let's see how they are bound to each other. A decline in production volumes entails a decrease in the number of workplaces, resulting in a rise in unemployment. The number of produced goods falls, which generates shortages leading to rising prices, and this gets reflected in the growing inflation.

What these indices are like these days

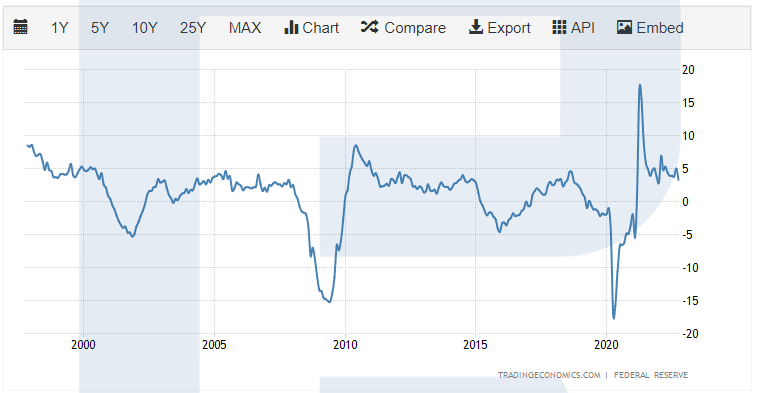

The levels of inflation and industrial production signal the onset of a recession in the US. In the chart below, we see that production volumes have dropped noticeably all over the country.

However, if we look at history, we will realise that nothing critical has happened yet: the index has just returned to average. The key is for these dynamics to stop timely.

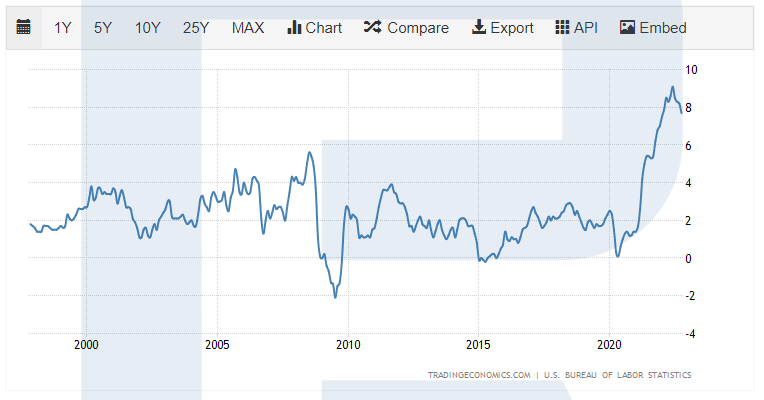

As for the US inflation, its level has indeed exceeded those of the previous years. However, note that the index has been falling since July 2022, and this was not due to a decline in industrial production but to logistics issues during the COVID-19 pandemic.

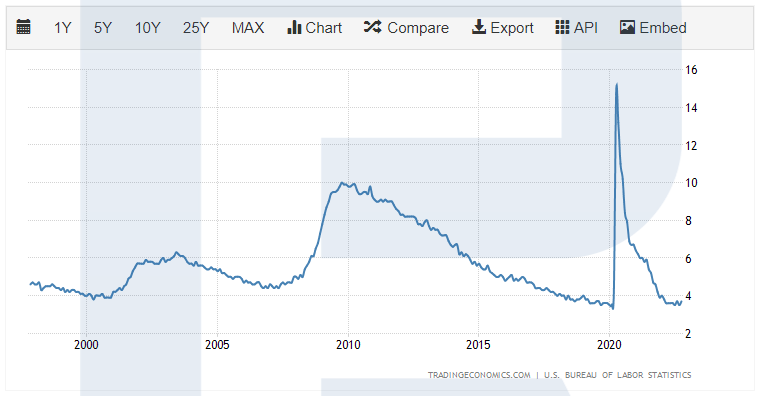

The third index we are interested in is the unemployment rate, and currently, it is at its low. All in all, the three parameters show us that the US is not in a recession yet.

Which companies supply electricity to consumers?

The leaders of the electricity sector in terms of capitalisation are NextEra Energy Inc. (NYSE: NEE), Duke Energy Corporation (NYSE: DUK), and Southern Company (NYSE: SO). Their capitalisation is 167 billion USD, 74 billion USD, and 71 billion USD, respectively.

NextEra Energy

NextEra Energy Inc. is an American company that uses its subsidiaries to produce and sell electric energy to individual and wholesale customers in the US. Energy is produced by wind, solar, nuclear, coal, and gas plants. In 2021, the company was serving 11 million clients.

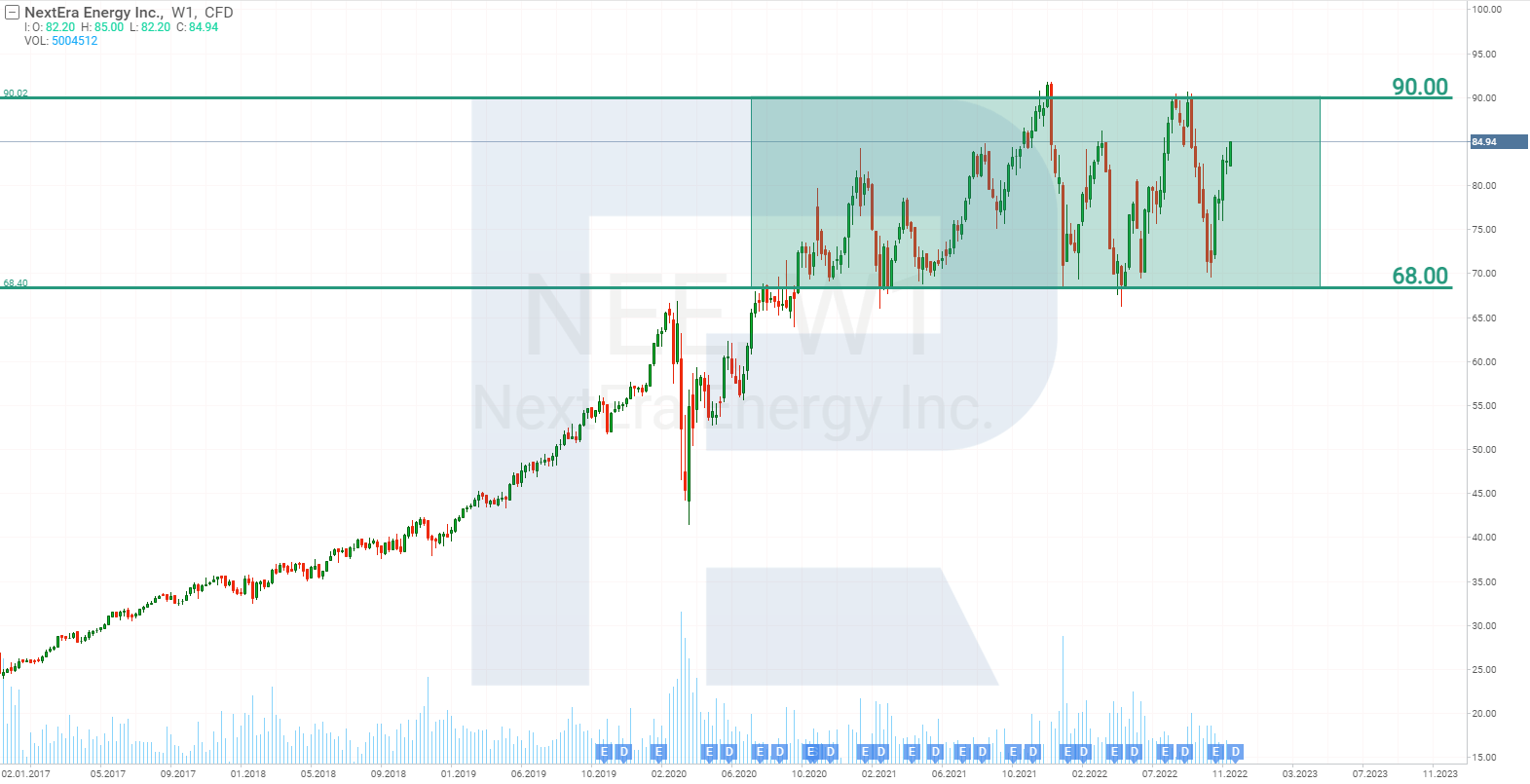

With the constantly increasing demand for renewable energy sources, NextEra Energy is actively investing in the sector. For example, on 18 November 2022, the company’s portfolio encompassing stocks from the solar and wind energy sectors increased by 805 million USD. The profit of NextEra Energy Inc. has been exceeding the expectations of Wall Street analysts in every quarterly report since 2021. When the article was being prepared, the shares were trading in a range between 68 and 90 USD.

Duke Energy

Duke Energy Corporation has its income more diversified than NextEra Energy Inc. The company works in the US market in three segments: electricity, gas, and renewable energy sources.

Duke Energy clients are physical people and legal entities, and their total number reaches 8.2 million. Apart from selling energy resources, the company owns the infrastructure for delivering these to consumers.

Unlike NextEra Energy which carried out a stock split in 2020, Duke Energy Corporation has never increased the number of its stock in turnover. The result is quite high EPS, and dividends of 4.1% a year, while NextEra Energy Inc. only pays 2% in dividends.

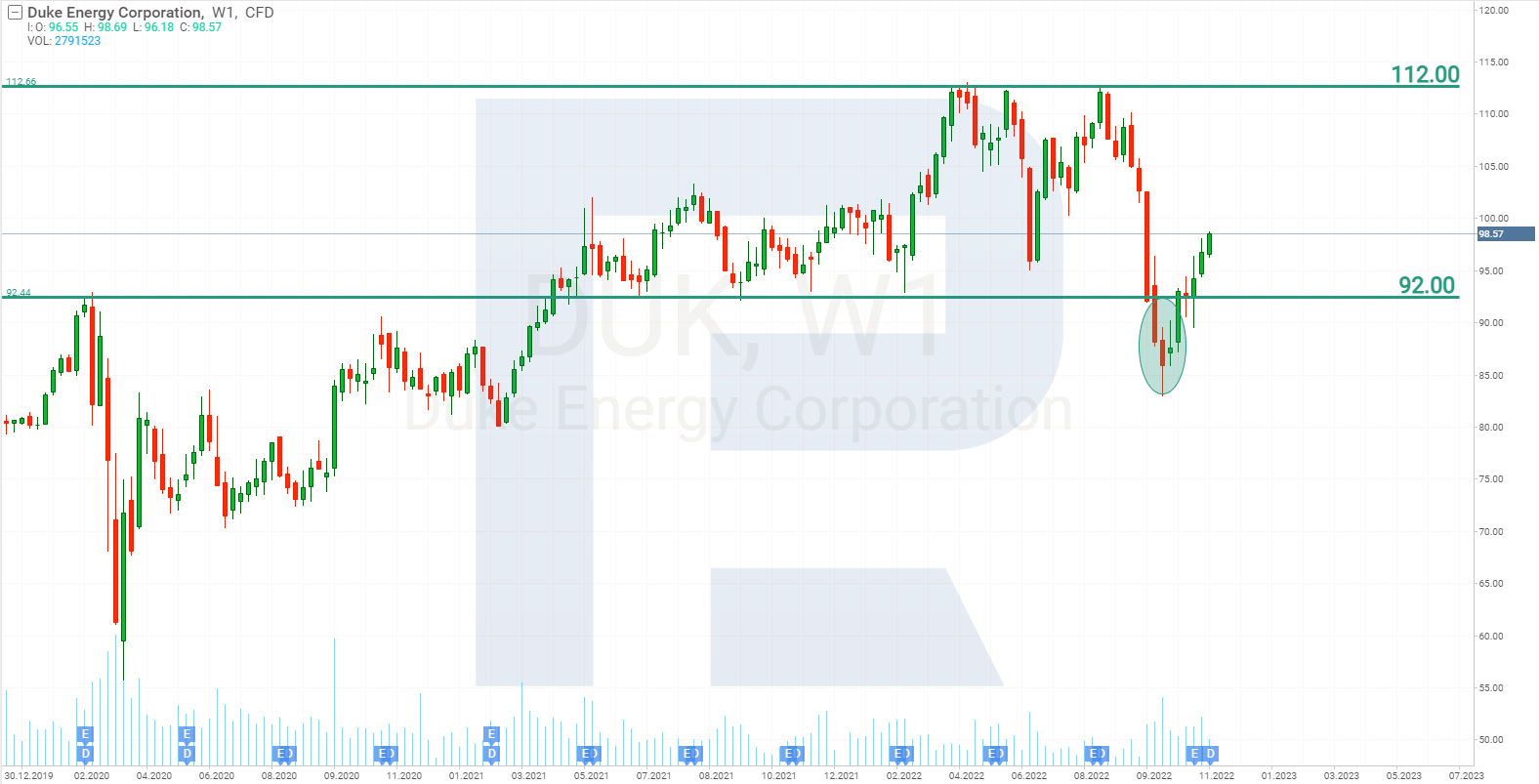

Over the last month, Duke Energy Corporation shares recorded a 15% growth, breaking through the resistance level of 92 USD. The shares need to see a further growth of 15% to reach an all-time high.

Southern Company

Southern Company produces, transports, and sells electric energy. Moreover, it manages a network of gas storage facilities and pipelines for transporting gas. The number of Southern Company clients has reached 8.7 million.

Moreover, the company provides services for wireless communications and fibre optic networks. This means a higher diversification of business than the above issuers.

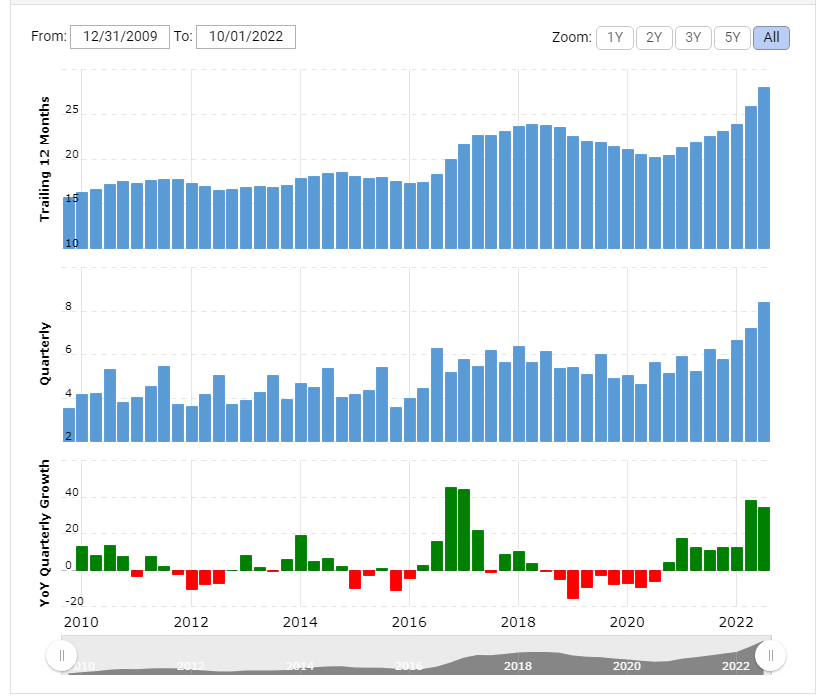

Southern Company is swiftly developing in the sector of renewable energy sources. It is the owner of 45 solar and 15 wind plants. In 2022, its annual income exceeded the high, reaching 27.9 billion USD.

We may suppose that a decline in industrial production might have a negative effect on the issuer because the demand for energy carriers from plants is likely to drop significantly. But the company managed to live through a decline in industrial production already in 2015 when production was negative; and concluding from the diagram below, the situation caused no serious effect on the earnings of the company, as they dropped by just 6%.

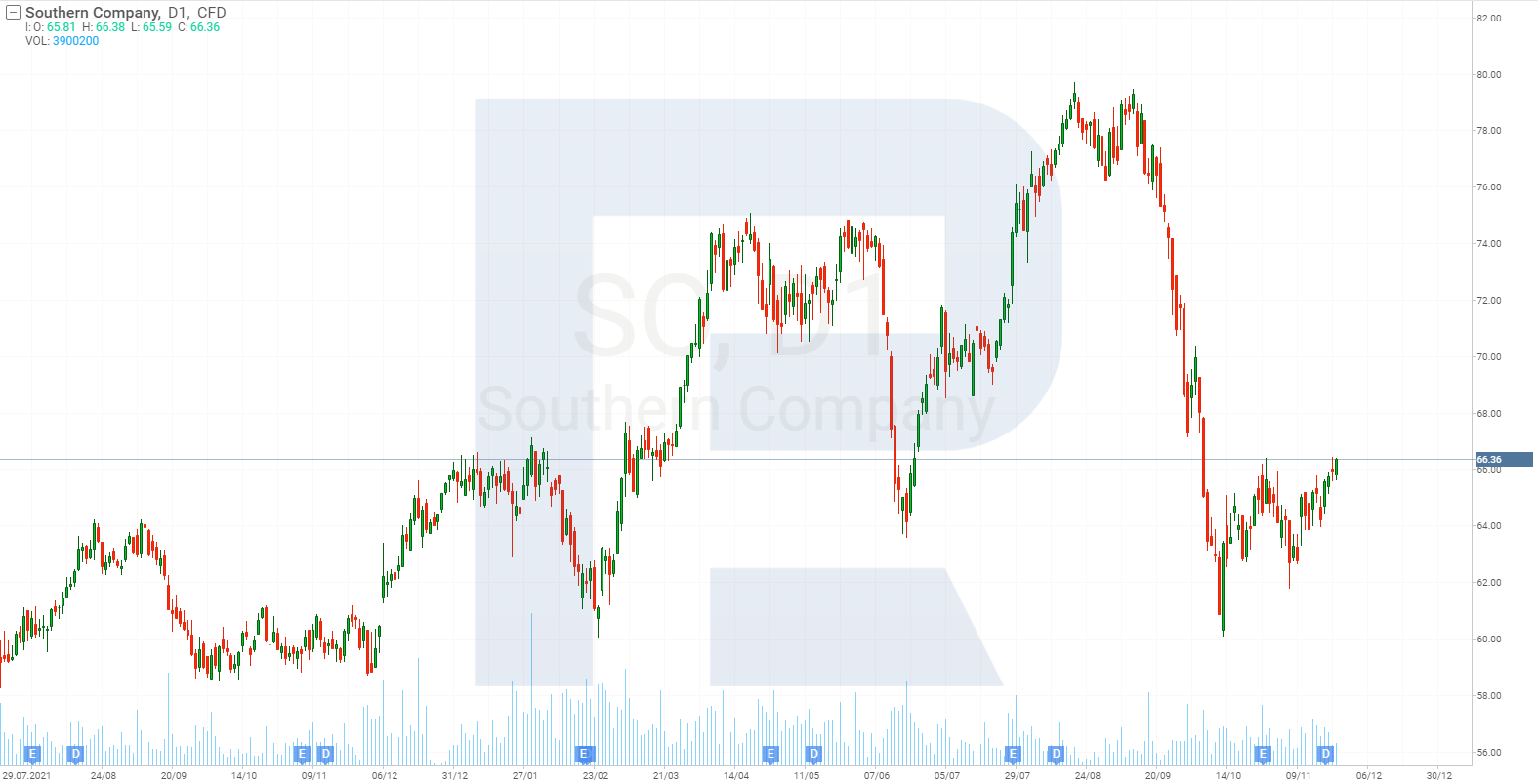

The shares of Southern Company are currently volatile. Over the last four months, they have seen prices fluctuate from 15 to 25%.

Risks of investing in energy companies

The rising prices of electric energy have increased the revenue of energy companies. This enables issuers to pay high dividends and carry out stock buyback programmes.

However, there is a risk that the government may pay particular attention to such a profitable sector and impose extra taxes on it. If this happens, companies will have less money to invest in green energy or buy back stocks.

Summary

The corporations above – NextEra Energy Inc., Duke Energy Corporation, and Southern Company – provide electricity produced from equal hydrocarbons and green sources. The energy crisis and active implementation of ecologically safe transport made the demand for renewable energy sources increase.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high