Which ETFs are Investing in the Metaverse?

6 minutes for reading

With the Federal Reserve System tightening its monetary policy, US stock indices are trading lower. For example, the Nasdaq 100 (NAS100) is down 35% since the start of the year, and the S&P 500 (US500) is down 25%.

However, the Fed will not continue with the rate hikes forever: experts predict this cycle might end in 2023. Companies will then adjust to the current rates, and stock indices will gradually recover. And the question of where to invest will become even more pressing.

With the abundance of issuers on the market, there is always the risk of wrongly selecting one or two companies. An alternative is ETFs which consist of stocks of firms that operate and grow in the same industry. Today, we will touch on the topic of the meta-universe and look at which exchange-traded investment funds are betting on the virtual world.

What’s interesting about the metaverse?

The metaverse is predicted to revolutionise the user experience, making extensive use of artificial intelligence technology. It's a digital world where users can interact with each other through avatars.

Research shows that the metaverse has already attracted more than USD 10 billion in funding, including virtual reality and augmented reality technology.

In October 2021, at an online presentation, Mark Zuckerberg announced the desire to create a digital universe called Meta in which users could vacation, work, buy and sell digital goods, and travel to other virtual worlds. Soon after, Facebook was renamed Meta Platforms Inc.

This intensified the registration of new ETFs investing in the meta-universe. Investor interest in this area increased significantly and where there is demand, there is always supply.

Which funds focus on the metaverse?

Of all the exchange-traded investment funds that are betting on the development of the digital virtual universe, today we will look at three with "metaverse" in their name – the Roundhill Ball Metaverse, the Fount Metaverse, and the Evolve Metaverse.

Roundhill Ball Metaverse

Roundhill Ball Metaverse (NYSE: METV) was launched in June 2021. The fund has more than USD 400 million in assets under management. The fund invests in 40 companies that are actively involved in the development of the metaverse. The bulk of the portfolio is occupied by US firms, with Asian firms only accounting for 20% of the total.

Apple Inc. (NASDAQ: AAPL) has the largest weighting in the Roundhill Ball Metaverse portfolio at 8.09%, followed by NVIDIA Corporation (NASDAQ: NVDA) at 7.87%.

The fund's top stocks include:

- Roblox Corp. (NYSE: RBLX) – 7.31%

- Meta Platforms Inc. (NASDAQ: META) – 6.95%

- Sea Ltd. (NYSE: SE) – 3.84%

- QUALCOMM Incorporated (NASDAQ: QCOM) – 3.6%

- Autodesk Inc. (NASDAQ: ADSK) – 3.48%

- Snap Inc. (NYSE: SNAP) – 3.4%

The Roundhill Ball Metaverse was the first ETF focused on the metaverse and, judging by the average daily trading volume, it is still the most popular among such funds.

Fount Metaverse

The Fount Metaverse ETF (NYSE: MTVR) was launched in October 2021. It has approximately USD 6.1 million in assets under management. The Fount Metaverse selects stocks for purchase using artificial intelligence and a proprietary algorithm that predicts the revenue growth of the firms from the sale of goods and services related to the metaverse.

The top 10 stocks in this fund include:

- Apple Inc. (NASDAQ: AAPL) – 12.01%

- Alphabet Inc. (NASDAQ: GOOG) – 4.3%

- Meta Platforms Inc. (NASDAQ: META) – 3.41%

- Twitter Inc. (NYSE: TWTR) – 2.93%

- Pinterest Inc. (NYSE: PINS) – 2.74%,

- Roblox Corp. (NYSE: RBLX) – 2.62%

- Activision Blizzard Inc. (NASDAQ: ATVI) – 2.37%

- DraftKings Inc. (NASDAQ: DKNG) – 2.25%

- Adobe Incorporated (NASDAQ: ADBE) – 2.2%

- Oriental Land Co Ltd (TYO: 4661) – 2.16%

Evolve Metaverse

The Evolve Metaverse has USD 8.4 million in assets under management. It is the first Canadian ETF to invest in the metaverse, and its stocks are traded on the Toronto Stock Exchange. The fund's top 10 stocks include:

- Take-Two Interactive Software Inc. (NASDAQ: TTWO) – 3.6 %

- Snap Inc. (NYSE: SNAP) – 3.56%

- Activision Blizzard Inc. (NASDAQ: ATVI) – 3.54%

- Autodesk Inc. (NASDAQ: ADSK) – 3.52%

- Coinbase Global Inc. (NASDAQ: COIN) – 3.51%

- Adobe Incorporated (NASDAQ: ADBE) – 3.51%

- Electronic Arts Inc. (NASDAQ: EA) – 3.51%

- Roblox Corp. (NYSE: RBLX) – 3.47%

- Alphabet Inc. (NASDAQ: GOOG) – 3.47%

- Apple Inc. (NASDAQ: AAPL) – 3.45%

What are the risks of investing in the metaverse?

Virtual reality is just beginning to develop, and it is still unknown whether it will be accepted by society in the future. And young industries are characterised by high volatility, with both high returns and significant drawdowns.

Exchange-traded investment funds that bet on the meta-industry have been in existence for just over a year, and there is no historical data allowing us to analyse them yet. At the same time, the amount of assets under the management of some of these ETFs does not exceed USD 10 million. This implies that either there are few investors, or the amounts invested in the fund are very modest. This also suggests two things: one – investors are interested, but they are very cautious, and two – the bravest have already invested, while others are still at the monitoring stage.

In addition, these ETFs have low trading volumes. For example, the Roundhill Ball Metaverse has an average daily volume of around 300,000 stocks and the Fount Metaverse has no more than 5000. By comparison, technology sector funds have more than 7 million stocks.

To date, none of these funds has generated investment returns since inception. Perhaps the timing of their creation was not the best, because the cycle of the tightening monetary policy began in 2022, and stocks of technology companies have fallen. And the portfolios of funds investing in the metaverse are largely made up of technology stocks.

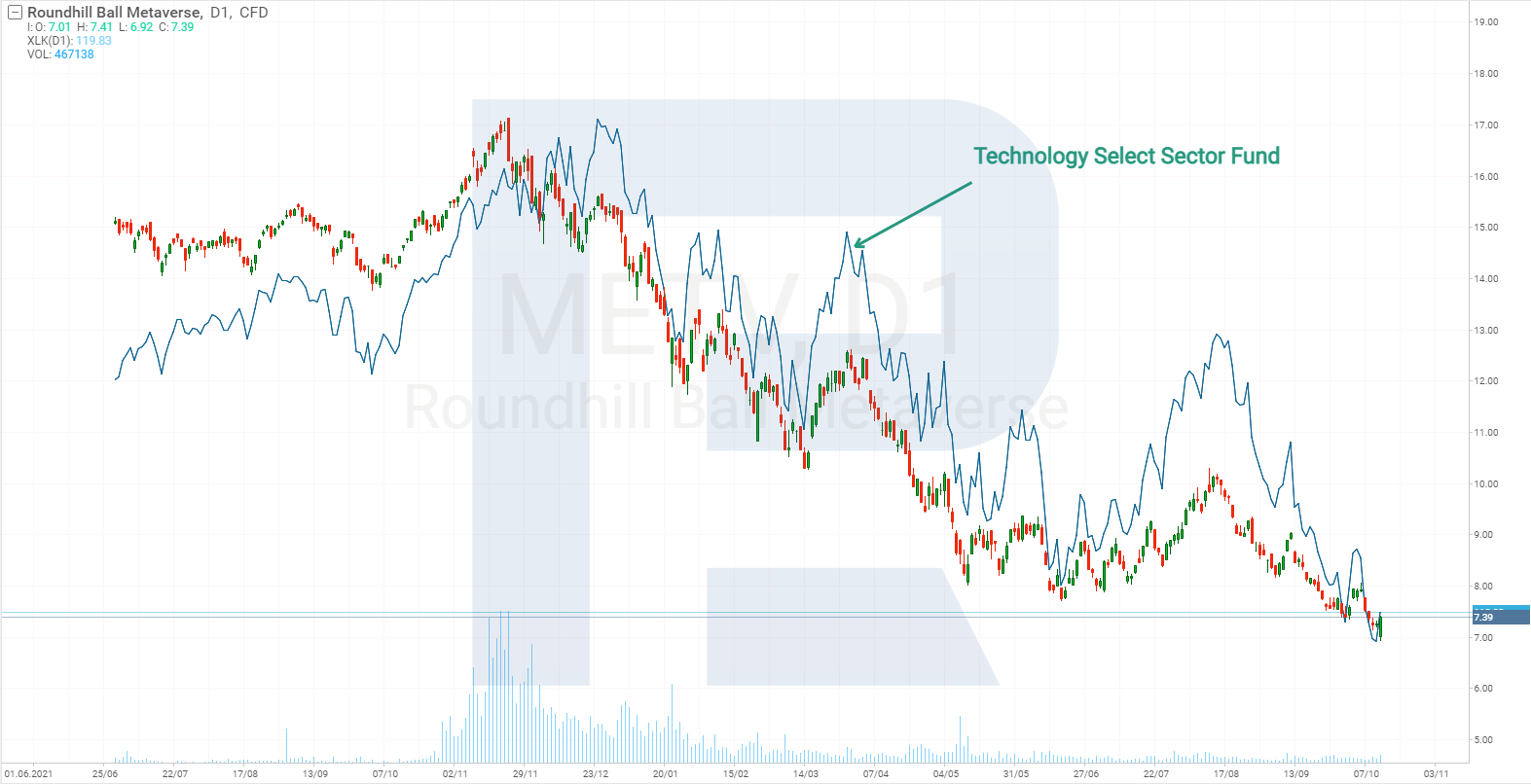

Take a look at the chart. Do you notice the correlation between metaverse ETFs and technology sector ETFs?

Conclusion

Trading volumes for ETFs that invest in virtual reality are still very low, indicating that the industry is in its infancy. It has yet to overcome the impending recession and high capital borrowing rates.

It is likely that many companies will start cutting costs soon, reducing investments, and laying off employees. Consequently, the development of the metaverse will probably slow down, but it is not likely to stop. According to analysts, this segment has a good chance of surviving the challenges ahead.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high