Analysing Elon Musk's Investments in Tesla

4 minutes for reading

Over the last two months, the quotes of Tesla Inc. (NASDAQ: TSLA) dropped by more than 35%. The Director-general of the company, Elon Musk, facilitated this decline, among other things. While he has not bought a single share of his corporation since 2021, on 8 November this year, he sold 19.5 million shares for about 4 billion USD.

Today we will try to analyse the trades made by Elon Musk and another stock market celebrity, Cathie Wood, with the shares of the most expensive car maker in the world.

Musk’s investments in Tesla stock

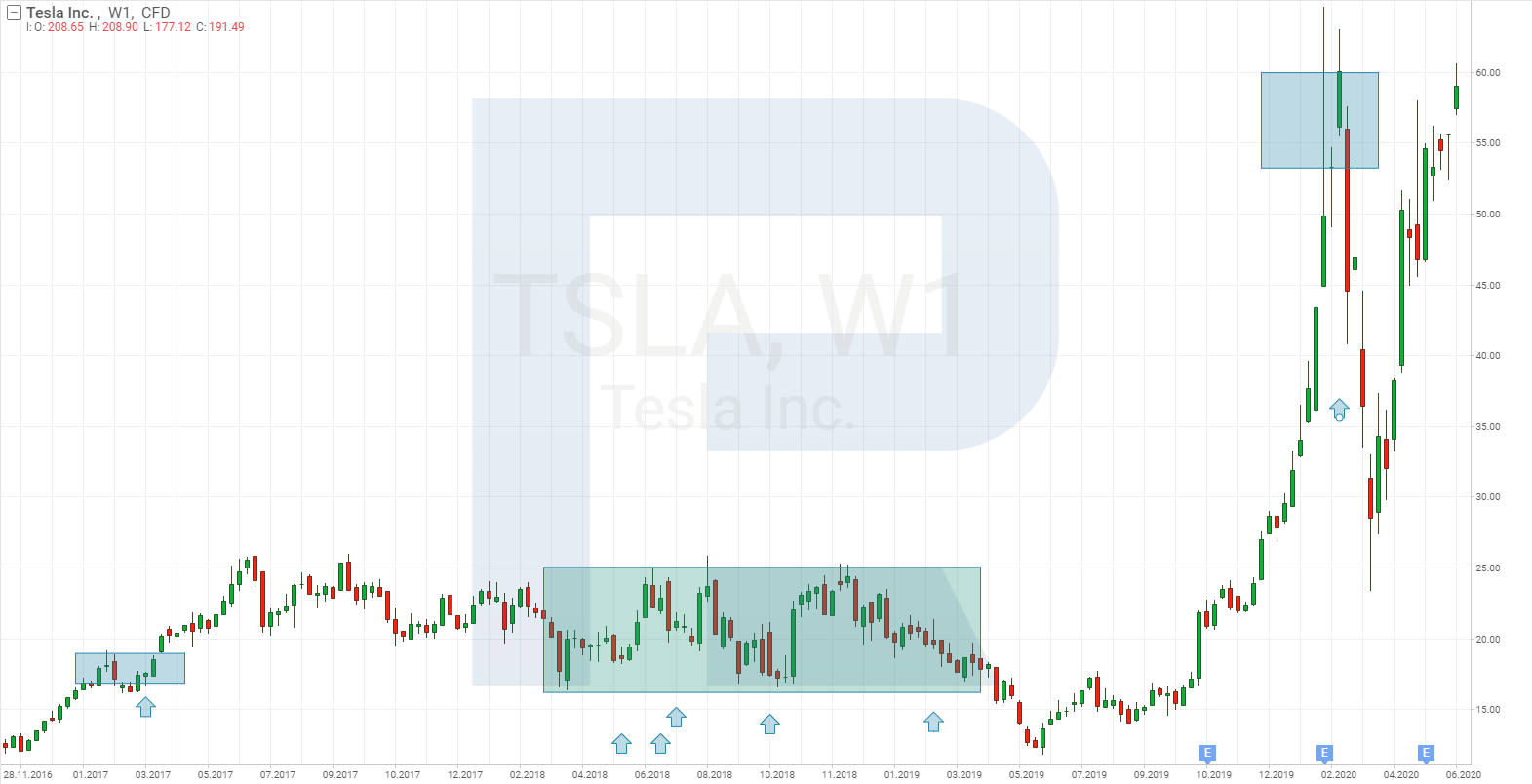

Elon Musk invested 20 million USD in his car-making company for the first time in August 2015. At that time, the share price was 242 USD – this was the price before the split. However, less than a year later, he sold 2.7 million shares for 593 million USD at the price of 213 USD each. The reason behind this sale was the necessity to raise funds to pay taxes after the execution of options.

In 2017, Musk bought 95,420 shares for 25 million USD. Thereafter, he invested in his own company for almost 45 million USD from May through October 2018, and again in May 2019 about 25 million USD. The latest investment was in February 2020, when he bought one million USD worth of shares.

Musk selling Tesla shares

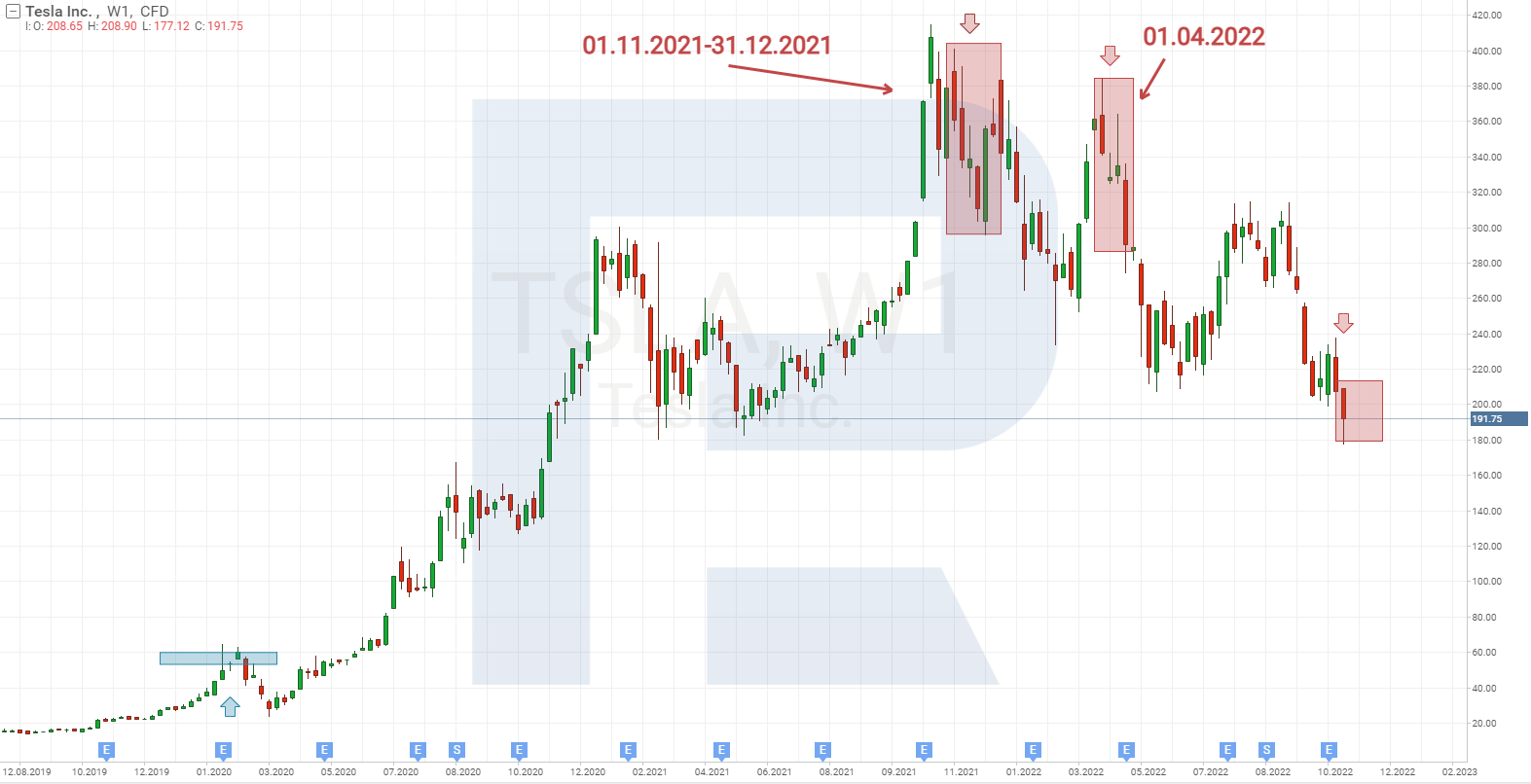

The billionaire started selling Tesla shares in November 2021 and was very persistent at it. Over just one month, he sold 9.1 million shares for about 10 billion USD. The sales of the stock, which started on 8 November 2021, made the shares crash 16%, after which the price almost played back the decline.

In December 2021, Musk sold 6.5 million shares, which intensified the pressure on the quotes and sold them down by 19.5%. However, this decline was bought back by the market as well.

In April this year, Elon Musk announced his intention of buying the Twitter social network, with the board of directors of Twitter approving the trade the same month. From 26 through 28 April, the businessman sold 9.5 million Tesla shares for about 8.5 billion USD in order to finance the agreement with the network. Tesla stock crashed 38% as a result.

Thereafter, Musk reversed his decision to buy Twitter, which entailed a trial. The judge gave the parties the last chance to settle the conflict and close the trade. This led to Musk having to sell 19.5 million shares of his company for almost 4 billion USD, which sent the shares plummeting 20%.

Cathie Wood and Tesla’s shares

Another famous personality in the stock market that actively invests in Tesla stock along with Musk is Cathie Wood, the manager of ARK Investment Management LLC. As her trades sound loud in the market, let's analyse her influence on the shares of the electric car maker.

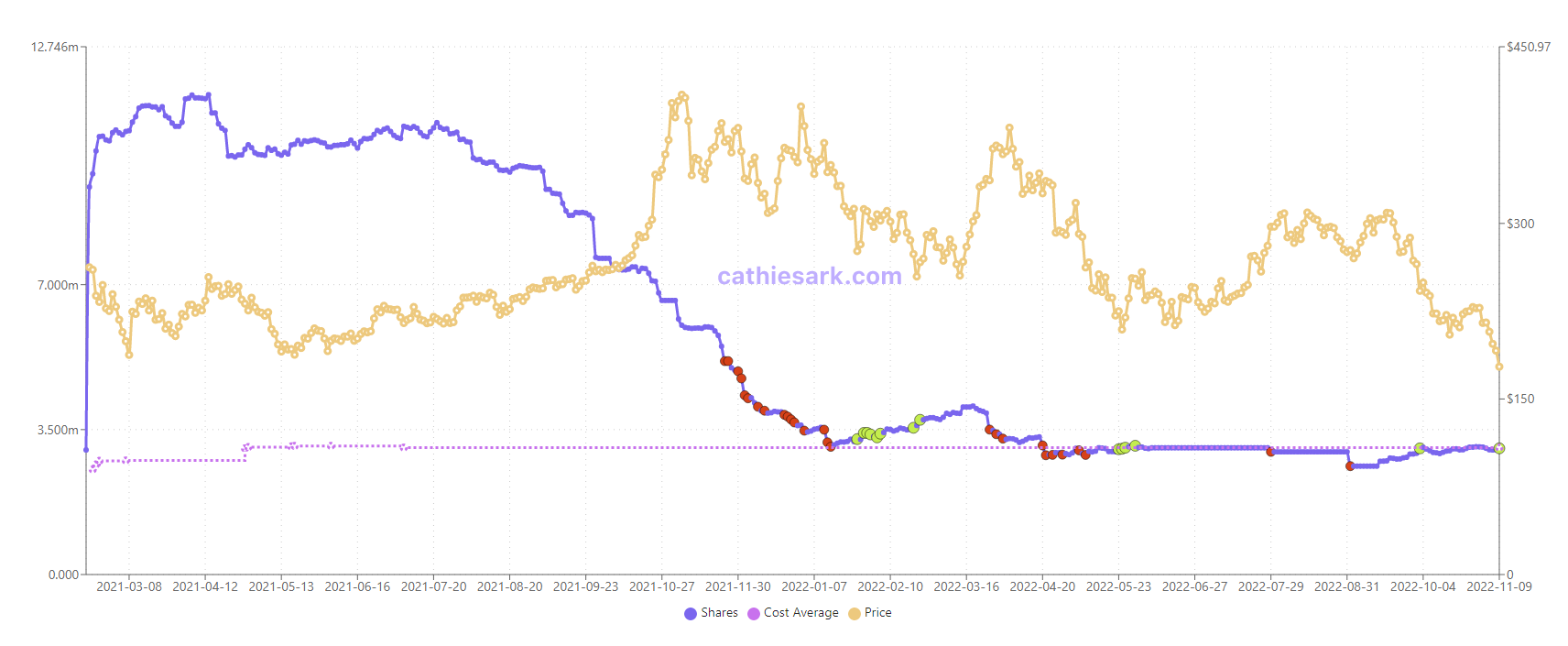

ARK Investment Management invested in Tesla for the first time in 2016, with the larger trades made at the beginning of 2021. According to Cathie Wood, what makes the corporation interesting is not necessarily the growing number of electric cars sold but the technology it owns.

When Tesla shares were nearing the high in 2021, ARK Investment Management started selling the shares of the electric car maker actively, thereby taking the profit.

When this article was being prepared, ARK Investment Management had four million Tesla shares in its portfolio, after previously having 16 million shares. Thanks to the first investments in 2016, the average purchasing price of Tesla shares is about 108 USD.

Starting in September 2022, Cathie Wood began to buy Tesla shares again when their price dropped 35% below the all-time high. The manager of ARK Investment Management conducts operations with these shares almost every day.

What hedge funds do to Tesla shares

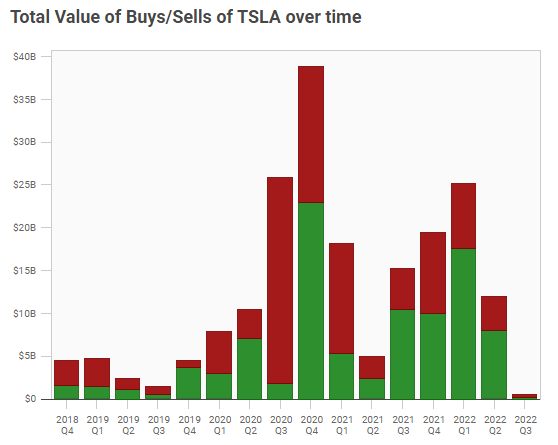

In Q1 2021, hedge funds were mainly selling Tesla shares, while in Q2 they bought them for 17.5 billion USD. However, in Q3, hedge fund activity dropped noticeably. The largest shareholder of Tesla is BlackRock Inc., owning 166.1 million shares.

Summary

Tesla's Director-General stopped investing in his company in 2021. The sales of Tesla shares made by Elon Musk, including those that were made to finance the purchase of Twitter, had a bad impact on Tesla's stock quotes.

On the Tesla share price chart, a Head and Shoulders pattern can be noticed, which, as a rule, signals a possible change in the trend direction. If Musk refrains from selling Tesla shares for billions of dollars, the decline might stop and the Head and Shoulders might not work.

If we look at the company from Cathie Wood's point of view, who claims Tesla to be a tech company, not a car maker, then the current share price will not seem overestimated.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high