How to Trade Nikkei 225 Index?

7 minutes for reading

The Nikkei 225 is one of the most important stock indices like the NASDAQ, Dow Jones, or S&P 500. The Nikkei 225 reflects the state of the Japanese economy and the overall business activity in the country. It is considered one of the oldest indices in Asia, and includes Japan's top 225 companies that are listed on the Tokyo Stock Exchange. The most famous ones are Sony Corporation, Canon Inc, Nissan Motor Company, and Honda Motor Company.

Curiously enough, the index was named after a Japan economics/business newspaper that used to calculate the instrument. It was first published as long ago as 1950 and was calculated as the arithmetic mean of the companies’ securities. A company’s weight in the index is calculated based not on the general market capitalisation but directly on the stock price. The set of companies in the index is revised every September, with changes accepted in October.

A simple strategy for trading Nikkei 225

The use of classical tech analysis for trading is not popular with all traders since it involves a lot of thought and requires drawing different levels and patterns. A significant disadvantage of the analysis is that it is subjective: some will think a pattern is not regular enough, while others will see a triangle instead of, say, a reversal pattern. Let's have a look at a strategy for trading the Nikkei 225 that is not subjective.

Which indicators do we need?

After all, it cannot be said that the instrument demonstrates no trends at all: strong directed movements do happen sometimes. So, let's add Moving Averages for defining the direction of future positions and the Fractals indicator for signalling market entry and placing Stop Losses. The timeframe used is M30.

Strategy parameters

We have chosen several indicators. Now, let's decide which parameters we want to change for the strategy to work with the index.

- Exponential Moving Average (EMA) with period 25 is a fast MA that will be the closest to the price.

- EMA with period 195 is a slow MA that is much further away from the price.

- Fractal settings are standard, and are formed as a triangle under a chart candlestick.

How to open a buying trade for Nikkei 225

The following are the conditions for a buying signal to form:

- EMA 25 has just broken EMA 195 from below and now rests above it. This also indicates the beginning of a bullish trend.

- Fractals have formed above the candlesticks.

- Place a pending Buy Stop order 2-5 points above the Fractals.

- Place a Stop Loss behind the nearest descending fractal before the crossing of the MAs.

- Place the first Take Profit at the width of the SL. Try placing the second SL at the double width of the SL. Alternatively, use Trailing Stop to maximise your profit.

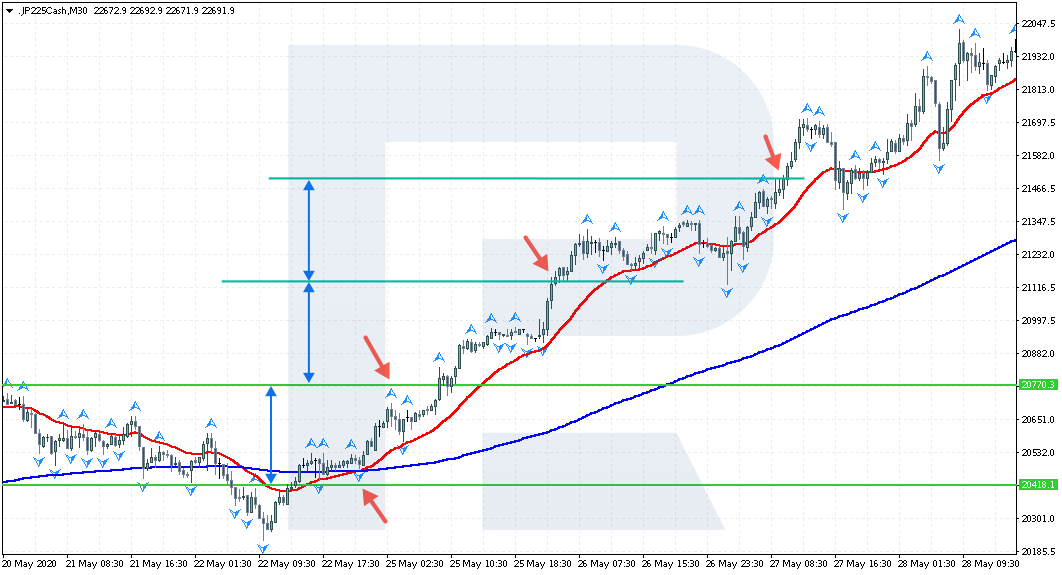

Buying the index by the strategy

Let's have a look at an example. As it can be seen, after crossing, the fast Moving Average rests above the slow one. A fractal formed above the candlesticks – this is the first fractal after the crossing of the MAs. Place a pending order above the fractal at the price of 20770.

Place an SL at 20418 – below the last fractal and before the crossing of the MAs. Place the first TP at the distance equal to that between the entry point and the SL – this is the level of 21122. Close the second part of the position at 21474, or place a Trailing Stop. In our case, the movement was very strong, so both positions closed with a very good profit.

How to open a selling trade for Nikkei 225

To open a successful selling trade for Nikkei 225 by the strategy, comply with the following requirements:

- EMA 25 has just broken EMA 195 from above and rests below it. This also indicates the beginning of a descending impulse.

- Fractals have formed under the candlesticks.

- Place a pending Sell Stop 2-5 points under the Fractals.

- Place an SL behind the nearest ascending fractal before the crossing of the MAs.

- Place the first TP at the width of the SL and the second one at its double width, or use Trailing Stop to maximise your profit.

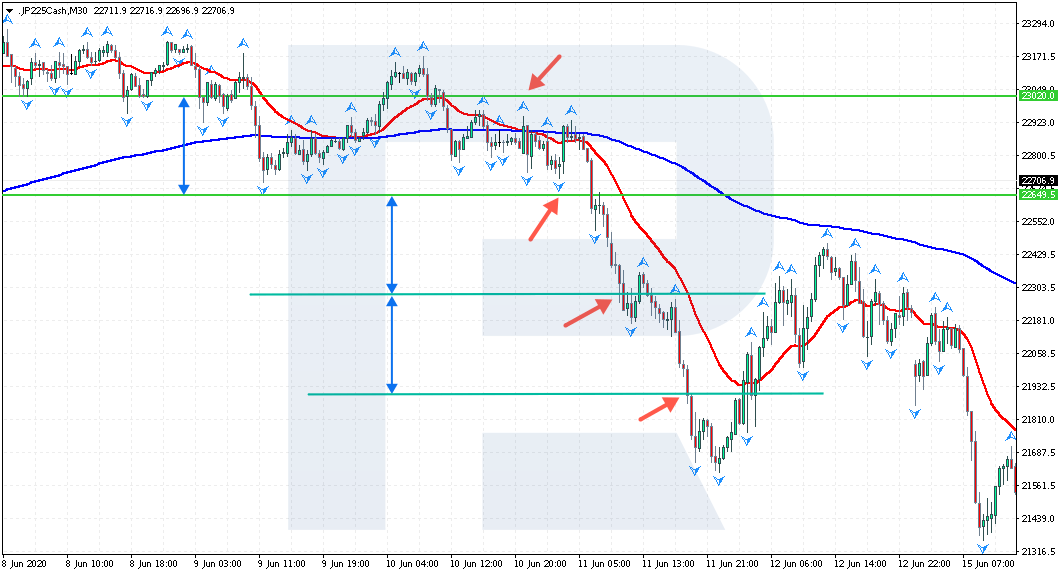

Selling the index by the strategy

Let's have a look at an example of a selling trade that follows the buying one. As it can be seen, the MAs have crossed: the EMA 25 has crossed the EMA 195 from above and now rests under it. Find the first descending fractal and place a pending Sell Stop 2-5 points below the indicator at the price of 22649.

Place an SL at the level of 23020, above the last ascending fractal and before the crossing of the MAs. Place the first TP at the distance that equals the distance between the entry point and the SL, which is the level of 22278. Close the second part of the position at the level of 21907 or use a Trailing Stop: the trade will close at the moment when the price reverses against us.

In this case too, the movement downwards was quite strong, and both positions closed with a profit.

Summary

On the whole, trading Nikkei 225 does not differ much from trading other stock assets. Classic tech analysis works well here; you may also make a good profit using the levels and simple graphic patterns. Those who crave for trading indicators may use the strategy on M30 that we have just discussed.

The advantages of the strategy include simple and clear rules of entering and exiting the market. We trade the trend, and strong movements on the chart might bring us a good profit. Moreover, you may backtest the system and see how well it works under different circumstances.

Keep in mind that the strategy may be changed: you may add your instruments to make market entries more precise. All in all, this approach is recommended to both beginners and experts who have not traded the Nikkei 225 yet.

* - Past performance does not predict future returns.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 69,88% of retail investor accounts lose

. 69,88% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high